Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies. Balchem Corporation (NASDAQ:BCPC) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Balchem

What Is Balchem's Net Debt?

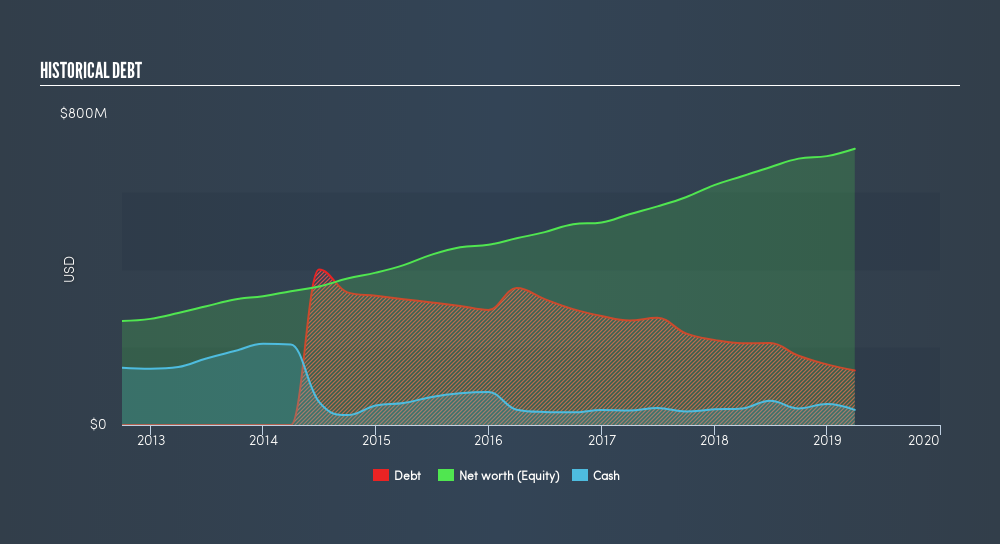

The image below, which you can click on for greater detail, shows that Balchem had debt of US$140.0m at the end of March 2019, a reduction from US$210.3m over a year. However, it does have US$39.0m in cash offsetting this, leading to net debt of about US$101.0m.

How Healthy Is Balchem's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Balchem had liabilities of US$63.8m due within 12 months and liabilities of US$197.6m due beyond that. Offsetting these obligations, it had cash of US$39.0m as well as receivables valued at US$99.8m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$122.5m.

Given Balchem has a market capitalization of US$3.22b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Either way, since Balchem does have more debt than cash, it's worth keeping an eye on its balance sheet.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Balchem has a low net debt to EBITDA ratio of only 0.66. And its EBIT easily covers its interest expense, being 14.8 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Fortunately, Balchem grew its EBIT by 3.8% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Balchem can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Balchem generated free cash flow amounting to a very robust 86% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Balchem's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its conversion of EBIT to free cash flow is also very heartening. Zooming out, Balchem seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. Over time, share prices tend to follow earnings per share, so if you're interested in Balchem, you may well want to click here to check an interactive graph of its earnings per share history.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:BCPC

Balchem

Develops, manufactures, and markets specialty performance ingredients and products for the nutritional, food, pharmaceutical, animal health, medical device sterilization, plant nutrition, and industrial markets worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives