- United States

- /

- Metals and Mining

- /

- NasdaqGS:CENX

Century Aluminum (CENX): Valuation in Focus After Strong Sales But Sharply Lower Profits

Reviewed by Simply Wall St

Century Aluminum (CENX) just released its third-quarter results, showing higher revenue compared to last year, but also a sharp decline in net income and earnings per share. This combination of stronger sales and weaker profits is grabbing investor attention.

See our latest analysis for Century Aluminum.

Century Aluminum’s share price has surged lately, up 14.0% just in the last day, as investors try to make sense of rising revenues alongside weaker profits. That momentum has been building for a while, with an impressive year-to-date share price return of 84% and a total shareholder return of nearly 273% over five years. This underscores both recent optimism and strong long-term gains.

If you’re looking to broaden your perspective beyond the headlines, now’s a perfect moment to explore fast growing stocks with high insider ownership.

With such strong returns and attention-grabbing earnings, the big question now is whether Century Aluminum’s current share price reflects real value or if future growth is already included in the price, leaving limited upside for new buyers.

Most Popular Narrative: 7.8% Overvalued

Century Aluminum's last close of $33.05 stands above the narrative's fair value estimate of $30.67 per share. This highlights the tension between pricing momentum and analyst caution over future assumptions.

The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production. This move aims to capture rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections, supporting future revenue growth and improved fixed cost absorption, resulting in enhanced net margins.

What’s the driving force behind this pricing disconnect? A bold forecast for production capacity, government-backed incentives, and a dramatic leap in earnings power is at the heart of the narrative. Want to see the surprising financial leaps analysts are betting on? Dive into the full story for the granular projections and critical variables that build this fair value case.

Result: Fair Value of $30.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, downside risks remain, including policy changes to tariffs or a sharp rise in energy costs. Either of these factors could significantly impact profitability.

Find out about the key risks to this Century Aluminum narrative.

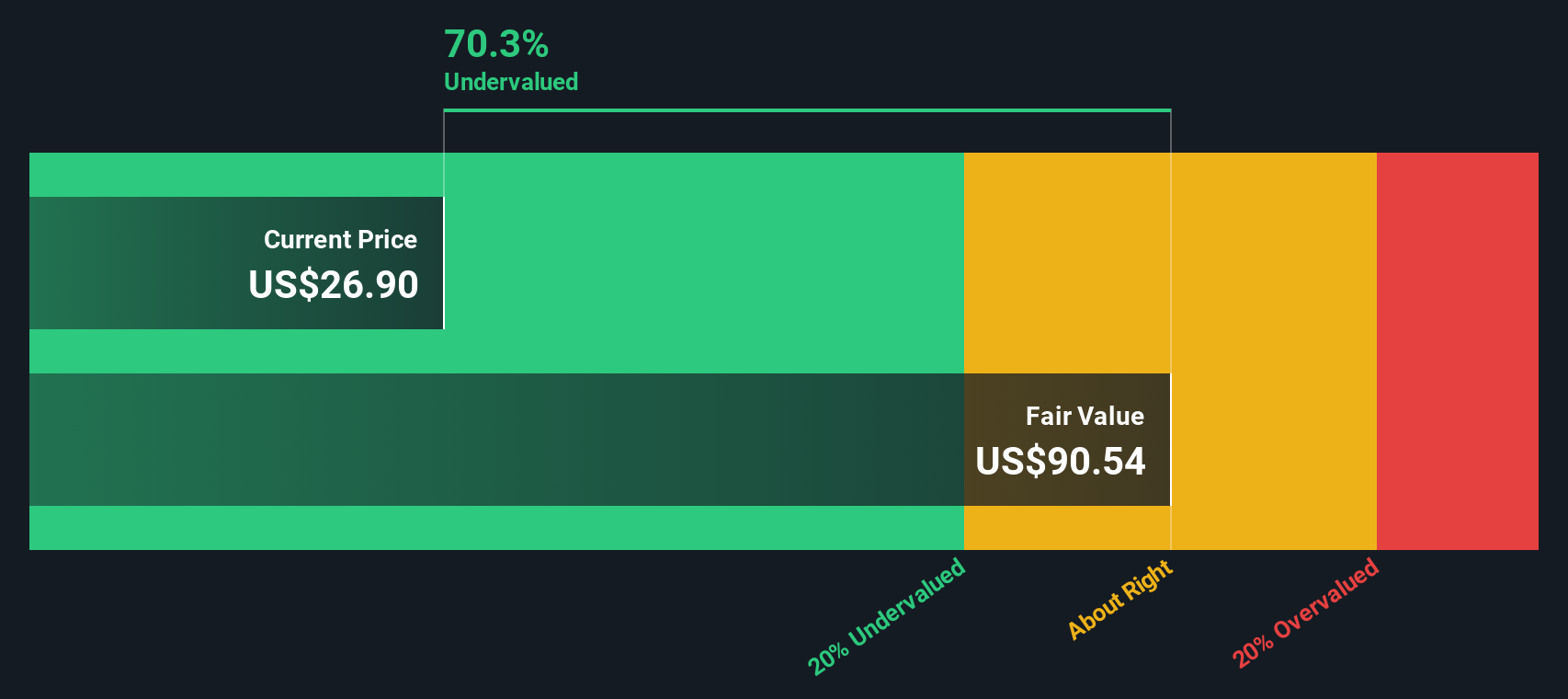

Another View: Discounted Cash Flow Says Undervalued

While the narrative-based fair value pegs Century Aluminum as overvalued, our DCF model suggests the opposite. The SWS DCF model values the company at $68.16 per share, which is more than double the current price. That is a striking disconnect and raises a key question: which method better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Century Aluminum Narrative

If you want to dig into the numbers and shape your own outlook, building a personalized narrative is quick and straightforward. Do it your way.

A great starting point for your Century Aluminum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means always staying ahead of the curve. Don’t miss out on new themes and top stocks. These ideas could shape your next big win.

- Ride the momentum and boost your returns by checking out these 870 undervalued stocks based on cash flows, featuring businesses trading below their true worth.

- Capture the power of tomorrow by harnessing growth opportunities with these 24 AI penny stocks, spotlighting companies at the forefront of artificial intelligence innovation.

- Take control of your income strategy with these 16 dividend stocks with yields > 3%, curated for those seeking reliable dividend yields and long-term financial confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENX

Century Aluminum

Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives