- United States

- /

- Chemicals

- /

- NasdaqGM:LOOP

Loop Industries, Inc. (NASDAQ:LOOP) Looks Just Right With A 28% Price Jump

Despite an already strong run, Loop Industries, Inc. (NASDAQ:LOOP) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

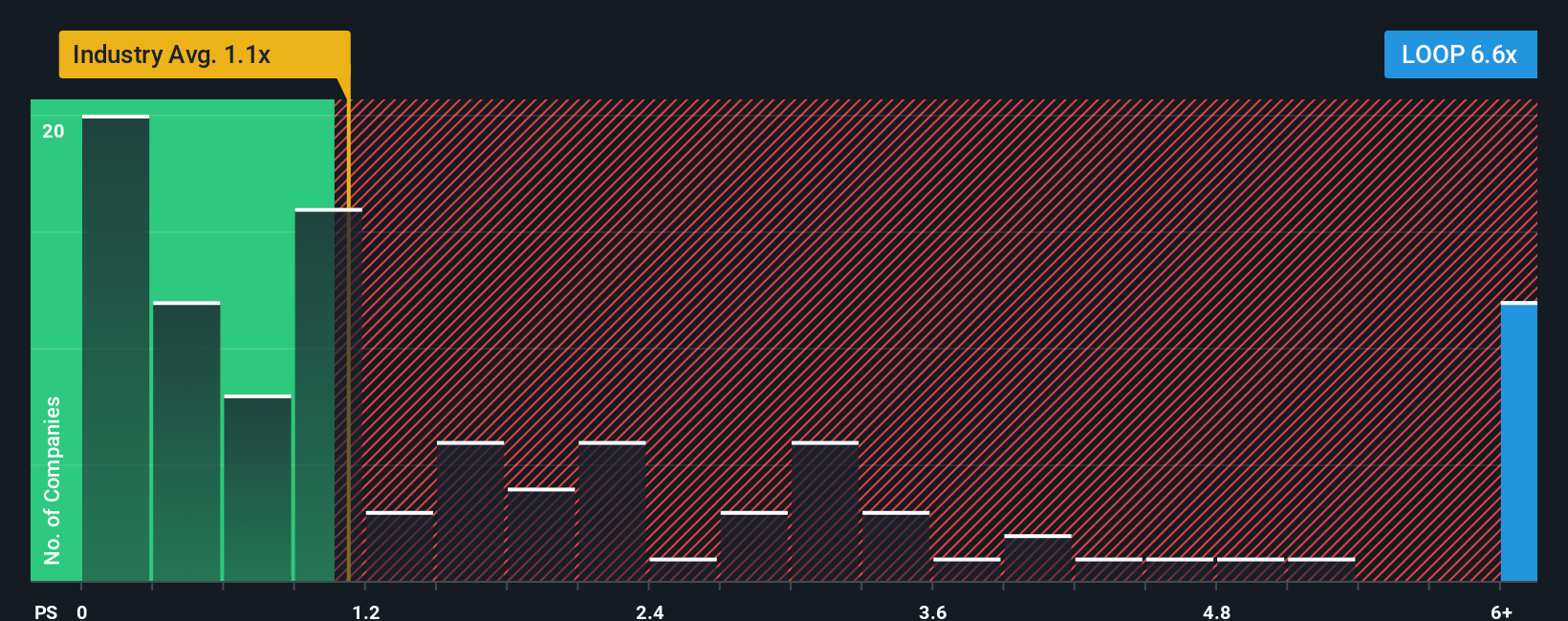

After such a large jump in price, you could be forgiven for thinking Loop Industries is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 6.6x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Loop Industries

How Loop Industries Has Been Performing

With revenue growth that's superior to most other companies of late, Loop Industries has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Loop Industries.What Are Revenue Growth Metrics Telling Us About The High P/S?

Loop Industries' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Looking ahead now, revenue is anticipated to climb by 66% per annum during the coming three years according to the three analysts following the company. That's shaping up to be materially higher than the 21% per year growth forecast for the broader industry.

With this information, we can see why Loop Industries is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Loop Industries have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Loop Industries shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Loop Industries (1 is significant!) that you need to be mindful of.

If you're unsure about the strength of Loop Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:LOOP

Loop Industries

A technology company, focuses on depolymerizing waste polyethylene terephthalate (PET) plastics and polyester fibers into its base building block monomers.

High growth potential with slight risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion