- United States

- /

- Insurance

- /

- NYSE:WTM

White Mountains Insurance Group (WTM): Exploring Valuation After Recent Share Price Outperformance

Reviewed by Simply Wall St

White Mountains Insurance Group (WTM) has been drawing fresh attention lately, especially after its recent performance caught investors’ eyes. The stock is up by almost 10% over the past month, and this increase has outpaced many in its sector.

See our latest analysis for White Mountains Insurance Group.

Momentum has been picking up for White Mountains Insurance Group, with its recent 9.8% 1-month share price return pushing it ahead of sector peers and adding to a longer record of solid total shareholder returns, with 5.1% over the last year and a striking 112% over five years. This steady climb suggests that investors are increasingly confident in the company’s direction and growth potential, especially following its latest upward move.

If you’re looking to spot other companies with breakout potential, now’s a perfect chance to broaden your investing universe and discover fast growing stocks with high insider ownership

With shares surging and a strong track record behind it, investors may be left wondering if White Mountains Insurance Group is trading below its true value or if the market is already factoring in all its future growth.

Price-to-Earnings of 24.3x: Is it justified?

White Mountains Insurance Group is currently trading at a price-to-earnings (P/E) ratio of 24.3x, putting it at a premium relative to both peers and the broader US insurance sector.

The P/E ratio gauges what investors are willing to pay today for each dollar of earnings. It reflects market expectations for growth, profitability, and stability. For insurers, this measure often helps distinguish rapidly growing companies or those with strong, predictable profits from others in the industry.

White Mountains Insurance Group's multiple significantly exceeds the peer average of 14.6x and the US insurance industry average of 13.9x. This suggests that the current market price likely incorporates expectations for substantial growth or future recovery. However, recent earnings moves and sector trends may not fully support such a high premium at this stage.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.3x (OVERVALUED)

However, a lack of clear earnings growth and limited analyst visibility could quickly shift sentiment if future results fall short of lofty expectations.

Find out about the key risks to this White Mountains Insurance Group narrative.

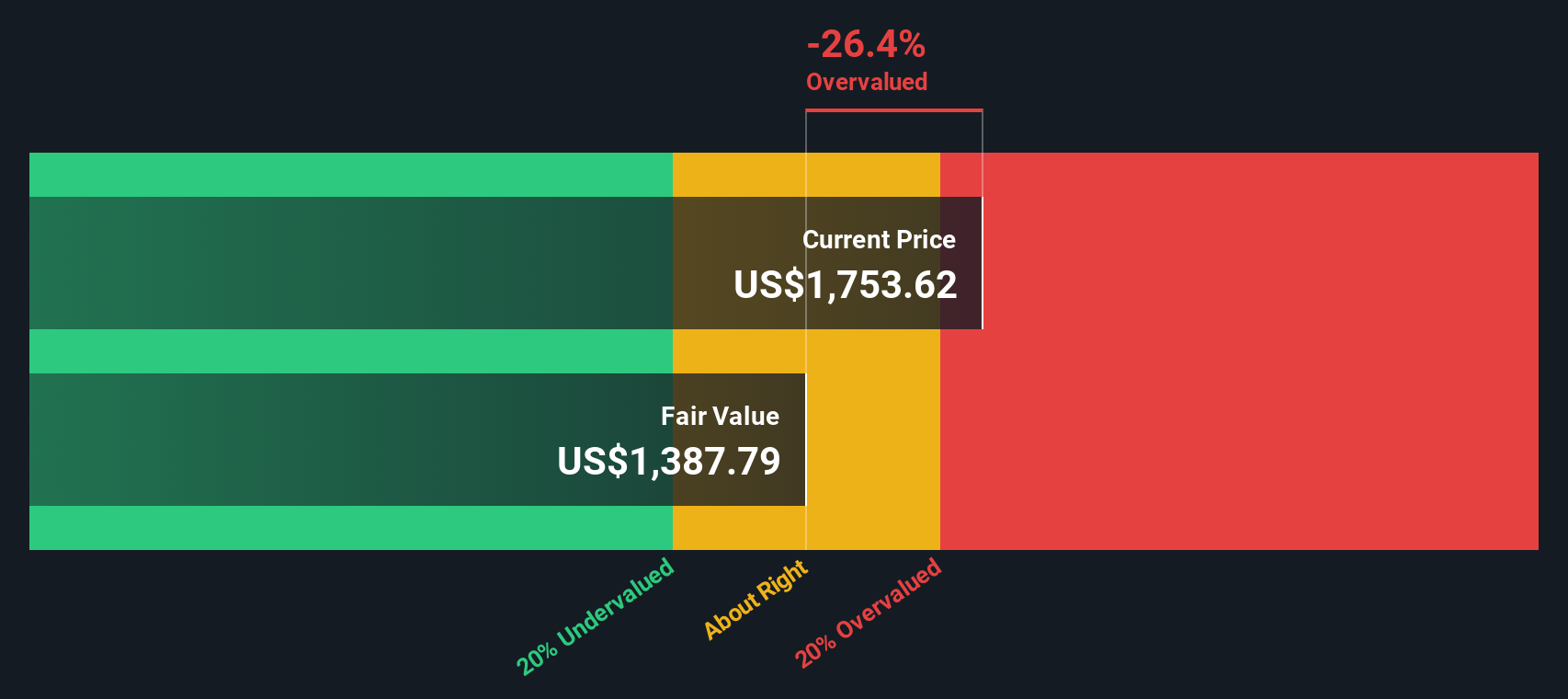

Another View: Discounted Cash Flow

Our SWS DCF model presents a very different view of White Mountains Insurance Group compared to what the market currently reflects. Based on future estimated cash flows, the model indicates the shares are overvalued and trading well above our fair value estimate of $1,388. This significant disagreement between valuation methods increases the importance of careful consideration for investors. Is the market's optimism justified, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out White Mountains Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own White Mountains Insurance Group Narrative

If you want to look beyond these conclusions or test your own ideas, it only takes a few minutes to build your personal thesis. Do it your way

A great starting point for your White Mountains Insurance Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have a few compelling prospects on their radar. If you want to keep your edge, make sure you take a look at these fresh opportunities right now.

- Tap into the power of artificial intelligence and uncover promising innovators by checking out these 27 AI penny stocks. Rapid transformation in this space is creating real winners.

- Secure steady income and growth potential by seeing these 17 dividend stocks with yields > 3%, which offers yields that outperform traditional options and provide dependable returns.

- Get ahead in the undervalued stock game as you explore these 875 undervalued stocks based on cash flows, featuring companies whose future cash flows suggest strong upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, provides insurance and other financial services in the United States.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives