- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Kaiser Aluminum (KALU) Margin Improvement Reinforces Bull Case Despite Slower Revenue Growth Forecast

Reviewed by Simply Wall St

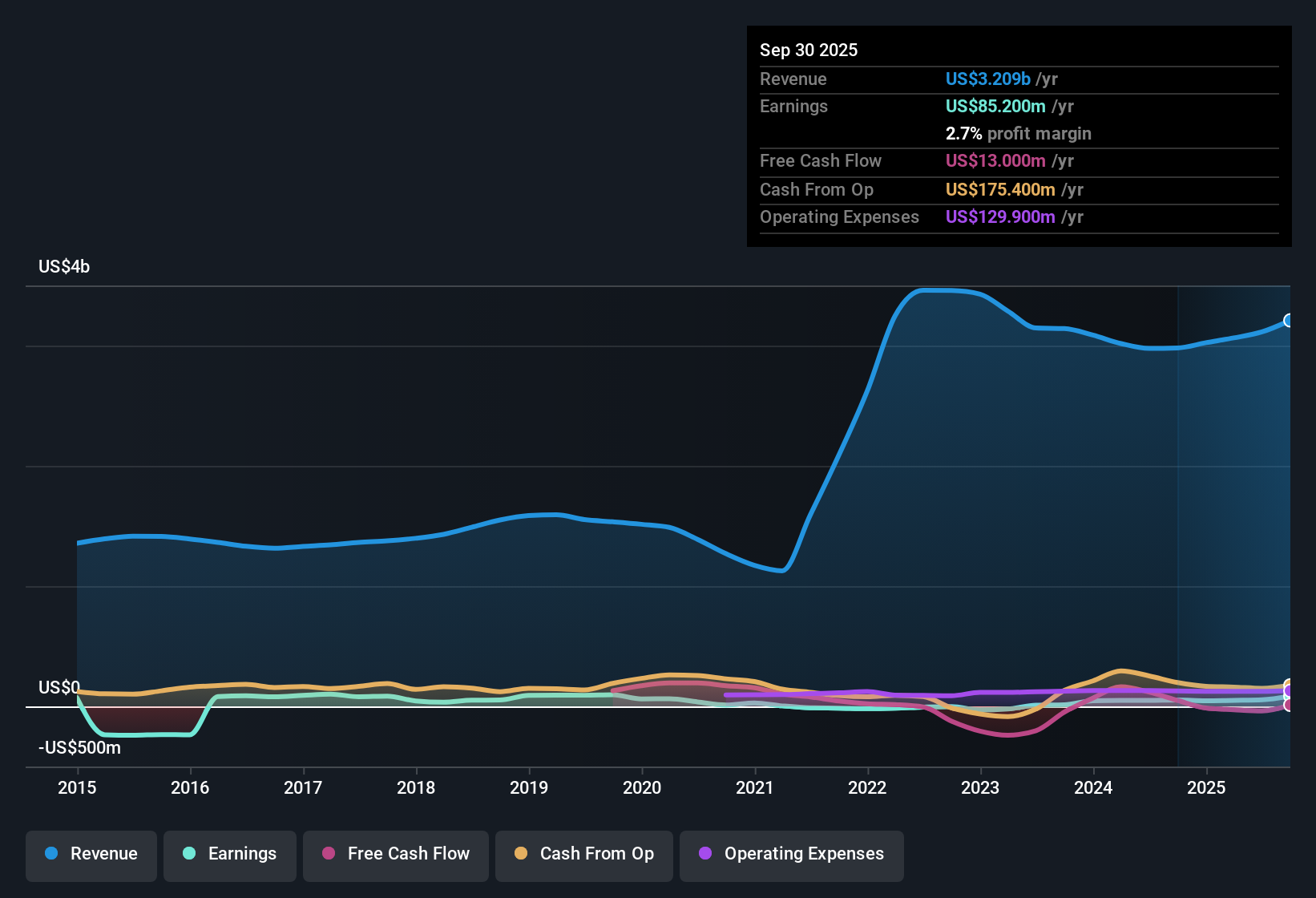

Kaiser Aluminum (KALU) reported net profit margins of 2.7%, up from 1.9% previously, and delivered annual earnings growth of 50.5% for the year. Shares finished the period at $95.58, trading below their estimated fair value of $113.84 and at an 18x Price-To-Earnings Ratio, which is lower than both industry and peer group averages. Investors are likely to view the combination of improved margins, robust past earnings momentum, and apparent undervaluation as positives at first glance.

See our full analysis for Kaiser Aluminum.Next, we will compare these headline results against the key narratives driving sentiment around Kaiser Aluminum, highlighting where consensus is confirmed and where surprises may emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Expansion Closes the Gap

- Kaiser Aluminum's net profit margin rose to 2.7%, up notably from 1.9%. The five-year average annual earnings growth sits slightly higher at 52.1% per year compared to the most recent year's 50.5%.

- What’s surprising is that recent margin improvement heavily supports the view that operational efficiency remains a core strength. This backs up positive market sentiment despite risks of margin pressure.

- This margin gain comes as overall earnings growth tempers, suggesting that cost controls are in effect rather than just revenue acceleration.

- Confidence in management’s cost discipline and efficiency is gaining traction, even while sector peers face volatile input costs and supply chain obstacles.

Growth Trails Broader Market Pace

- The company forecasts future revenue to climb at 4.5% per year, which is well below the broader US market growth rate of 10% per year.

- Bears argue that the revenue growth lag underscores the risk that Kaiser Aluminum may not keep pace with sector leaders.

- Despite healthy margins, slower projected top-line growth could limit how much upside the stock offers when macro trends favor more aggressive players.

- The less robust growth projection becomes a sticking point for those warning about overreliance on margin management, especially if end markets fail to rebound quickly.

Trading Below DCF Fair Value Benchmarks

- Kaiser Aluminum’s share price at $95.58 is below the peer group Price-To-Earnings ratio average of 30.5x and the industry’s 24.9x. It also trades at a significant discount to its DCF fair value estimate of $113.84.

- Compared to peers with higher multiples, the current pricing challenges concerns about overvaluation and raises the prospect that the market is undervaluing the company's steady profitability profile.

- The lower-than-average P/E ratio makes the stock appealing to value-oriented investors seeking established margin stability and a visible gap to intrinsic valuation.

- This valuation tension is especially relevant when viewed alongside Kaiser's track record for growing earnings at a rate well above most mid-cap industrials.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kaiser Aluminum's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Kaiser Aluminum’s profit margins have improved, its projected revenue growth lags the broader market and may limit long-term upside potential.

If faster growth is what you’re after, check out high growth potential stocks screener (59 results) to find established companies forecast to deliver much stronger earnings momentum in the years ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives