- United States

- /

- Chemicals

- /

- NasdaqCM:PCT

Why PureCycle Technologies (PCT) Is Up on EU Certification and Belgium Expansion Plans

Reviewed by Sasha Jovanovic

- Earlier this month, PureCycle Technologies announced plans to build its first European facility at the port of Antwerp, Belgium, and reported it had received the REACH Certificate of Compliance, enabling the sale of its PureFive™ resin in the European Union.

- This dual move signals PureCycle's entry into new international markets while meeting the EU's rigorous environmental and safety standards for recycled materials.

- We’ll explore how securing regulatory approval to sell in the EU may reshape PureCycle’s investment narrative and international expansion prospects.

Find companies with promising cash flow potential yet trading below their fair value.

What Is PureCycle Technologies' Investment Narrative?

For PureCycle shareholders, the investment story hinges on whether the company can turn regulatory wins and global expansion into financial stability. The recent move into Belgium, paired with the REACH compliance for its PureFive™ resin, positions PureCycle to tap into the European recycling market, potentially one of its most important short-term catalysts. Entering the EU, however, does not immediately address the company’s ongoing losses and limited cash resources, which existing analysis identifies as key risks. Until the new Antwerp facility comes online in 2028, most of the near-term excitement may center on the company’s ability to secure sales and partnerships within Europe, leveraging its compliance certification. Still, with shares trading at a significant premium to book value and persistent unprofitability, the business remains sensitive to execution risks, especially as forecasts project continued losses despite robust revenue expectations. On the flip side, cash runway concerns remain critical for investors to consider.

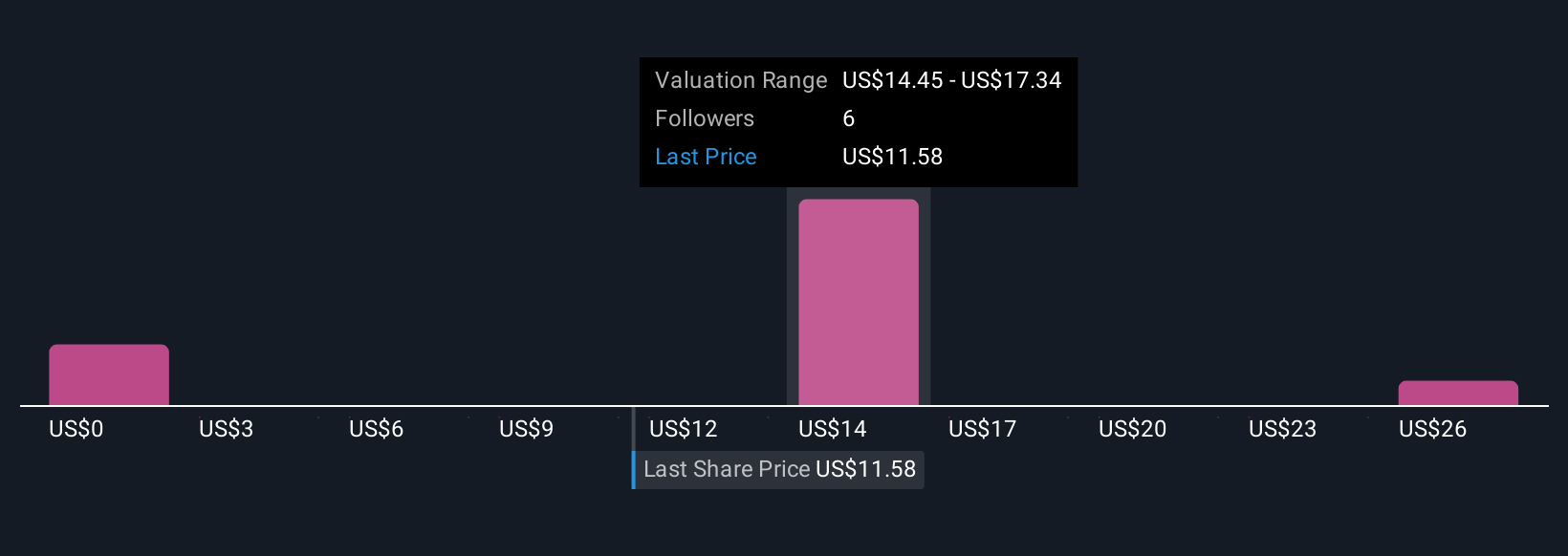

Upon reviewing our latest valuation report, PureCycle Technologies' share price might be too optimistic.Exploring Other Perspectives

Explore 4 other fair value estimates on PureCycle Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own PureCycle Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PureCycle Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free PureCycle Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PureCycle Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PCT

PureCycle Technologies

Engages in the production of recycled polypropylene (PP).

Adequate balance sheet with low risk.

Market Insights

Community Narratives