- United States

- /

- Metals and Mining

- /

- NasdaqGS:STLD

How Investors Are Reacting To Steel Dynamics (STLD) Completing $800 Million Debt Refinancing and Redemption

Reviewed by Sasha Jovanovic

- Earlier this week, Steel Dynamics announced it completed the sale of US$650 million in 4.000% Notes due 2028 and US$150 million in additional 5.250% Notes due 2035, using proceeds to redeem US$400 million of 5.000% Notes due 2026 and for general corporate purposes.

- This refinancing activity reflects an active shift in the company’s capital structure, potentially affecting both its interest expenses and financial flexibility in the coming years.

- We’ll now explore how this significant debt refinancing could shape Steel Dynamics’ investment narrative and future financial profile.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Steel Dynamics Investment Narrative Recap

To be a shareholder in Steel Dynamics today, you need to believe that domestic infrastructure spending, manufacturing reshoring, and demand for sustainable steel products will drive higher volumes and resilient pricing amidst industry volatility. The recent refinancing, swapping higher-cost 2026 debt for new 2028 and 2035 notes, doesn’t materially alter these main short-term drivers but may marginally enhance financial flexibility; however, the biggest near-term risk remains the drag on margins and free cash flow from sizable capital outlays on newer, still-unprofitable segments.

Of the company’s recent announcements, the October 2025 launch of BIOEDGE™ and EDGE™, lower-carbon steel products made with electric arc furnace technology, directly relates to a core catalyst: capturing premium demand from customers with strict emissions requirements. This innovation positions Steel Dynamics to benefit from sustainability trends, supporting both volume and margin expansion despite ongoing pressures from imports and cyclical end markets.

But on the other hand, investors should keep an eye on how slower-than-expected ramp-up or adoption of these new aluminum and biocarbon operations could start to…

Read the full narrative on Steel Dynamics (it's free!)

Steel Dynamics' narrative projects $21.6 billion revenue and $2.6 billion earnings by 2028. This requires 8.1% yearly revenue growth and a $1.6 billion earnings increase from $1.0 billion today.

Uncover how Steel Dynamics' forecasts yield a $167.42 fair value, a 6% upside to its current price.

Exploring Other Perspectives

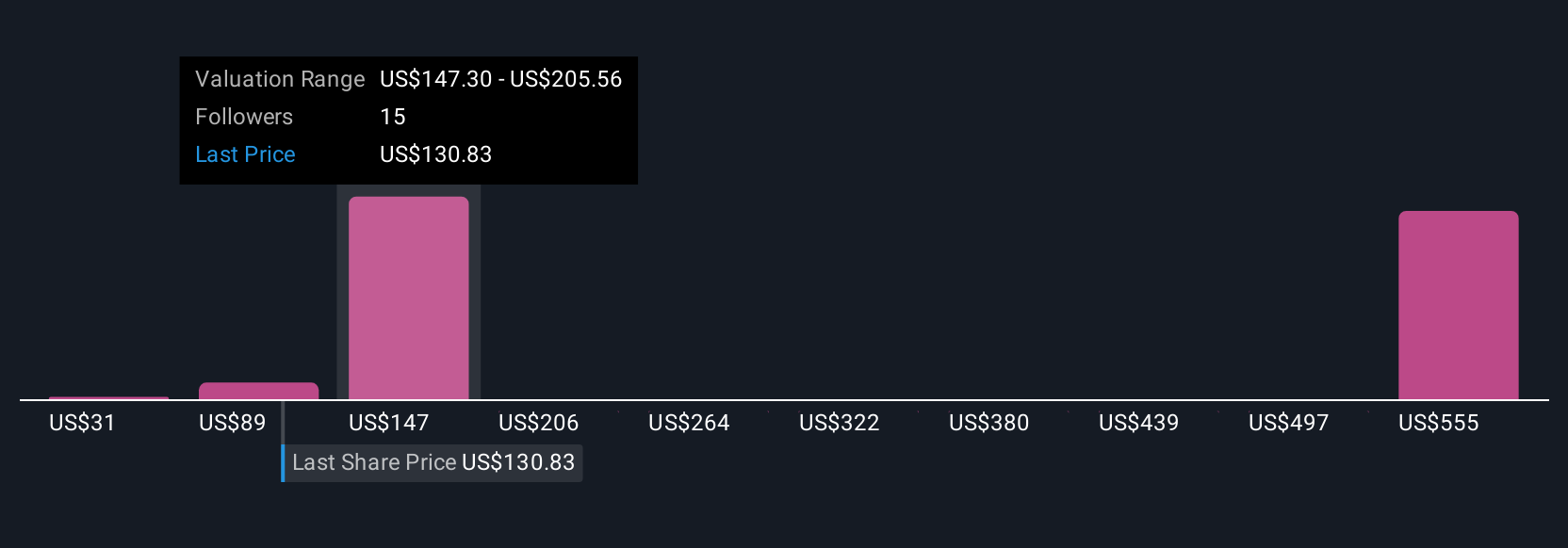

Five Simply Wall St Community fair value estimates for Steel Dynamics range widely, from US$95 to US$293,382 per share. While some expect upside from investments in sustainable steel products, your view on the risk around capital intensity and operating losses in new segments could shift your confidence in the company’s long-term profit path, explore how different investors approach these questions.

Explore 5 other fair value estimates on Steel Dynamics - why the stock might be worth as much as 85% more than the current price!

Build Your Own Steel Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Steel Dynamics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Steel Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Steel Dynamics' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STLD

Steel Dynamics

Operates as a steel producer and metal recycler in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives