- United States

- /

- Metals and Mining

- /

- NasdaqCM:GSM

Ferroglobe (NASDAQ:GSM) shareholder returns have been strong, earning 282% in 3 years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But in contrast you can make much more than 100% if the company does well. For example, the Ferroglobe PLC (NASDAQ:GSM) share price has soared 282% in the last three years. How nice for those who held the stock! It's also good to see the share price up 61% over the last quarter.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Ferroglobe

Because Ferroglobe made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years Ferroglobe saw its revenue shrink by 16% per year. So we wouldn't have expected the share price to gain 56% per year, but it has. It's fair to say shareholders are definitely counting on a bright future.

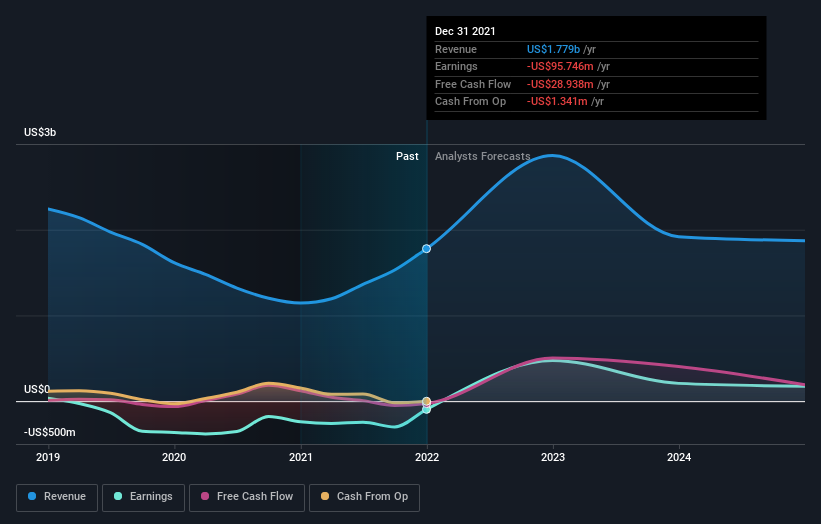

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free report showing analyst forecasts should help you form a view on Ferroglobe

A Different Perspective

It's nice to see that Ferroglobe shareholders have received a total shareholder return of 124% over the last year. Notably the five-year annualised TSR loss of 3% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Ferroglobe better, we need to consider many other factors. Even so, be aware that Ferroglobe is showing 2 warning signs in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GSM

Ferroglobe

Produces and sells silicon metal, and silicon and manganese-based ferroalloys in the United States, Europe, and internationally.

Flawless balance sheet and good value.