- United States

- /

- Chemicals

- /

- NasdaqGS:HWKN

Will Higher Analyst Estimates Alter the Long-Term Capital Efficiency Story at Hawkins (HWKN)?

Reviewed by Sasha Jovanovic

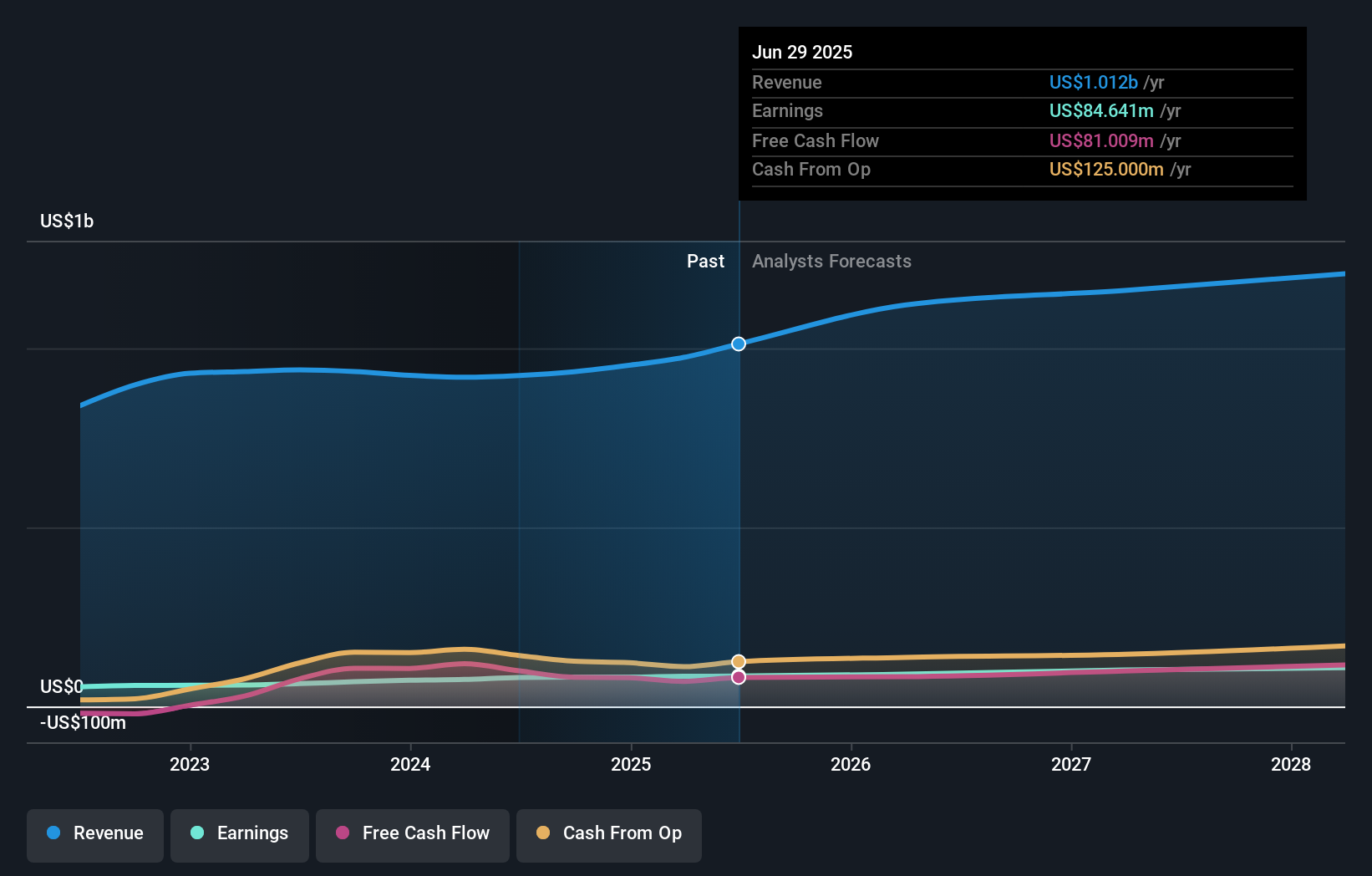

- Hawkins was recently upgraded to a Zacks Rank #2, reflecting a more favorable outlook as analysts raised their earnings estimates for the company.

- Hawkins has consistently maintained a return on capital above the industry average while significantly increasing its capital employed over the past five years.

- We'll explore how the analyst upgrade, driven by higher earnings estimates, shapes Hawkins' current investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Hawkins' Investment Narrative?

For Hawkins, the core story remains about consistent performance and disciplined capital allocation. The latest analyst upgrade, sparked by raised earnings estimates, could reignite interest in the shares and potentially affect near-term trading, but the long-range catalysts are unchanged: stable profit growth, a reliable dividend, and the company’s tendency to reinvest capital effectively. Despite the upbeat signals, including recent dividend hikes and rising sales, the stock is already priced above most fair value estimates and trades at a premium to industry and peer price-to-earnings ratios. Risks now center on elevated valuation, reliance on continued earnings growth, and execution of any future acquisitions, especially as profit margin expansion has started to plateau and debt levels remain high. The analyst upgrade may temper concerns, but value-conscious investors still must weigh premium pricing against future growth.

Yet, the risk posed by Hawkins’ high valuation is something investors should be watching. Hawkins' share price has been on the slide but might be up to 33% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Hawkins - why the stock might be worth as much as $166.00!

Build Your Own Hawkins Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hawkins research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hawkins research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hawkins' overall financial health at a glance.

No Opportunity In Hawkins?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hawkins might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HWKN

Hawkins

Operates as a water treatment and specialty ingredients company in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives