- United States

- /

- Metals and Mining

- /

- NasdaqGS:STLD

How Investors Are Reacting To Steel Dynamics (STLD) Launching Lower-Carbon Steel Lines for Key Sectors

Reviewed by Sasha Jovanovic

- In late October 2025, Steel Dynamics, Inc. announced the launch of two lower-embodied-carbon steel product lines, BIOEDGE™ and EDGE™, produced exclusively using electric arc furnace technology and supported by Green-e Energy certified renewable or emission-free nuclear energy certificates to reduce Scope 1 and Scope 2 emissions.

- This move leverages SDI Biocarbon Solutions' renewable biocarbon sourcing and directly targets surging demand from automotive, construction, renewable energy, and infrastructure sectors aiming to decarbonize their supply chains.

- We'll explore how Steel Dynamics' focus on lower-carbon steel offerings could reshape its longer-term competitive positioning and growth outlook.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Steel Dynamics Investment Narrative Recap

To own Steel Dynamics stock, you need to believe in the ongoing shift toward sustainable steel solutions and the company's ability to capture increasing demand from construction, automotive, and infrastructure sectors through investments in decarbonization. The recent introduction of low-carbon steel lines addresses environmental trends, but does not meaningfully reduce near-term risks: ramp-up challenges and operating losses from new aluminum and biocarbon operations remain the key short-term catalyst and concern, with adoption rates and cost control being central factors.

Among recent news, Steel Dynamics’ share buyback completion stands out, it saw the company repurchase 2.45% of its shares for US$464.54 million since February 2025. These buybacks occur as the business faces both rising capital investments and continued earnings expectations, balancing return of cash to shareholders with the need to fund growth initiatives.

Yet, if demand risks in cyclical sectors emerge, investors should be aware that...

Read the full narrative on Steel Dynamics (it's free!)

Steel Dynamics is projected to achieve $21.6 billion in revenue and $2.6 billion in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 8.1% and a $1.6 billion increase in earnings from the current $1.0 billion.

Uncover how Steel Dynamics' forecasts yield a $153.83 fair value, a 3% downside to its current price.

Exploring Other Perspectives

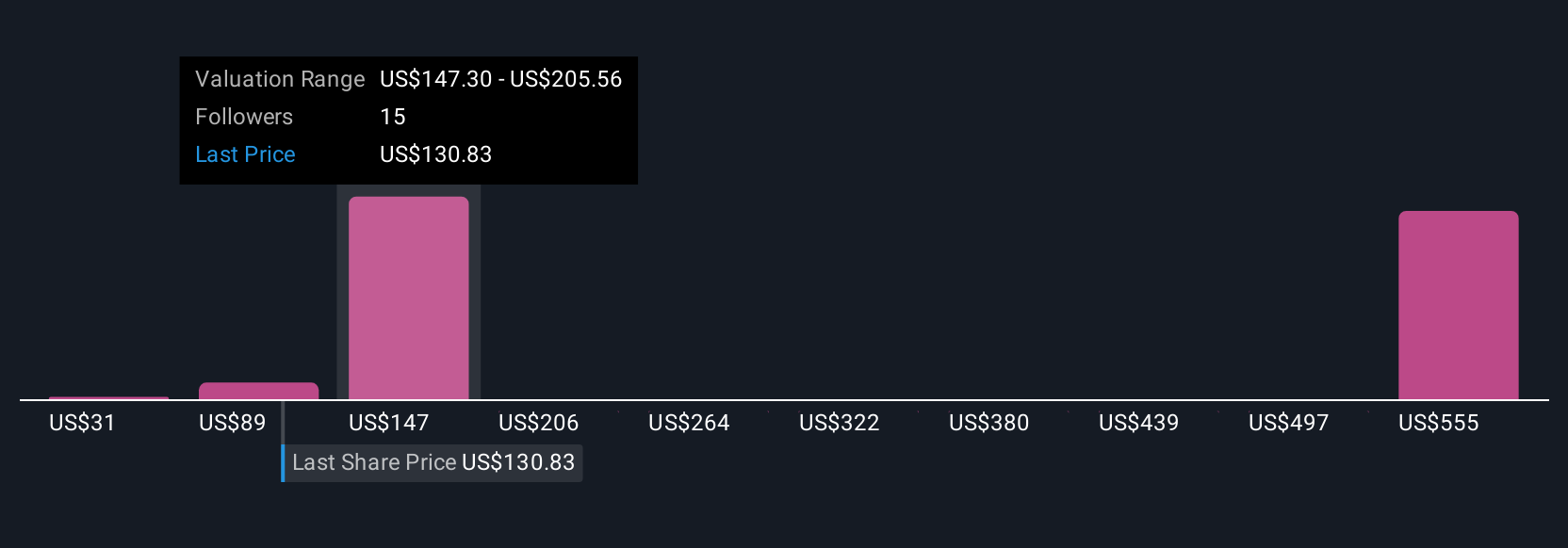

Five fair value estimates from the Simply Wall St Community range from US$95 to US$307.54, reflecting a wide spread in outlooks. While many focus on sustainability-led growth, you should also consider how ongoing investment losses and slower-than-anticipated adoption could slow profit recovery, be sure to weigh multiple viewpoints before deciding.

Explore 5 other fair value estimates on Steel Dynamics - why the stock might be worth 40% less than the current price!

Build Your Own Steel Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Steel Dynamics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Steel Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Steel Dynamics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STLD

Steel Dynamics

Operates as a steel producer and metal recycler in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives