- United States

- /

- Chemicals

- /

- NasdaqCM:PCT

What Does TD Cowen’s Downgrade Reveal About PureCycle’s (PCT) Long-Term Investor Appeal?

Reviewed by Sasha Jovanovic

- Earlier this week, TD Cowen analyst James Schumm downgraded PureCycle Technologies to a hold rating, reflecting a shift in outlook towards the company's shares.

- Analyst rating changes such as this can influence investor sentiment and are often closely monitored as indicators of changing perspectives within the financial community.

- We’ll explore how this analyst downgrade shapes PureCycle Technologies’ investment narrative, especially in light of its recent share price reaction.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is PureCycle Technologies' Investment Narrative?

To be a PureCycle Technologies shareholder, belief in its long-term vision to revolutionize plastics recycling is essential, especially as the company remains in its early revenue phase and is not forecast to turn a profit soon. The recent downgrade by TD Cowen and a lowered price target signal some recalibration in expectations following a drop in the share price, but this shift may not immediately alter the key catalysts: scaling production at its Ironton facility, executing international expansion plans like the Antwerp site, and attaining broader commercialization of its resin. On the risk front, the downgrade sharpens attention on persistent losses, cash runway concerns, and ongoing class-action lawsuits. However, with the price decline already substantial, the downgrade appears more likely to reflect risks already priced in rather than adding a new challenge for the company’s immediate outlook.

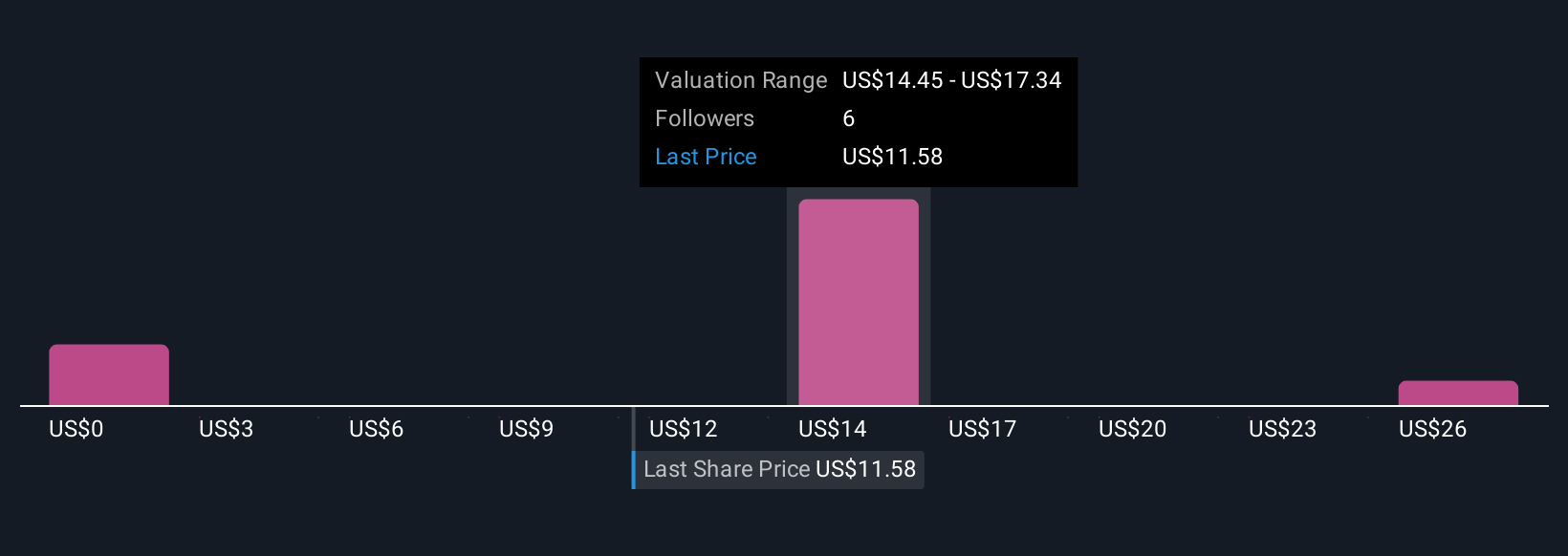

But with less than a year of cash runway, funding remains a pressing concern. Our comprehensive valuation report raises the possibility that PureCycle Technologies is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 4 other fair value estimates on PureCycle Technologies - why the stock might be worth over 3x more than the current price!

Build Your Own PureCycle Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PureCycle Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free PureCycle Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PureCycle Technologies' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PCT

PureCycle Technologies

Engages in the production of recycled polypropylene (PP).

Mediocre balance sheet with limited growth.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.