- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Why Kaiser Aluminum (KALU) Is Up 16.4% After Reporting Surging Q3 Profits and Strong Outlook

Reviewed by Sasha Jovanovic

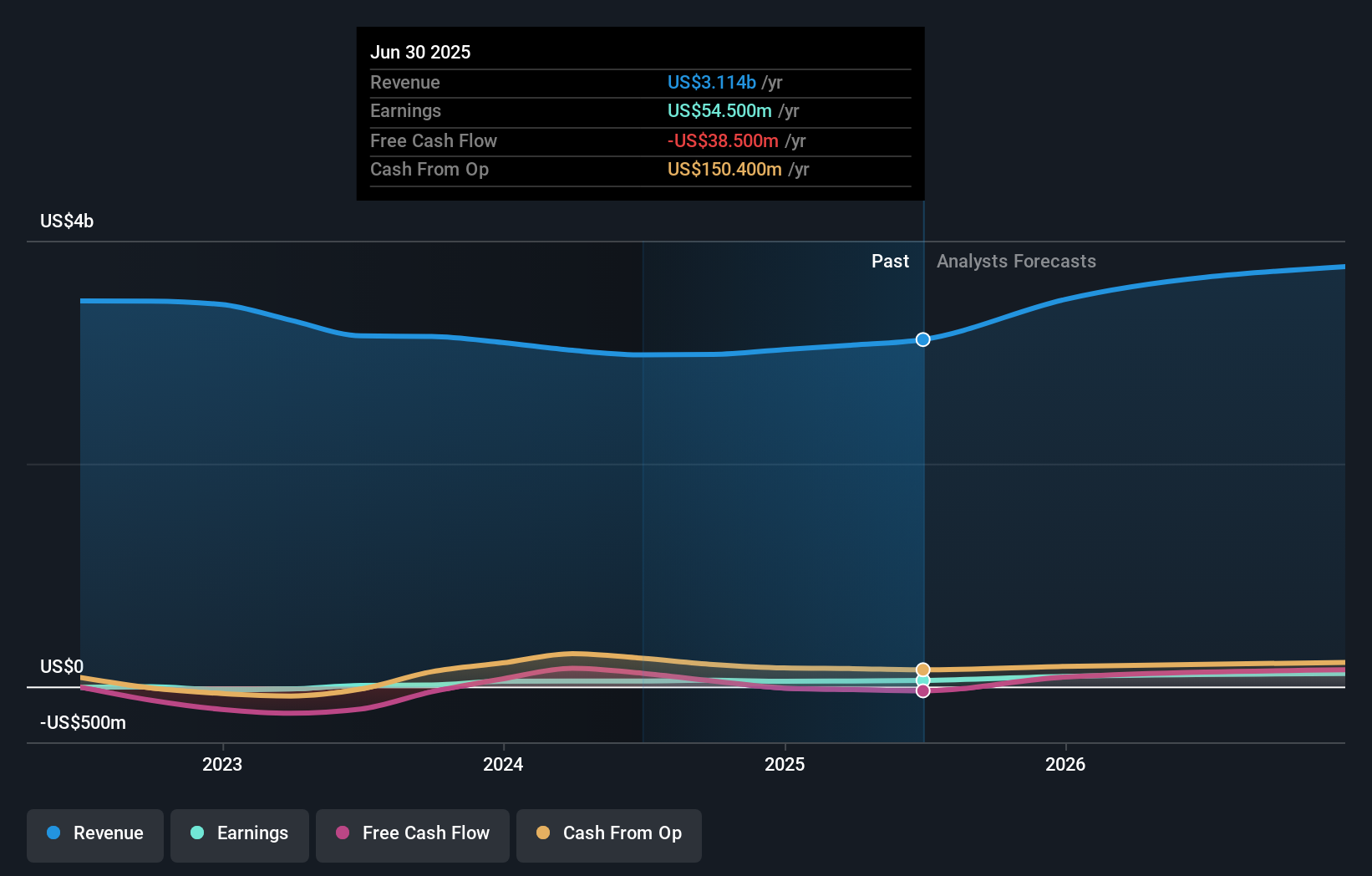

- Kaiser Aluminum Corporation recently reported third quarter 2025 results, highlighting US$843.5 million in sales and a significant jump in net income to US$39.5 million from US$8.8 million a year earlier.

- Management emphasized increased capacity and robust demand across aerospace, packaging, engineering, and automotive markets, underpinning a more optimistic outlook for future earnings.

- To understand the implications for Kaiser Aluminum, we'll examine how its strong operational performance and rising outlook shape the company's investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

What Is Kaiser Aluminum's Investment Narrative?

If you’re considering Kaiser Aluminum, you’ll likely want to believe in its ability to convert operational momentum into lasting shareholder value. The recent plan to refinance debt through a US$500 million senior notes offering, aimed at redeeming existing notes due 2028, is not expected to fundamentally alter the company’s short term catalysts. Kaiser’s near-term story continues to center on expanding capacity in core markets like aerospace and packaging, along with ongoing margin improvement efforts. While the refinancing move could lower interest costs and provide greater financial flexibility, it doesn’t materially shift the biggest current risks, such as weaker operating cash flow relative to debt and ongoing sensitivity to raw material price swings. The most important developments still hinge on maintaining recent earnings growth and reliable demand, with the debt restructuring a supportive, but not transformative, factor for the underlying investment thesis.

But remember, growing earnings haven’t fully addressed concerns about cash flow coverage on debt. Kaiser Aluminum's shares have been on the rise but are still potentially undervalued by 18%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Kaiser Aluminum - why the stock might be worth as much as 23% more than the current price!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives