- United States

- /

- Metals and Mining

- /

- NasdaqCM:GSM

Ferroglobe (GSM): Losses Narrow 19.5% Annually, Profit Forecasts Shape Value Narrative Ahead of Earnings

Reviewed by Simply Wall St

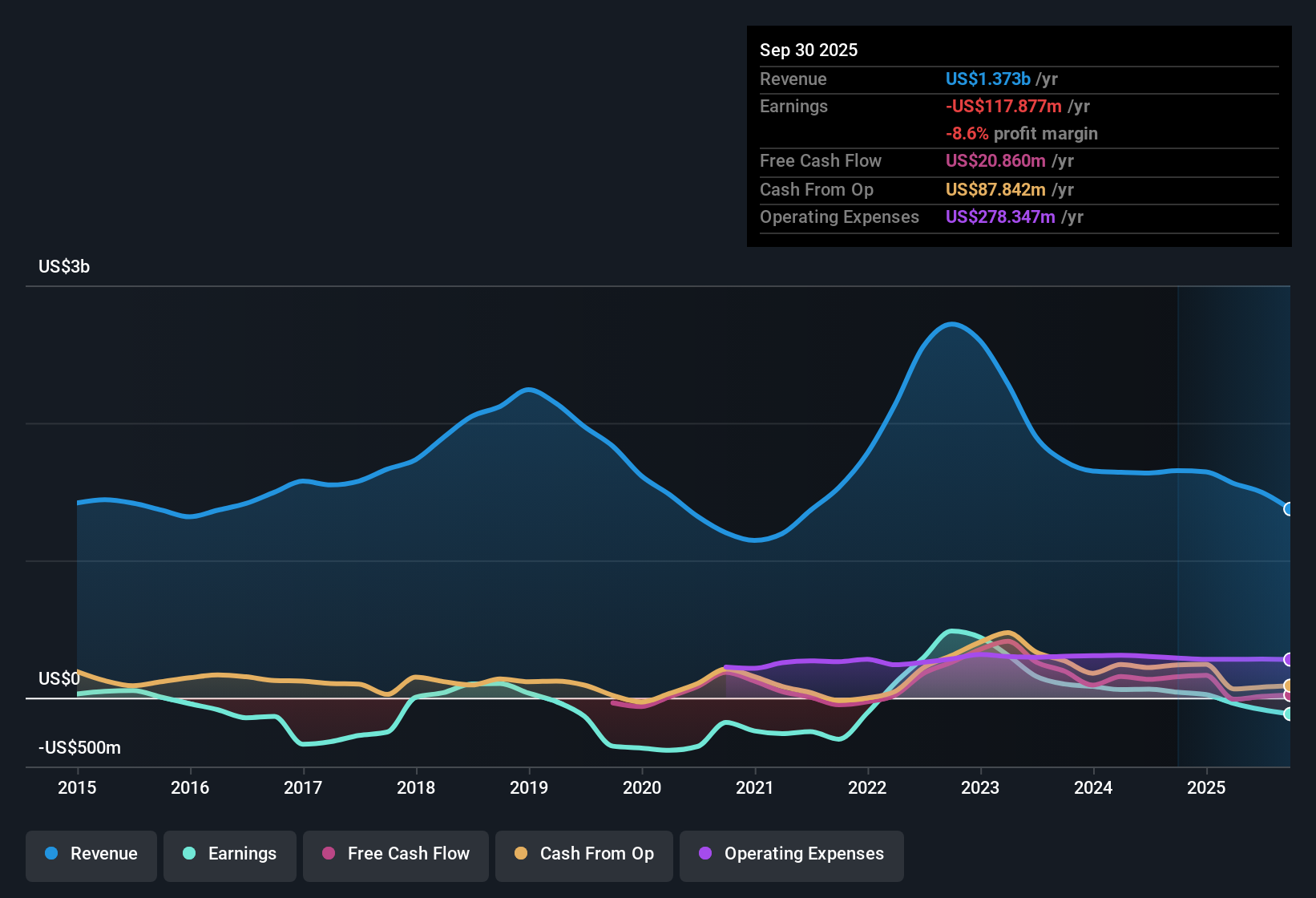

Ferroglobe (GSM) has narrowed its losses over the past five years, cutting them by 19.5% annually. Although the company remains unprofitable, analysts expect GSM to swing to profitability within three years, with earnings set to grow 118.82% per year and revenue forecast to rise 13.6% per year. Both trends outpace the broader US market. Shares currently trade at $4.14, well below the estimated fair value of $18.98, tilting the balance of rewards toward both value and strong growth potential.

See our full analysis for Ferroglobe.Next, we’ll see how these headline numbers stack up against the current narratives about Ferroglobe, highlighting where the data backs up investor sentiment and where it might spark a fresh perspective.

See what the community is saying about Ferroglobe

Margins Tipped to Swing Positive

- Profit margins are forecast to rise sharply from -5.8% today to 11.4% within three years, according to analysts' consensus view.

- This margin turnaround is supported by expectations for EU safeguard measures and US tariffs to reduce cheap imports and increase local pricing. The consensus narrative notes this should accelerate revenue recovery and operational leverage.

- Analysts also highlight that volume growth from solar and EV markets could drive more stability. Persistent trade uncertainties, however, threaten visibility and long-term planning even as profit margins are projected to climb.

- Consensus narrative points out that growing demand for high-value silicon specialties is expected to boost both volumes and margins.

- The focus on silicon-rich anodes for batteries and expanding partnerships in the tech sector is seen as a key factor to push earnings above current negative levels and support premium pricing.

- Margin improvement is also expected to benefit from operational flexibility, such as switching to higher-margin products. This could strengthen performance even in uneven industry conditions.

- See how the margin surge and tech market upside tie into analysts' balanced take on GSM's path with the full narrative. 📊 Read the full Ferroglobe Consensus Narrative.

Peer Valuation Discount Still Wide

- Ferroglobe trades at a Price-To-Sales Ratio of 0.6x, which is a deep discount compared to both the US Metals and Mining industry average of 2.7x and the peer average of 10.1x.

- Consensus narrative highlights that this valuation gap suggests the market remains skeptical about the durability of margin gains and continued revenue growth, despite improving fundamentals.

- This discount could also reflect ongoing risk around trade protection measures and revenue visibility, but analysts' consensus points out that if revenue reaches the projected $2.0 billion, the valuation could re-rate significantly.

- The DCF fair value estimate is $18.53, which is more than four times the current share price of $4.14.

- Analysts believe that for shares to reach this DCF fair value, not only will margins have to improve as projected, but market confidence in earnings resilience must also rise to align with the more optimistic consensus scenario.

- Notably, the consensus view highlights the tension between discounted valuation metrics and the rapid profit growth forecast, with both gaps offering upside if operational targets are met and macro risks subside.

Profitability Targeted for 2028, but Risks Remain

- Analysts expect Ferroglobe to reach profitability by 2028, with earnings moving from -$86.3 million currently to $222.1 million and a PE of 8.6x. Heavy dependence on trade measures, however, remains a central risk according to consensus narrative.

- The path to profitability relies on stable protectionist policies and sustained demand from growth sectors. However, the consensus narrative warns that delays or weak implementation of EU safeguard measures could erode planned margin gains.

- Prolonged pricing pressure from Chinese imports and production curtailments in Europe highlight execution risk, which could make it harder for Ferroglobe to fund growth or return capital as planned, consensus narrative notes.

- Consensus narrative also indicates that guidance withdrawal for 2025 underscores lingering uncertainty and risk to long-term projections, despite ambitious growth forecasts.

- These gaps in forward guidance cause concern among analysts, as they suggest difficulties in predicting revenue and margin recovery amidst volatile industry pricing and global trade policies.

- This uncertainty means investors should monitor developments in trade policy and market conditions closely, as they could materially affect Ferroglobe's ability to achieve long-term profit targets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ferroglobe on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? Share your perspective and shape your own narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ferroglobe.

See What Else Is Out There

Ferroglobe’s profit outlook is highly sensitive to unpredictable trade policies and fluctuating margins, which makes long-term earnings projections and financial stability less certain.

If steadier results matter to you, use stable growth stocks screener (2078 results) to zero in on companies delivering reliable revenue and profit growth across different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GSM

Ferroglobe

Produces and sells silicon metal, and silicon and manganese-based ferroalloys in the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives