- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Royal Gold (RGLD): Assessing Valuation After Dividend Hike and Portfolio Moves

Reviewed by Simply Wall St

Royal Gold (RGLD) just announced a 6% increase to its annual dividend for 2026, raising the payout from $1.80 to $1.90 per share. This move highlights management’s confidence in future cash flows and commitment to rewarding shareholders.

See our latest analysis for Royal Gold.

The recent dividend boost comes on the back of several portfolio moves, including strategic acquisitions and exiting non-core holdings. Building on this momentum, Royal Gold’s share price is up 36.6% year-to-date, and its one-year total shareholder return sits at an impressive 25.4%. This signals that investors are recognizing both near-term growth and a stronger long-term outlook as management focuses on value creation and portfolio discipline.

If you’re interested in uncovering more opportunities beyond today’s gold rally, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Given the stock’s strong run and recent financial gains, is Royal Gold still trading at an attractive valuation? Or has the market already factored in all of its growth potential, leaving limited upside for new investors?

Most Popular Narrative: 25.9% Undervalued

Royal Gold’s latest close of $183.79 is well below the narrative’s fair value estimate, suggesting the current price could offer notable upside. This valuation is supported by positive developments in both acquisition activity and long-term growth projections, making the narrative highly watched among analysts and investors alike.

The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base by reducing single-asset risk and increasing exposure to long-term growth projects. This could drive more stable and growing revenue streams and support improved net margins.

Want to know why this value projection stands out? The calculation depends on a blend of ambitious growth forecasts and future profit margins that defy sector norms. Curious how this approach leads to such a premium valuation? The complete breakdown reveals the boldest assumptions driving these numbers. Are you ready to see what really fuels the upside?

Result: Fair Value of $248.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained drop in gold prices or integration hurdles from recent acquisitions could quickly challenge Royal Gold’s positive long-term outlook.

Find out about the key risks to this Royal Gold narrative.

Another View: What Do Multiples Say?

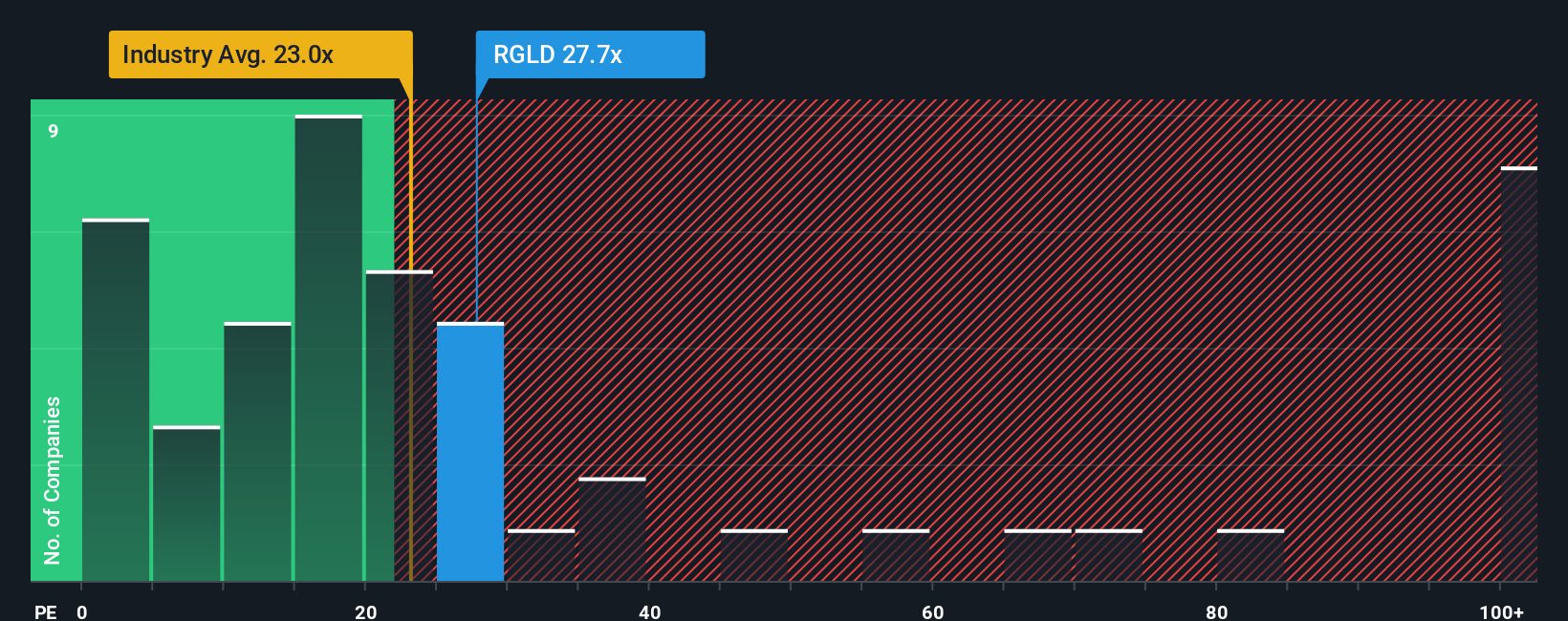

Looking at Royal Gold’s price-to-earnings ratio, the story shifts. Shares currently trade at 32.3 times earnings, well above the industry average of 20.5 and the sector peer average of 19. The fair ratio, based on regression analysis, is 24.1. This premium signals heightened valuation risk, as investors are paying much more for today’s profits than the market typically does. Could this mean future returns are already baked in, or is there more upside if growth keeps outpacing expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Gold Narrative

If these views don’t quite fit your perspective, you can dive into the numbers yourself, shape your own conclusions, and Do it your way all in just a few minutes.

A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your portfolio miss out on the next big winners. See what else savvy investors are watching and position yourself for smarter returns.

- Spot market-beating growth trends by checking out these 923 undervalued stocks based on cash flows delivering strong cash flow potential right now.

- Join the AI revolution and get ahead with these 25 AI penny stocks poised to disrupt industries worldwide.

- Accelerate your income goals by scanning these 16 dividend stocks with yields > 3% offering higher-than-average yields and robust payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives