- United States

- /

- Metals and Mining

- /

- NasdaqGM:USAR

USA Rare Earth (USAR) Is Up 49.8% After Barbara Humpton Named CEO and UK Acquisition Revealed – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On September 29, 2025, USA Rare Earth announced the appointment of Barbara Humpton as CEO and closed its acquisition of UK-based Less Common Metals, advancing its mine-to-magnet strategy with new projects in Texas and Oklahoma.

- Humpton's leadership and confirmation of active discussions with the Trump administration about potential federal partnerships signal a significant alignment with U.S. government priorities to bolster domestic rare earth supply chains.

- We’ll explore how confirmation of direct White House discussions under new CEO Barbara Humpton could reshape USA Rare Earth’s investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is USA Rare Earth's Investment Narrative?

To buy into the USA Rare Earth story, investors need to have conviction in the push for an independent, end-to-end rare earth supply chain in the US, a vision that now seems closer to reality with Barbara Humpton at the helm and the acquisition of Less Common Metals. The company's short-term catalysts had revolved around government partnership speculation, new project launches, and the execution of recent capital raises amid losses and a thin revenue pipeline. This week's confirmation of direct talks with the Trump administration takes that catalyst from rumor to real possibility, helping explain the sharp move in shares and forcing the risk/reward equation to shift: any formal government support could alter the near-term funding outlook and potentially reduce execution risk, particularly with a more experienced CEO leading negotiations. That said, execution and dilution risks haven't disappeared, and with shares now highly volatile and the company still unprofitable, the balance of upside and downside may be evolving faster than analysts or past analysis captured. On the flip side, recent shareholder dilution is an important detail that investors should not overlook.

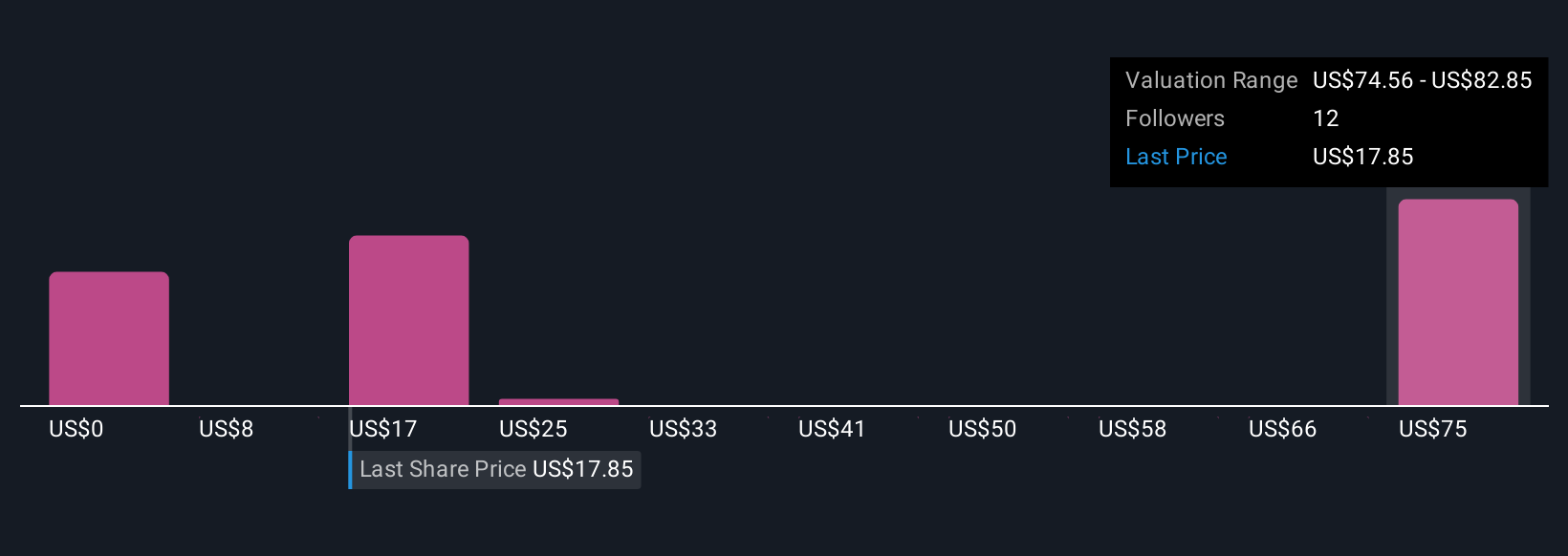

USA Rare Earth's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 13 other fair value estimates on USA Rare Earth - why the stock might be worth over 3x more than the current price!

Build Your Own USA Rare Earth Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your USA Rare Earth research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free USA Rare Earth research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate USA Rare Earth's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USAR

USA Rare Earth

Engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

Moderate risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives