- United States

- /

- Metals and Mining

- /

- NasdaqGM:ACNT

Ascent Industries Co.'s (NASDAQ:ACNT) Prospects Need A Boost To Lift Shares

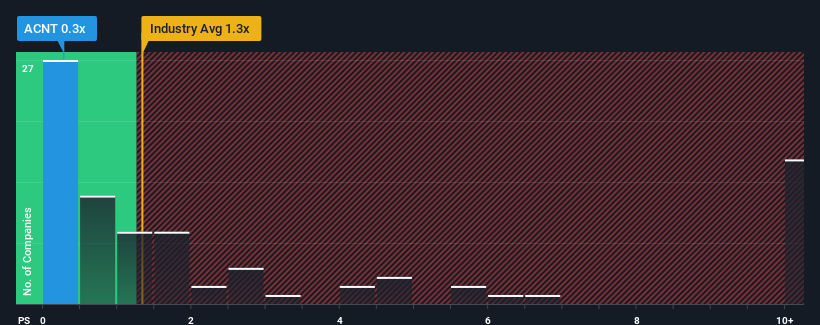

Ascent Industries Co.'s (NASDAQ:ACNT) price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Metals and Mining industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ascent Industries

How Has Ascent Industries Performed Recently?

Recent times have been pleasing for Ascent Industries as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Ascent Industries' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Ascent Industries?

In order to justify its P/S ratio, Ascent Industries would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. This was backed up an excellent period prior to see revenue up by 31% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 22% over the next year. Meanwhile, the broader industry is forecast to expand by 12%, which paints a poor picture.

With this in consideration, we find it intriguing that Ascent Industries' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Ascent Industries' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Ascent Industries maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Ascent Industries' poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Ascent Industries you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:ACNT

Ascent Industries

An industrials company, produces and sells stainless steel pipe and tube, and specialty chemicals in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives