- United States

- /

- Chemicals

- /

- NasdaqCM:PCT

Is PureCycle (PCT) Turning High-Profile Sports Branding Into a Credible Capacity-Build Strategy?

- PureCycle Technologies recently announced a collaboration with Churchill Container and 4ocean to supply Run It Back souvenir cups made with its PureFive recycled resin at the College Football Playoff National Championship, while also revising its construction agreement for a future recycling facility in Augusta, Georgia, including a US$500,000 payment to AEDA and updated project milestones.

- Together, the high-visibility sustainability initiative at a major sporting event and the recalibrated Augusta build-out plan spotlight how PureCycle is pairing brand exposure with measured capacity planning.

- We’ll now examine how the Run It Back cup initiative with 4ocean and Churchill Container shapes PureCycle’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is PureCycle Technologies' Investment Narrative?

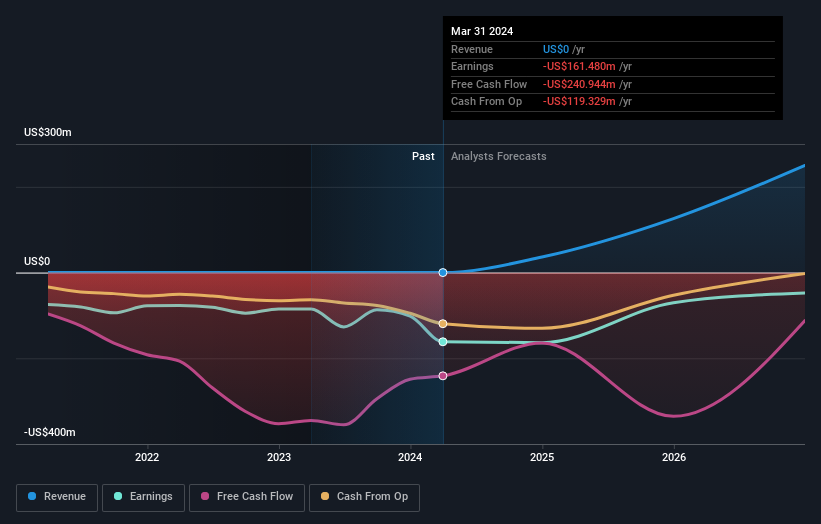

To own PureCycle, you really have to buy into the idea that its purification tech can turn into a scaled, commercially relevant recycled resin platform before the cash runway runs too thin. The recent Run It Back cup collaboration at the College Football Playoff looks more like brand building than a financial swing, but it does reinforce the company’s push to get PureFive resin into visible, real-world use cases alongside existing wins in caps and stadium cups. By contrast, the revised Augusta construction agreement is more meaningful for near term catalysts and risks: a slower, milestone driven build with a US$500,000 payment to AEDA tempers capacity expectations and puts more scrutiny on funding, execution and timing. That is where the stock’s story can shift quickest from here.

However, tighter Augusta timelines and funding needs introduce execution risk that investors should not ignore. PureCycle Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 6 other fair value estimates on PureCycle Technologies - why the stock might be worth less than half the current price!

Build Your Own PureCycle Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PureCycle Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free PureCycle Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PureCycle Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PCT

PureCycle Technologies

Engages in the production of recycled polypropylene (PP).

Mediocre balance sheet with low risk.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

The "AI Fear" Arbitrage Opportunity

From $5M to $2B: Why the 2024 Crash Was the Best Buying Opportunity in Consumer Stocks

EU#7 - From Aprons in Galicia to the World’s Most Efficient Fashion Machine

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion

Looks interesting, I am jumping into the finances now. Your 15% margin seems high for a conservative model, can't just ignore the years they need to invest. You didnt seem to mention that they had to dilute the sharebase by issuing ~40mil shares. raising ~8 mil. should be enough if mouse does OK. If not they will need to raise more to suvive. Losing 20m a year, 14m after there 6m cutbacks. Am I reading it right that they have no debt. have they any history of raising debt? First look it is too dependant on the mouse and GoT games. they do well stock will 2-3x, poorly and it will drop. I am not sure I agree with your work for hire backstop. Unlikely meta horizons will continue with the same size contract going forward. say 10% margins and 15x multiple on 30m. that is 45m, which with the new sharecount is 10c. It is a backstop but maybe not that strong. Mouse fails and devs could start jumping ship and outside contracts could dry up. Hmm on top of all that AI could be disrupting the work for hire model. I think I have mostly talked myself out of it. Although Mouse looks good and does seem like the type of game that could go viral on twitch for a few months. If it does you will likly get a great return 5x plus. crap maybe I am talking myself back in.