- United States

- /

- Chemicals

- /

- NasdaqCM:ORGN

Origin Materials, Inc.'s (NASDAQ:ORGN) 27% Cheaper Price Remains In Tune With Revenues

The Origin Materials, Inc. (NASDAQ:ORGN) share price has fared very poorly over the last month, falling by a substantial 27%. Longer-term, the stock has been solid despite a difficult 30 days, gaining 14% in the last year.

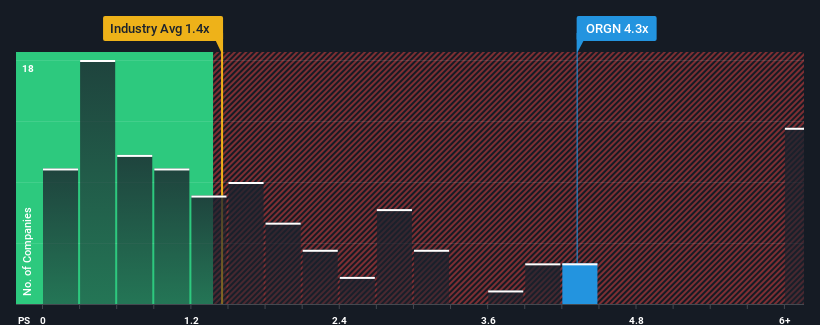

Even after such a large drop in price, given around half the companies in the United States' Chemicals industry have price-to-sales ratios (or "P/S") below 1.4x, you may still consider Origin Materials as a stock to avoid entirely with its 4.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Origin Materials

How Has Origin Materials Performed Recently?

Recent times have been pleasing for Origin Materials as its revenue has risen in spite of the industry's average revenue going into reverse. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Origin Materials will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Origin Materials' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 123% gain to the company's top line. Although, its longer-term performance hasn't been as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 42% as estimated by the sole analyst watching the company. With the industry only predicted to deliver 2.9%, the company is positioned for a stronger revenue result.

With this information, we can see why Origin Materials is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Even after such a strong price drop, Origin Materials' P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Origin Materials maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Origin Materials you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ORGN

Adequate balance sheet with slight risk.

Market Insights

Community Narratives