- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

A Look at Kaiser Aluminum’s (KALU) Valuation Following $500 Million Senior Notes Refinancing

Reviewed by Simply Wall St

Kaiser Aluminum (KALU) has just completed a private placement of $500 million in senior notes. The company aims to use the proceeds to refinance its existing notes set to mature in 2028. This refinancing step could influence the company’s balance sheet flexibility and future interest costs.

See our latest analysis for Kaiser Aluminum.

After a stellar 16.8% share price gain over the last month, Kaiser Aluminum has delivered a robust 29.8% year-to-date share price return, with total shareholder return of 17.8% over the past year. While refinancing activity and a recent insider sale have generated some headlines, the stock’s momentum suggests investors are reassessing both its growth prospects and risk profile.

If financial moves like these have you curious about other companies with strong momentum, it’s a great time to discover fast growing stocks with high insider ownership

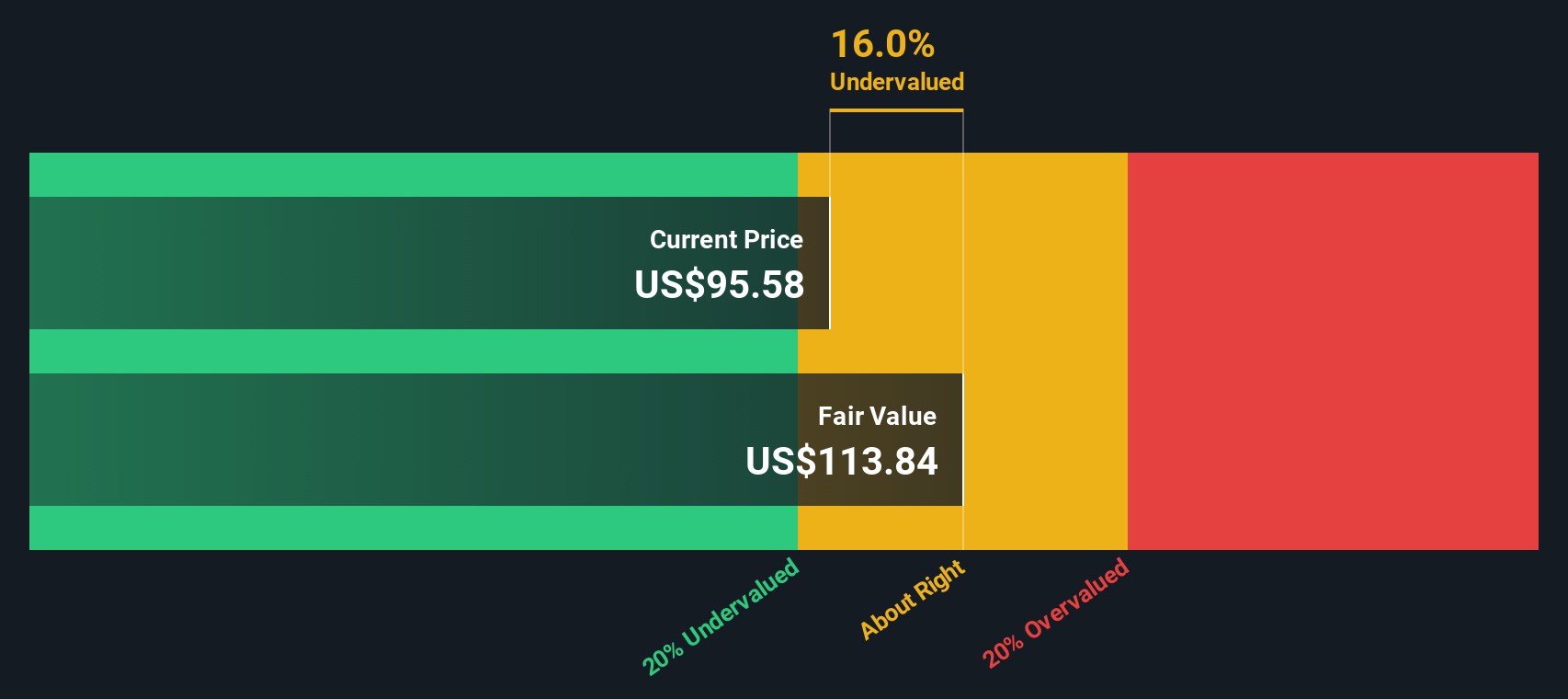

With the share price up nearly 30% this year and now trading at a notable discount to analyst price targets, investors might wonder whether Kaiser Aluminum is undervalued or if the market is already pricing in future growth expectations.

Price-to-Earnings of 17.2x: Is it justified?

Kaiser Aluminum currently trades at a price-to-earnings (P/E) ratio of 17.2x, indicating the market is willing to pay $17.20 for each $1 of earnings. With the last close at $91.22, this puts the company at a much lower multiple than both its peers and the wider industry.

The P/E ratio compares a company’s current share price to its per-share earnings, providing a quick snapshot of investor expectations for future profitability. For a manufacturer like Kaiser Aluminum, this multiple is especially relevant as it reflects both recent earnings growth and market perception of stability.

Kaiser Aluminum’s P/E of 17.2x is substantially below the peer average of 47.2x and the US Metals and Mining industry average of 20.5x. Compared to its calculated fair ratio of 19.6x, the market is currently underpricing Kaiser’s earnings potential relative to both direct peers and the broader sector benchmark. If the market moves toward the fair ratio, there could be meaningful upside.

Explore the SWS fair ratio for Kaiser Aluminum

Result: Price-to-Earnings of 17.2x (UNDERVALUED)

However, persistent volatility in short-term returns or slower than expected earnings growth could challenge the view that Kaiser Aluminum remains undervalued.

Find out about the key risks to this Kaiser Aluminum narrative.

Another View: SWS DCF Model Suggests Even More Upside

While the price-to-earnings ratio points to undervaluation, our DCF model calculates a higher fair value of $128.34 per share, compared to the current price of $91.22. If the market begins to recognize this, could Kaiser Aluminum be positioned for an even bigger move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

If you have a different take on Kaiser Aluminum or want to dig deeper into the numbers, you can build your own narrative in just a few minutes, starting with Do it your way

A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next big opportunity pass you by. Expand your investing strategy with unique stock ideas on Simply Wall Street and keep your portfolio ahead of the curve.

- Tap into the AI revolution by reviewing these 25 AI penny stocks making headlines with breakthrough innovations and scalable business models.

- Capture potential long-term income by considering these 16 dividend stocks with yields > 3% offering yields above 3% and a track record of steady payouts.

- Experience the power of quantum innovation as you evaluate these 26 quantum computing stocks shaping the landscape of cutting-edge computing and data security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives