- United States

- /

- Chemicals

- /

- OTCPK:AMRS.Q

If You Had Bought Amyris (NASDAQ:AMRS) Stock Five Years Ago, You'd Be Sitting On A 94% Loss, Today

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Amyris, Inc. (NASDAQ:AMRS) for five whole years - as the share price tanked 94%. More recently, the share price has dropped a further 35% in a month. We do note, however, that the broader market is down 26% in that period, and this may have weighed on the share price.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Amyris

Amyris wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last half decade, Amyris saw its revenue increase by 25% per year. That's better than most loss-making companies. So it's not at all clear to us why the share price sunk 43% throughout that time. You'd have to assume the market is worried that profits won't come soon enough. We'd recommend carefully checking for indications of future growth - and balance sheet threats - before considering a purchase.

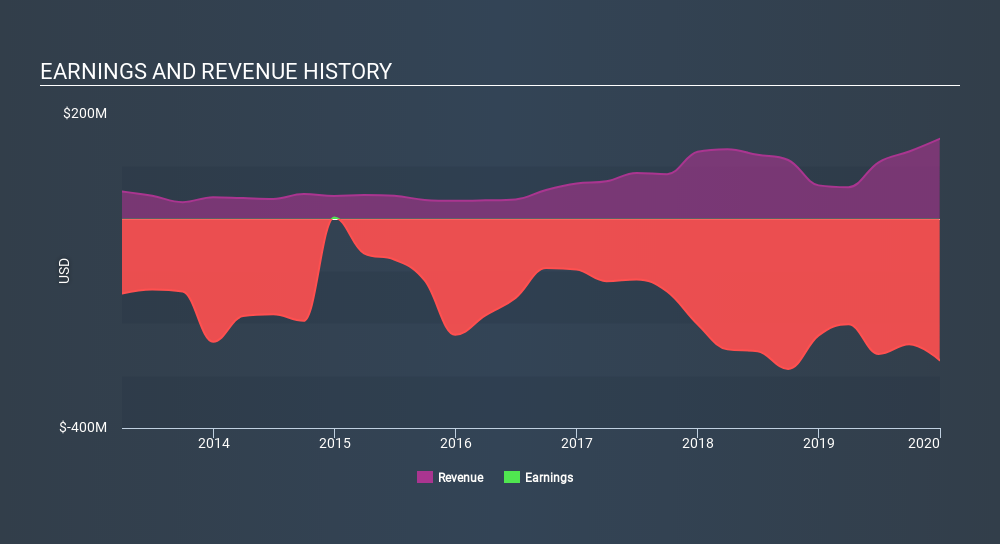

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Amyris in this interactive graph of future profit estimates.

A Different Perspective

While it's certainly disappointing to see that Amyris shares lost 8.1% throughout the year, that wasn't as bad as the market loss of 13%. What is more upsetting is the 43% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Amyris (at least 2 which are a bit unpleasant) , and understanding them should be part of your investment process.

Amyris is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:AMRS.Q

Amyris

Amyris, Inc. operates as a biotechnology company in Europe, North America, Asia, South America, and internationally.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives