- United States

- /

- Chemicals

- /

- NasdaqGS:LIN

Linde (LIN): Exploring Valuation After Analyst Upgrade and Renewed Investor Interest

Reviewed by Simply Wall St

After a fresh analyst upgrade from UBS and on-air recognition by Jim Cramer, Linde (LIN) has captured fresh attention. The conversation is centering on its diversified reach, operational momentum, and potential for stronger earnings next year.

See our latest analysis for Linde.

With all eyes on Linde's industry reach and solid project pipeline, it's worth noting the stock’s share price has climbed more than 2% year-to-date, even as its 1-year total shareholder return reflects a modest pullback. Still, long-term investors are sitting on a stellar 80% five-year total return. This suggests that momentum may be in a pause rather than a permanent stall, especially as operational upgrades and analyst optimism have entered the spotlight.

If Linde’s resilience through evolving industrial cycles grabbed your attention, you might want to broaden your search and discover fast growing stocks with high insider ownership.

With analyst upgrades and industry momentum in focus, the question now is whether Linde’s current valuation leaves further upside for investors, or if the market has already factored in the company’s future growth prospects.

Most Popular Narrative: 16.3% Undervalued

Linde’s current fair value estimate of $505.61 stands well above its last closing price of $423.39. This notable gap has investors talking. This valuation rests on an optimistic outlook for future earnings and profit margins, even with ongoing uncertainty in the macro environment.

Strategic investments and customer commitments in rapidly expanding growth markets such as commercial space launches, electronics, and clean hydrogen (with almost $5 billion in new clean energy contracts) offer a runway for high-margin revenue streams and new project conversion. These factors are expected to structurally lift blended margins and earnings.

Curious about what drives this optimism? The full narrative contains bold expectations about how Linde will turn new markets into stronger margins. What is the key projection analysts are betting on? See what could make or break this valuation forecast when you dive deeper into the numbers.

Result: Fair Value of $505.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in industrial demand and slow clean energy adoption in Europe could present challenges for Linde’s earnings growth and valuation outlook in the coming years.

Find out about the key risks to this Linde narrative.

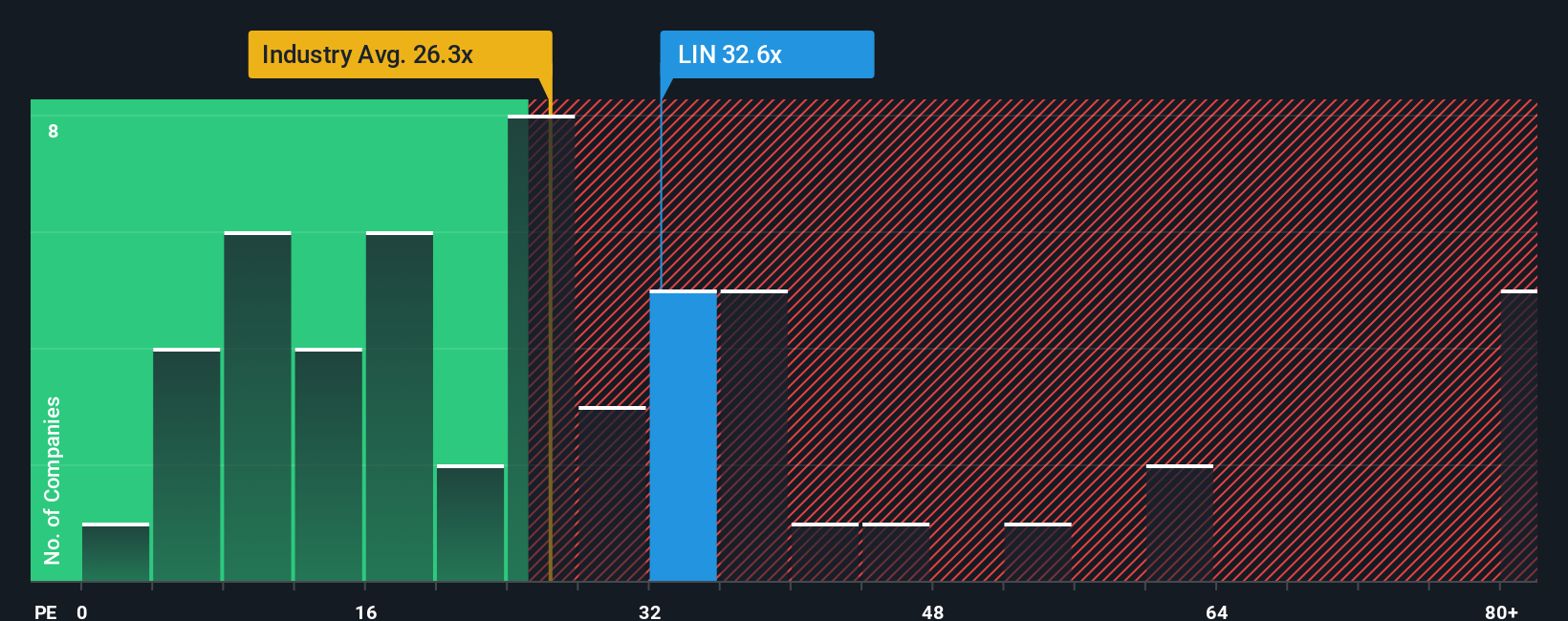

Another View: Market Comparisons Tell a Different Story

When we look at Linde’s valuation against the typical price-to-earnings ratio in its industry, the picture shifts. Linde trades at 27.9x earnings, which is higher than the US Chemicals industry average of 22.9x and above the fair ratio of 26.5x. This suggests investors are paying a premium, raising the question if the stock is priced for perfection or if room remains for upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Linde Narrative

If you want to uncover your own perspective or explore different angles in the data, you can easily craft a personal narrative for Linde in just a few minutes. Do it your way

A great starting point for your Linde research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Smart investors know that keeping options open is the key to building an edge. Take your research further with a few standout stock ideas from our easy-to-use screener tools and never let a compelling opportunity slip by.

- Boost income potential and spot long-term winners by scanning for consistent yields using these 16 dividend stocks with yields > 3%.

- Tap into powerful tech trends by checking out these 25 AI penny stocks with strong momentum in artificial intelligence innovation.

- Uncover future leaders trading at attractive prices when you search for value in these 887 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LIN

Linde

Operates as an industrial gas company in the United States, China, Germany, the United Kingdom, Australia, Mexico, Brazil, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives