- United States

- /

- Metals and Mining

- /

- NasdaqGM:NB

Will NioCorp (NB)'s Lockheed Martin Alliance Redefine Its Role in the Critical Minerals Supply Chain?

Reviewed by Sasha Jovanovic

- Lockheed Martin announced a partnership with NioCorp Developments to develop scandium-based technologies for advanced fighter aircraft under a $10 million U.S. Department of War initiative, supporting domestic production through the Elk Creek Critical Minerals Project in Nebraska.

- This collaboration highlights growing bipartisan U.S. government support for critical mineral supply chain independence and positions NioCorp as a key player in securing domestic access to rare materials.

- We'll explore how this new federal-backed alliance could shift NioCorp's investment narrative by advancing domestic supply of defense-critical minerals.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is NioCorp Developments' Investment Narrative?

For anyone interested in NioCorp Developments, the big picture is about turning breakthrough federal support and key partnerships into tangible cash flows. The new alliance with Lockheed Martin, to develop scandium-based defense materials backed by US$10 million in funding, sharply raises NioCorp’s visibility as a supplier of critical minerals, a role the US government is actively promoting. For investors, this adds real momentum to one of the top near-term catalysts: securing financing and advancing the Elk Creek Project toward production. However, while the partnership is a vote of confidence, major short-term risks remain. The company is still unprofitable, with zero revenue and a history of widened losses, and its auditor has flagged doubts about its ability to continue as a going concern. Short-term gains, especially after a very large year-to-date price jump, may depend more on resolving funding and execution hurdles than on government support alone. A sharp rise in dilution from ongoing equity raises is also a key risk for shareholders to weigh, as important as positive headlines.

Contrast this optimism with real concerns about NioCorp’s ongoing financial viability, which investors should not overlook.

Exploring Other Perspectives

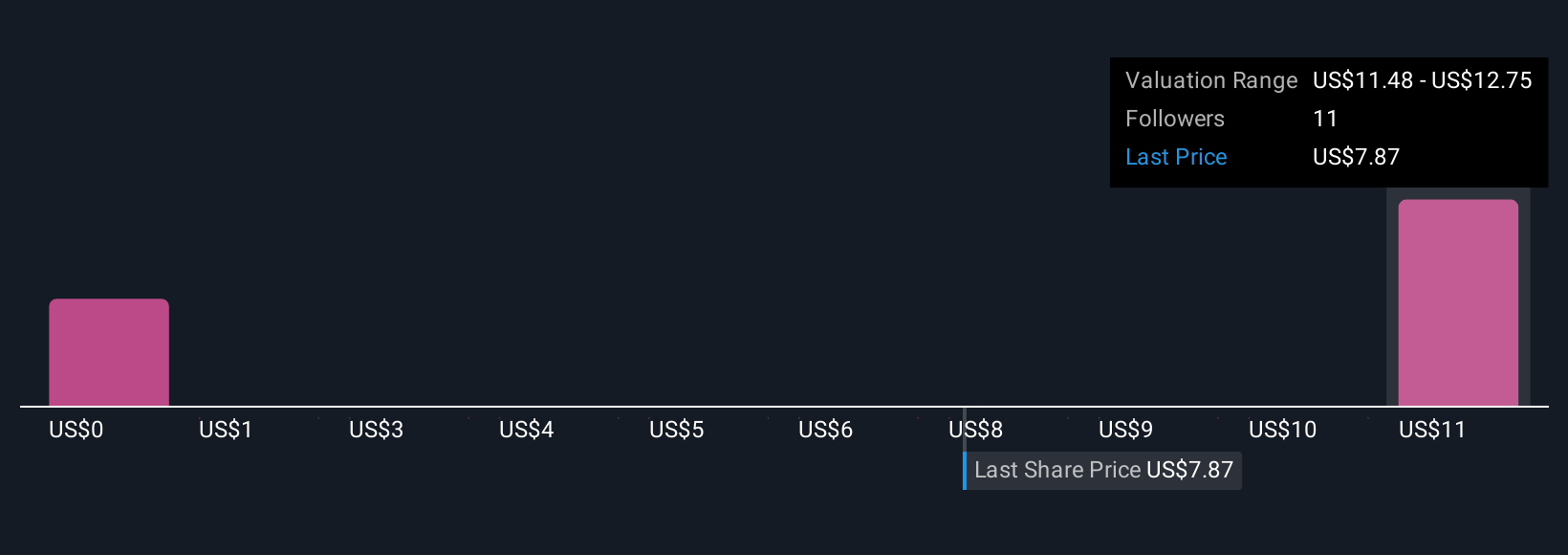

Explore 7 other fair value estimates on NioCorp Developments - why the stock might be worth as much as 74% more than the current price!

Build Your Own NioCorp Developments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NioCorp Developments research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free NioCorp Developments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NioCorp Developments' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NioCorp Developments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NB

NioCorp Developments

Engages in the exploration and development of mineral deposits in North America.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion