- United States

- /

- Chemicals

- /

- NasdaqGM:NTIC

Northern Technologies International Corporation's (NASDAQ:NTIC) 32% Dip Still Leaving Some Shareholders Feeling Restless Over Its P/ERatio

To the annoyance of some shareholders, Northern Technologies International Corporation (NASDAQ:NTIC) shares are down a considerable 32% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

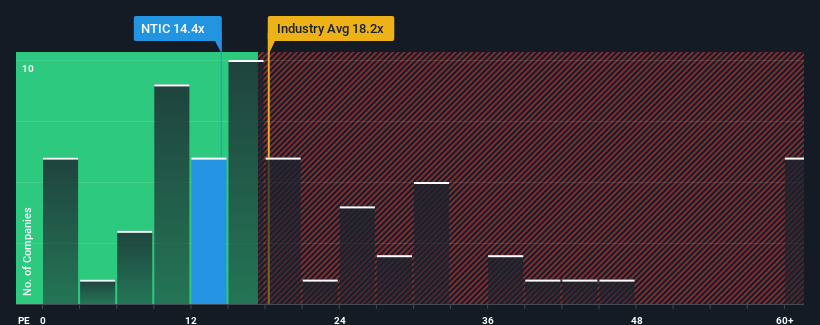

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Northern Technologies International's P/E ratio of 14.4x, since the median price-to-earnings (or "P/E") ratio in the United States is also close to 16x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Northern Technologies International certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Northern Technologies International

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Northern Technologies International's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 53% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 41% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 13% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Northern Technologies International is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh on the share price eventually.

The Final Word

With its share price falling into a hole, the P/E for Northern Technologies International looks quite average now. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Northern Technologies International currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Northern Technologies International that you need to be mindful of.

If you're unsure about the strength of Northern Technologies International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Northern Technologies International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NTIC

Northern Technologies International

Develops and markets rust and corrosion inhibiting solutions in North America, South America, Europe, the Middle East, China, Brazil, India, Rest of Asia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives