- United States

- /

- Metals and Mining

- /

- NasdaqGM:USAR

Assessing USA Rare Earth’s Value After Recent Texas Project Milestone and Price Swings

Reviewed by Bailey Pemberton

- Wondering if USA Rare Earth stock is truly undervalued or if its current price is just market noise? You are not alone. There is plenty of buzz around this stock’s real worth.

- It has been a rollercoaster ride recently, with the price down 15.5% over the past week and a steeper 48.1% drop in the last month. However, the stock has managed a 14.4% gain over the past year.

- Some of these moves come on the heels of big headlines, including a new partnership deal and progress in its Texas-based rare earth processing project. These developments have sparked both excitement and doubts among investors watching supply chain themes and U.S. resource policies closely.

- Right now, USA Rare Earth scores a 2 out of 6 on our valuation checks, meaning it stands out in only two areas for being undervalued. Next, we will break down the valuation from several angles. You will want to stick around for what might be an even better approach to truly sizing up this company.

USA Rare Earth scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: USA Rare Earth Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by forecasting its future cash flows and discounting them back to present value. This approach is widely used because it attempts to capture the fundamental, long-term prospects of a business based on its ability to generate cash.

For USA Rare Earth, the most recent reported Free Cash Flow (FCF) stands at negative $39 million, reflecting the company’s current investment-heavy phase. Analyst estimates suggest cash flows will remain negative for the next few years before turning positive, with an anticipated FCF of about $125 million by 2029. Projections, which blend both analyst expectations and further extrapolations by data sources, point to continued strong growth, with FCF numbers reaching almost $438 million by 2035.

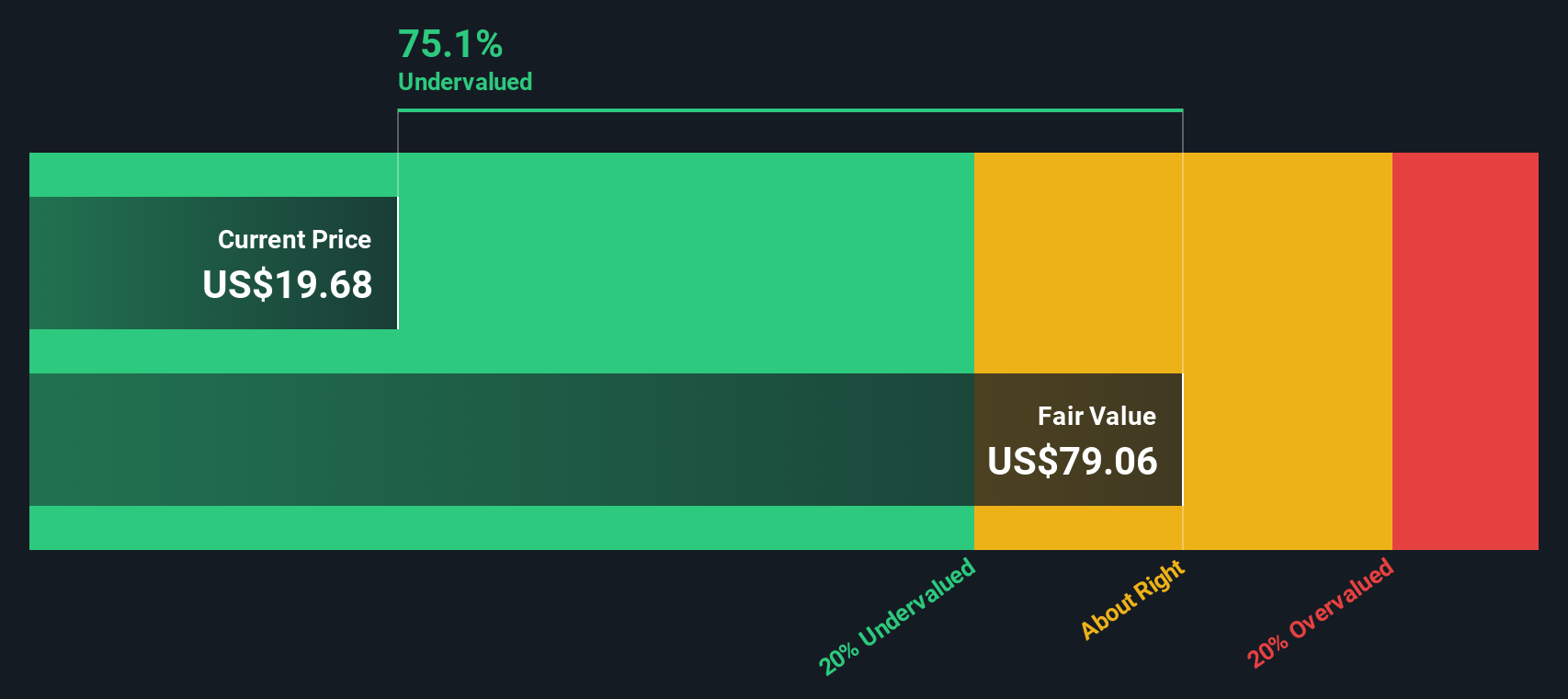

Using these projections, the DCF model calculates an intrinsic value of $41.40 per share. Compared to the stock's current trading price, this implies the shares are 70.4% undervalued. This discount suggests the market may not be recognizing the company’s future potential cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Rare Earth is undervalued by 70.4%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

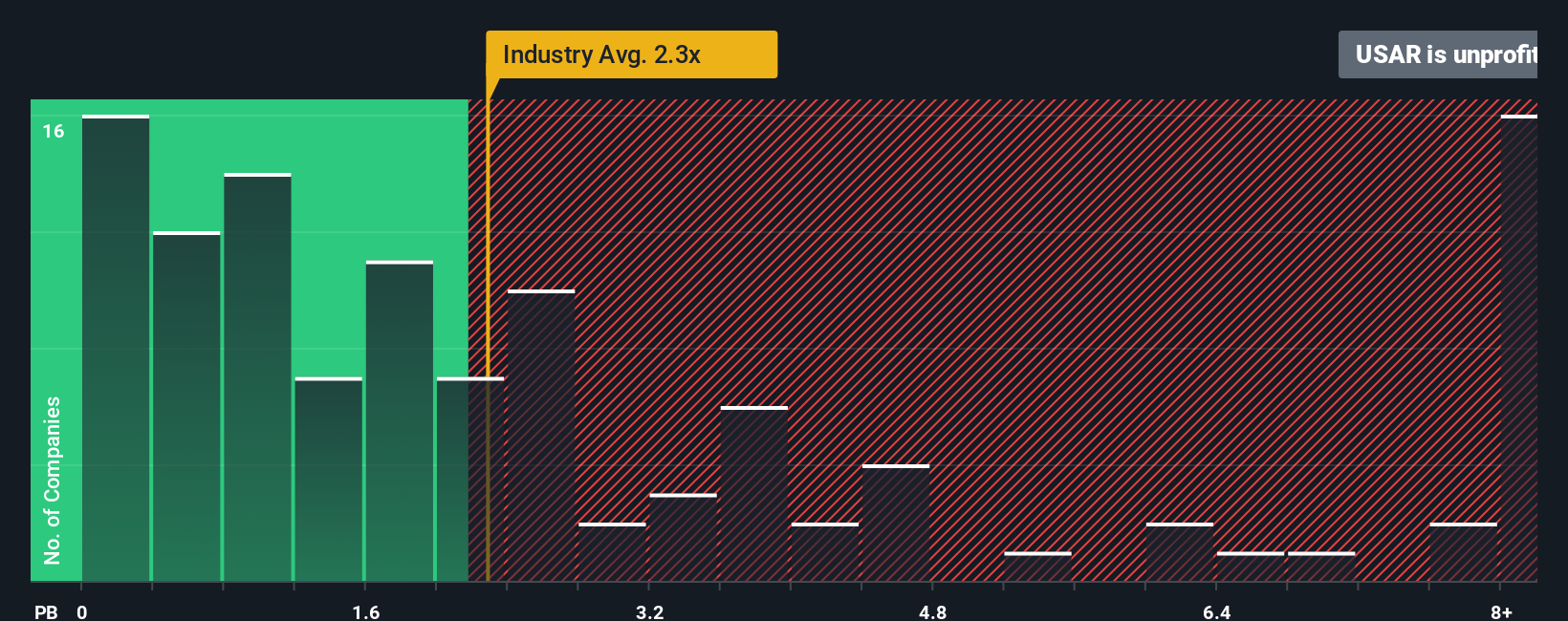

Approach 2: USA Rare Earth Price vs Book

For companies in resource-intensive industries like metals and mining, the Price-to-Book (P/B) ratio is often regarded as a relevant valuation measure. It compares the market price of a company’s shares to the book value of its assets, making it especially useful for businesses where assets have clear, tangible value.

Growth expectations and risk play a vital role in defining what a “normal” or “fair” P/B ratio should be. Companies with high growth prospects or low risk tend to command higher multiples, while those facing significant uncertainty may trade at a discount to their book value.

Currently, USA Rare Earth trades at a P/B ratio of -26.81x. In contrast, the metals and mining industry averages around 2.01x, and the peer group sits at -8.14x. These numbers suggest that USA Rare Earth’s book value is being deeply discounted by the market relative to both the sector and similar companies.

This is where the “Fair Ratio” from Simply Wall St comes in. Instead of relying on a broad industry or peer comparison, this metric tailors the benchmark to USA Rare Earth by considering its unique growth prospects, risk factors, profit margins, market capitalization, and its particular industry characteristics. By accounting for these elements, the Fair Ratio provides a more precise assessment of fair value for this stock.

When USA Rare Earth’s P/B multiple is compared with its Fair Ratio, there is a considerable gap, signaling the market may be overly pessimistic about the company’s true worth from an asset perspective.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1427 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Rare Earth Narrative

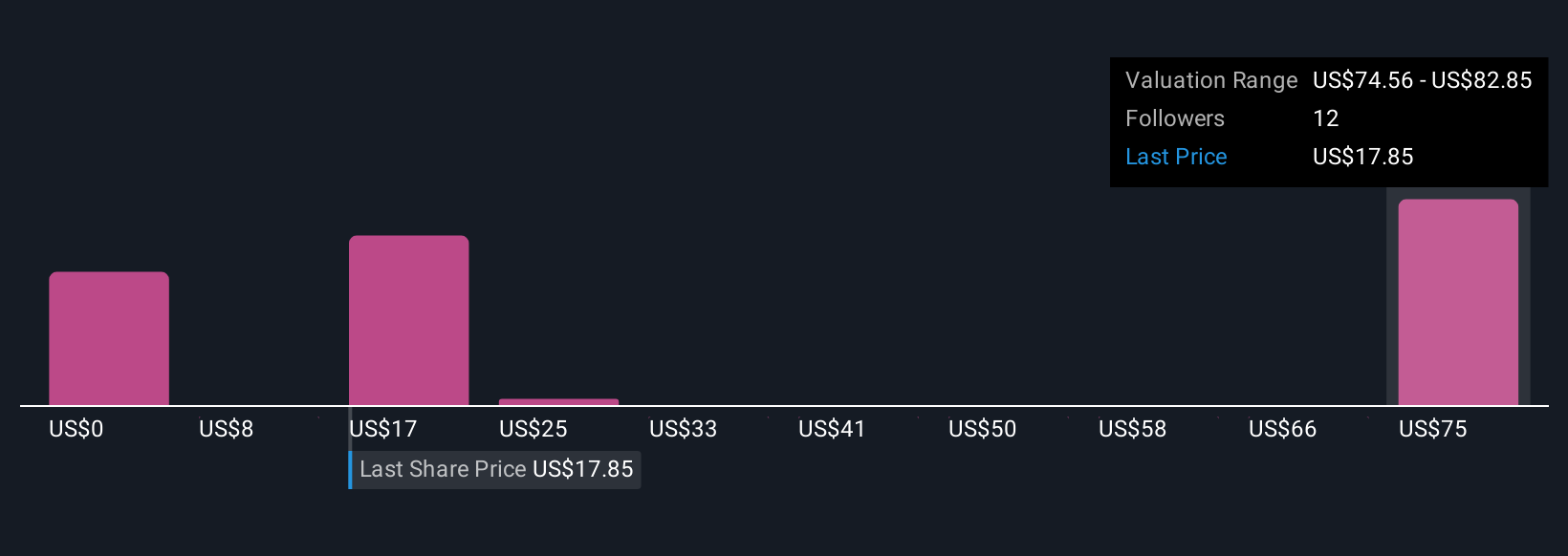

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your own story about a company, connecting the numbers with your interpretation of what the company’s future could look like. Instead of relying only on historical ratios, Narratives let you link your outlook on USA Rare Earth to custom forecasts for revenue, profits, and margins, and then see a fair value based on your assumptions.

Simply Wall St's platform makes using Narratives easy and accessible for all investors within the Community page, where millions contribute their views. Narratives empower you to make buy or sell decisions by continually comparing your fair value to the latest market price, updating instantly as news or earnings arrive.

For example, some investor Narratives have projected USA Rare Earth’s fair value as high as $88 per share while others see it as low as $15, reflecting different perspectives on growth and risk. Narratives help you turn your insights into real numbers, making your investment decisions both smarter and more personalized.

Do you think there's more to the story for USA Rare Earth? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USAR

USA Rare Earth

Engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives