- United States

- /

- Metals and Mining

- /

- NasdaqGS:AUGO

Aura Minerals (NasdaqGS:AUGO): Assessing Valuation After Major Dividend Announcement Signals Board Confidence

Reviewed by Simply Wall St

Aura Minerals (NasdaqGS:AUGO) just announced a dividend of $0.48 per share, totaling about $40.1 million. The payment is set for November 21 and signals the company’s focus on returning value to shareholders.

See our latest analysis for Aura Minerals.

Shares of Aura Minerals have more than doubled so far this year, with a strong year-to-date share price return of almost 193%, signaling renewed investor optimism. The recently announced dividend reflects management's confidence and has added to the upbeat momentum. The 1-year total shareholder return of 232% highlights the combined impact of dividend payouts and capital gains.

If Aura’s dividend news has you eyeing new opportunities, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Aura’s stock soaring and a generous dividend on the horizon, investors are left asking the big question: is the market underestimating the company’s potential, or is all the good news already reflected in the price?

Price-to-Sales of 3.8x: Is it justified?

Aura Minerals is currently trading at a price-to-sales (P/S) ratio of 3.8x, notably higher than the US Metals and Mining industry average of 2.6x. Despite its impressive share price run-up, this figure suggests the stock may be commanding a premium compared to sector peers.

The P/S ratio compares the market value of a company to its total sales, providing a way to value companies that may not yet be profitable. In capital-intensive sectors like mining, investors often use the P/S multiple to evaluate growth prospects and operational scale, especially when earnings are volatile or negative.

Though investors have given Aura a premium valuation relative to industry standards, this is partially justified by its rapid revenue growth trajectory. However, when comparing the current P/S ratio to the estimated fair price-to-sales ratio of 3.4x, Aura still appears slightly expensive. This creates a potential level toward which the market could adjust if expectations change.

Explore the SWS fair ratio for Aura Minerals

Result: Price-to-Sales of 3.8x (OVERVALUED)

However, ongoing volatility in net income and a 13% annual revenue growth rate could limit future upside if market sentiment shifts.

Find out about the key risks to this Aura Minerals narrative.

Another View: The SWS DCF Model Paints a Different Picture

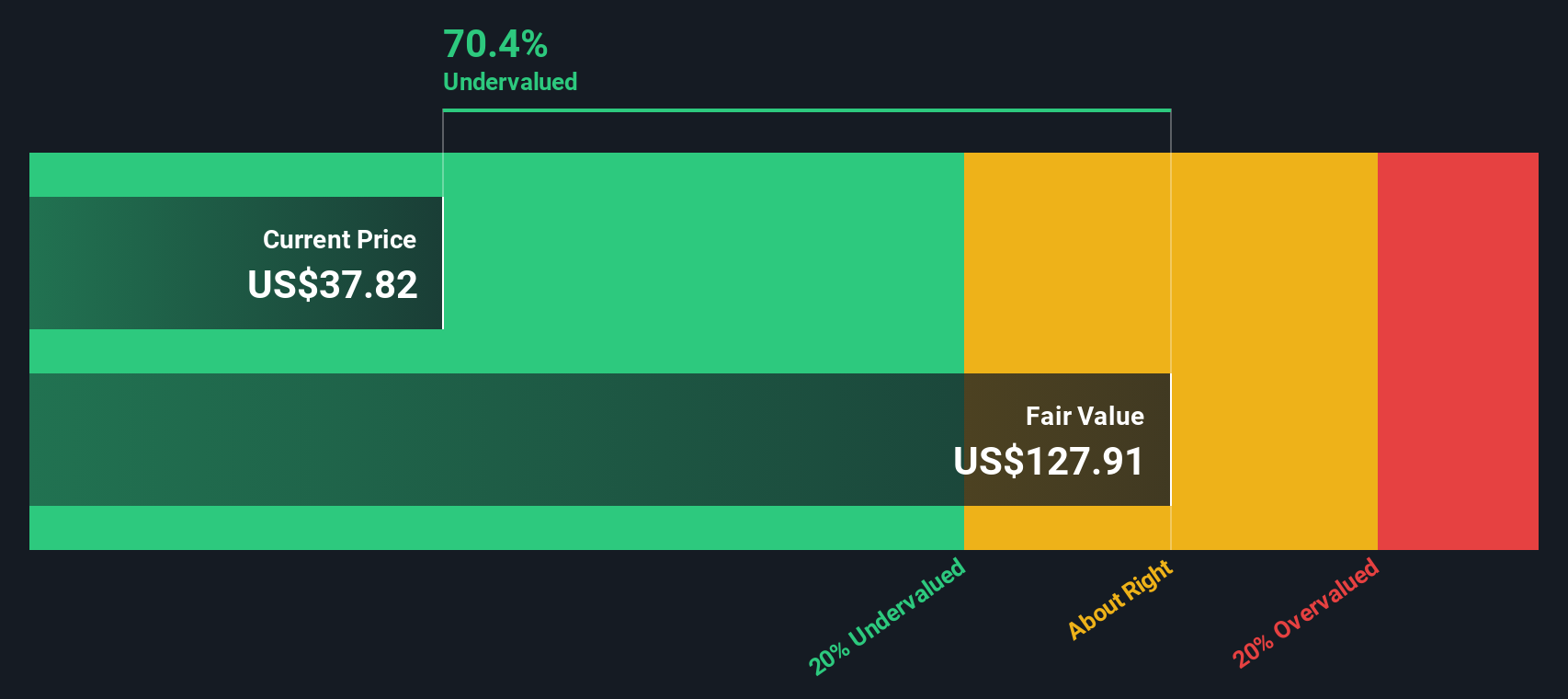

While Aura Minerals’ current price-to-sales ratio suggests the stock is trading at a premium, our DCF model offers a dramatically different perspective. According to the SWS DCF model, Aura is undervalued by nearly 70 percent, implying far more upside potential than the multiples suggest. Could the market be missing something significant, or is this a case of overly optimistic projections? The debate is far from over.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aura Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 885 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aura Minerals Narrative

If you see things differently or want to reach your own conclusions, you can dive into the numbers and build a fresh perspective in just a few minutes with Do it your way.

A great starting point for your Aura Minerals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't let your research stop here. Uncover game-changing opportunities by handpicking investments that could shape your financial future using the Simply Wall Street Screener.

- Target steady income by adding stocks with solid yields and stability available through these 16 dividend stocks with yields > 3%.

- Accelerate your growth potential by seizing early access to innovation with these 24 AI penny stocks from companies changing how AI drives business success.

- Position yourself at the cutting edge of tech by tapping into these 26 quantum computing stocks, where game-changing advancements are emerging now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AUGO

Aura Minerals

A gold and copper production company, focuses on the development and operation of gold and base metal projects in the Americas.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives