- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Will Linde's (LIN) Expansion in the Southeast Reveal a Broader Play for Regional Growth Leadership?

Reviewed by Sasha Jovanovic

- Earlier this month, Linde announced it had begun supplying industrial gases from a new air separation unit to customers across eastern Tennessee, northern Alabama, and Georgia, expanding its network in the Southeastern U.S.

- This move underscores Linde’s commitment to supporting industrial growth along the Interstate 75 corridor while strengthening supply reliability for a diverse customer base in the region.

- We’ll explore how the recent air separation unit launch could impact Linde’s investment narrative and future regional growth opportunities.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Linde Investment Narrative Recap

Linde’s investment case often centers on steady demand for industrial gases, reliable cash flow from long-term contracts, and exposure to global infrastructure and clean energy projects. The latest air separation unit (ASU) launch expands Linde’s US network but is unlikely to materially shift the biggest near-term catalyst, which remains project conversion in high-growth markets, or offset the primary risk relating to ongoing economic weakness and plant closures in Europe.

Among recent developments, Linde’s July 2025 commitment to supply industrial gases for rocket launches in Florida stands out, deepening the company’s presence in specialized end markets and reinforcing its multi-year project pipeline. This, paired with the Tennessee ASU, illustrates ongoing investment to support volume and margin resilience even as global industrial demand remains uncertain.

Yet, behind robust expansion in the US, investors should be mindful of the risks tied to prolonged deindustrialization and plant closures in Linde’s key European markets...

Read the full narrative on Linde (it's free!)

Linde's outlook anticipates $38.9 billion in revenue and $9.1 billion in earnings by 2028. This projection assumes 5.4% annual revenue growth and a $2.4 billion increase in earnings from the current $6.7 billion level.

Uncover how Linde's forecasts yield a $511.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

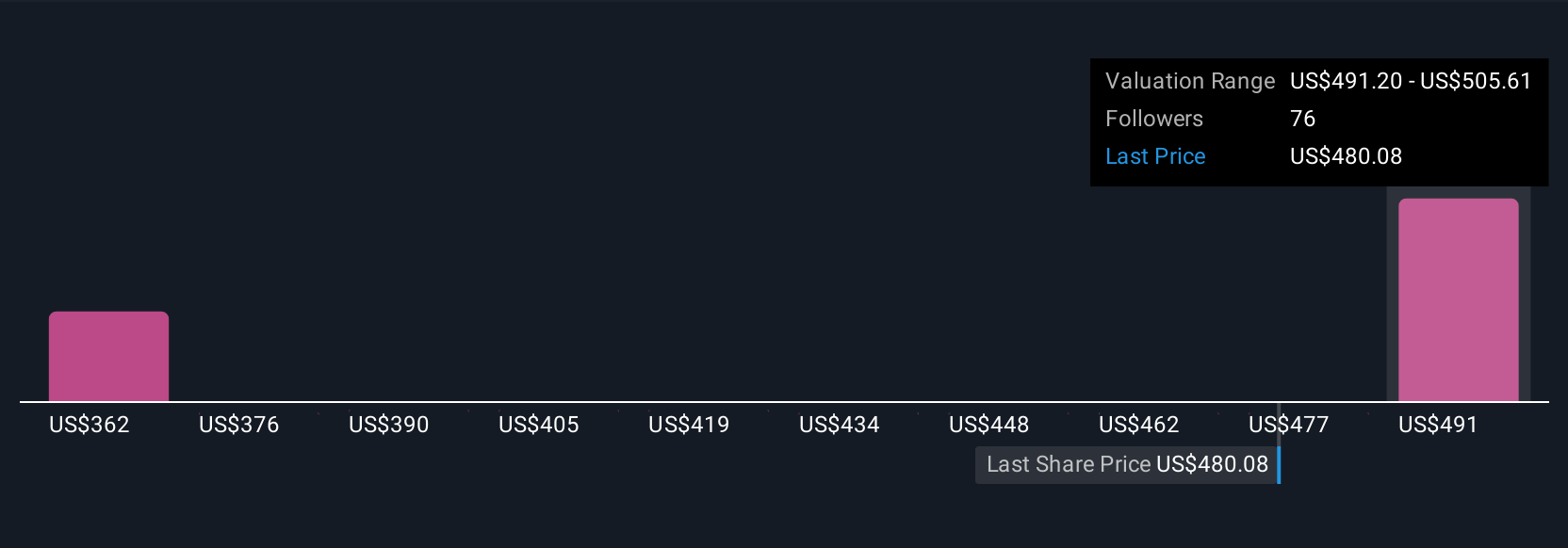

Simply Wall St Community members estimate Linde’s fair value between US$353.69 and US$511 across 4 independent valuations. Despite differing outlooks, many participants are closely watching how structural shifts in Europe could influence Linde’s future earnings and market position, explore these varied viewpoints to better understand the range of expectations.

Explore 4 other fair value estimates on Linde - why the stock might be worth as much as 15% more than the current price!

Build Your Own Linde Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Linde research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Linde's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives