- United States

- /

- Insurance

- /

- NYSE:WTM

White Mountains Insurance Group (WTM): Examining Valuation Following Increased Short Interest and Mixed Quarterly Results

Reviewed by Simply Wall St

White Mountains Insurance Group (WTM) has landed in the spotlight following a jump in short interest alongside its latest earnings results. The company reported higher year-over-year revenue, but lower net income and earnings per share.

See our latest analysis for White Mountains Insurance Group.

White Mountains Insurance Group’s share price has climbed 9.1% over the past three months, suggesting momentum is quietly building despite only a modest 1-year total shareholder return of 0.4%. The increased short interest, along with mixed earnings results, has clearly drawn more market attention lately, setting the stage for both opportunity and risk as the narrative evolves.

If you’re wondering what other names might also be gathering interest, now's a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with White Mountains Insurance Group’s solid revenue growth, lagging profits, and rising short interest, the real question is whether the current share price leaves room for upside or if the market is already taking future gains into account.

Price-to-Earnings of 35x: Is it justified?

White Mountains Insurance Group currently trades at a price-to-earnings ratio of 35x. This is significantly higher than its direct peers and the broader US Insurance industry average.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay per dollar of earnings. For an insurance company like White Mountains, this ratio should reflect the growth and quality of profits. In this case, profits have been volatile and recently impacted by large one-off losses.

Compared to the US Insurance industry average P/E of 13x, White Mountains is priced at a substantial premium. Peer companies are also averaging a similar 13.2x P/E. This raises questions as to whether the company’s future profit potential justifies such a steep valuation, especially as recent earnings growth has been negative and profits have declined over the past five years.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 35x (OVERVALUED)

However, with a lofty valuation and declining profits, any negative earnings surprise or regulatory shift could quickly prompt a sharp change in investor sentiment.

Find out about the key risks to this White Mountains Insurance Group narrative.

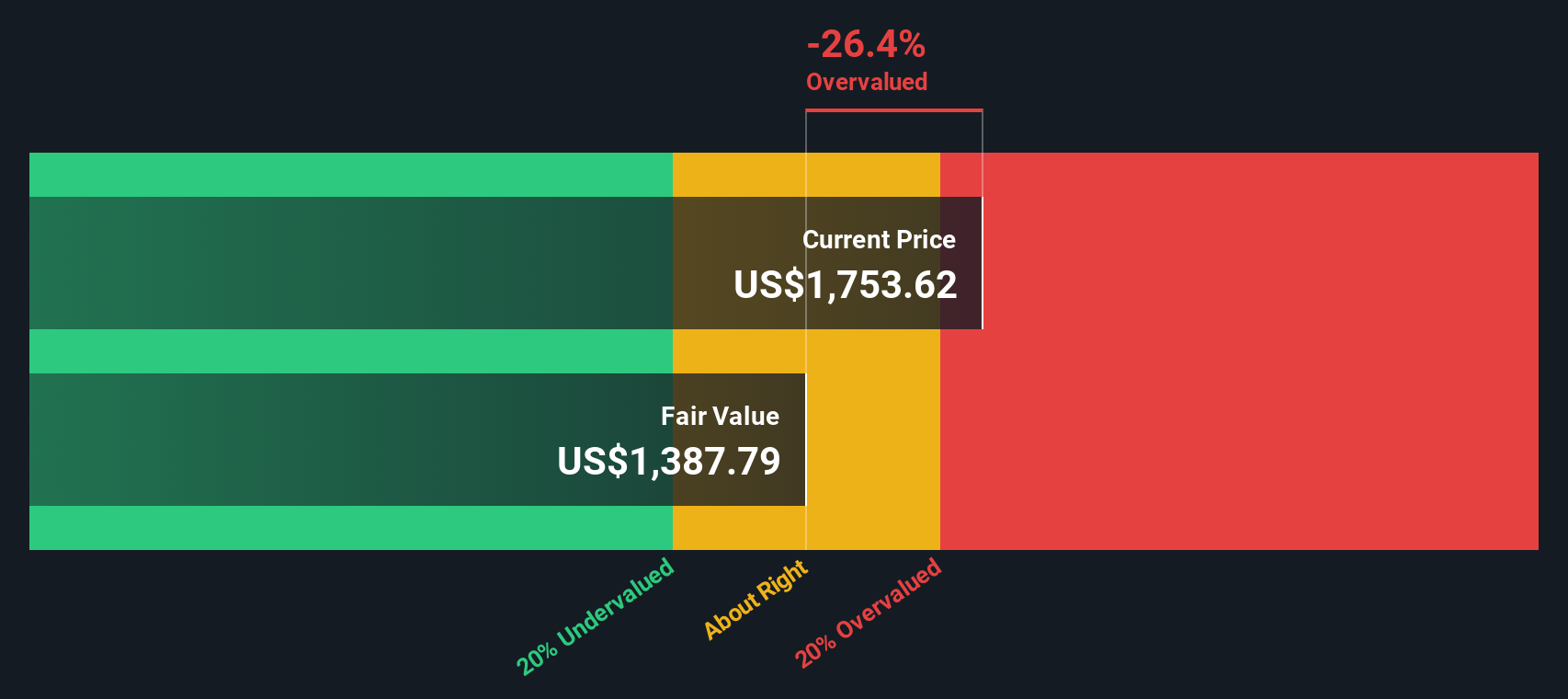

Another View: DCF Model Paints a Different Picture

Looking at valuation from a different perspective, our DCF model values White Mountains Insurance Group at $1,172.01, which is significantly below its current trading price of $1,924.67. This suggests the stock may be overvalued, offering a contrasting conclusion for investors to consider. Is the market overly optimistic, or could there be underlying factors at play?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out White Mountains Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own White Mountains Insurance Group Narrative

If you reach different conclusions or want to chart your own path, it's simple to review the numbers and craft a personalized narrative in just a few minutes. Do it your way

A great starting point for your White Mountains Insurance Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Ready for Your Next Move?

Don’t limit yourself to just one opportunity. With so many compelling investing angles, you could be missing out on top-performing stocks and rising trends.

- Capitalize on market mispricing and reap the benefits with these 886 undervalued stocks based on cash flows that financial experts are watching closely right now.

- Catch the excitement as artificial intelligence steps into the spotlight by reviewing these 25 AI penny stocks making waves with game-changing innovations.

- Start your search for strong, consistent income by targeting these 16 dividend stocks with yields > 3% delivering reliable yields and financial stability that stand out from the average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, engages in the provision of insurance and other financial services in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives