- United States

- /

- Chemicals

- /

- NasdaqGS:IOSP

What Innospec (IOSP)'s Dividend Hike and Buybacks Reveal About Its Response to Earnings Pressure

Reviewed by Sasha Jovanovic

- In recent days, Innospec Inc. reported third quarter 2025 results with net income of US$12.9 million on sales of US$441.9 million, declared a semi-annual dividend of US$0.87 per share to be paid in late November, and completed a significant share repurchase totaling 246,528 shares for US$22.2 million.

- The combination of a marked year-over-year earnings decline and concurrent shareholder return initiatives highlights Innospec's approach to balancing capital deployment with near-term profitability pressures.

- We'll examine how Innospec's sizable dividend increase informs the company's investment narrative amid recent earnings challenges.

Find companies with promising cash flow potential yet trading below their fair value.

Innospec Investment Narrative Recap

To be an Innospec shareholder right now, you need conviction in its ability to leverage long-term demand for specialty and sustainable chemicals, even as near-term pressures challenge profitability. The recent dividend increase and share buyback are unlikely to materially shift the immediate catalyst: restoring earnings momentum, while the biggest risk remains ongoing margin pressure in core segments amid raw material volatility.

The standout recent announcement is the sizable dividend hike to US$0.87 per share, which arrives during a period of declining net income and signals ongoing priority to shareholder returns. This move could be seen as a reflection of management’s confidence in cash generation, but it does not directly ease concerns about margin compression and profitability recovery, which are central to the stock's short-term outlook.

By contrast, investors should be aware that raw material cost swings and slow pricing adjustments may quickly ...

Read the full narrative on Innospec (it's free!)

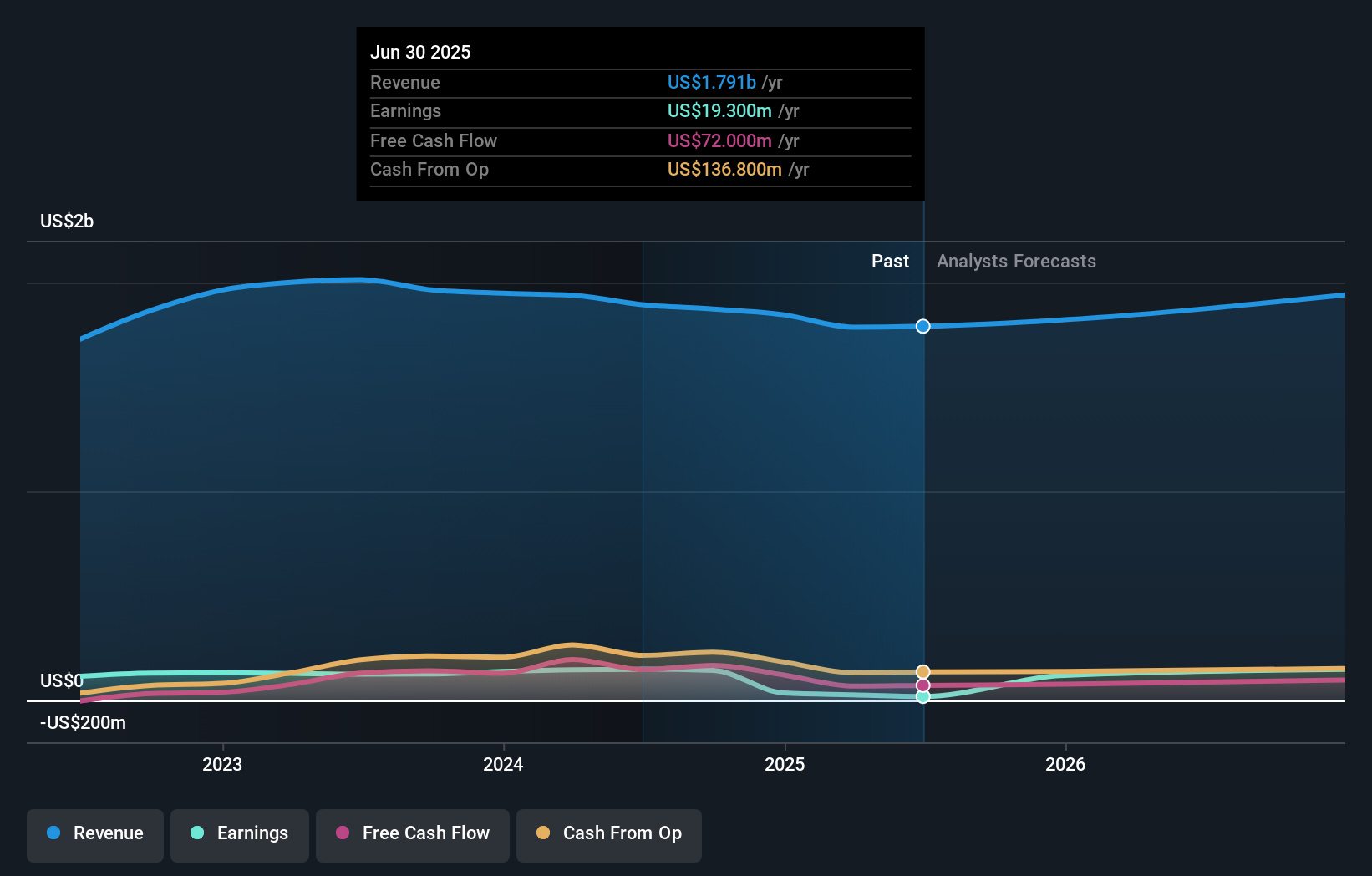

Innospec's outlook anticipates $2.1 billion in revenue and $457.7 million in earnings by 2028. This scenario is based on annual revenue growth of 5.4% and an earnings increase of $438.4 million from the current earnings of $19.3 million.

Uncover how Innospec's forecasts yield a $107.50 fair value, a 44% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community currently features a single fair value estimate of US$126.24 for Innospec, pointing to views of significant undervaluation. With margin preservation remaining a focus, consider how others may interpret the company’s ability to sustain returns despite recent profit declines.

Explore another fair value estimate on Innospec - why the stock might be worth just $126.24!

Build Your Own Innospec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innospec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Innospec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innospec's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IOSP

Innospec

Develops, manufactures, blends, markets, and supplies specialty chemicals in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives