- United States

- /

- Insurance

- /

- NYSE:WTM

White Mountains Insurance Group (WTM): Evaluating Valuation After $300M Share Buyback and $1.75B Bamboo Sale

Reviewed by Simply Wall St

White Mountains Insurance Group (WTM) just announced a significant self-tender offer, aiming to repurchase up to $300 million of its shares. In addition, the company completed a $1.75 billion sale of its Bamboo homeowners’ insurance platform, retaining a minority stake.

See our latest analysis for White Mountains Insurance Group.

Shares of White Mountains Insurance Group have gained steady ground this week as news of the $300 million self-tender and the Bamboo platform sale made waves. While the stock's 7-day share price return is a healthy 6.05% and year-to-date gains now total 3.87%, the 1-year total shareholder return remains slightly negative at -0.44%. This highlights how recent momentum is finally pushing against a more muted long-term backdrop.

If a specialty insurance play with fresh momentum piqued your interest, it could be the perfect time to seek out other under-the-radar growth stories. Discover fast growing stocks with high insider ownership.

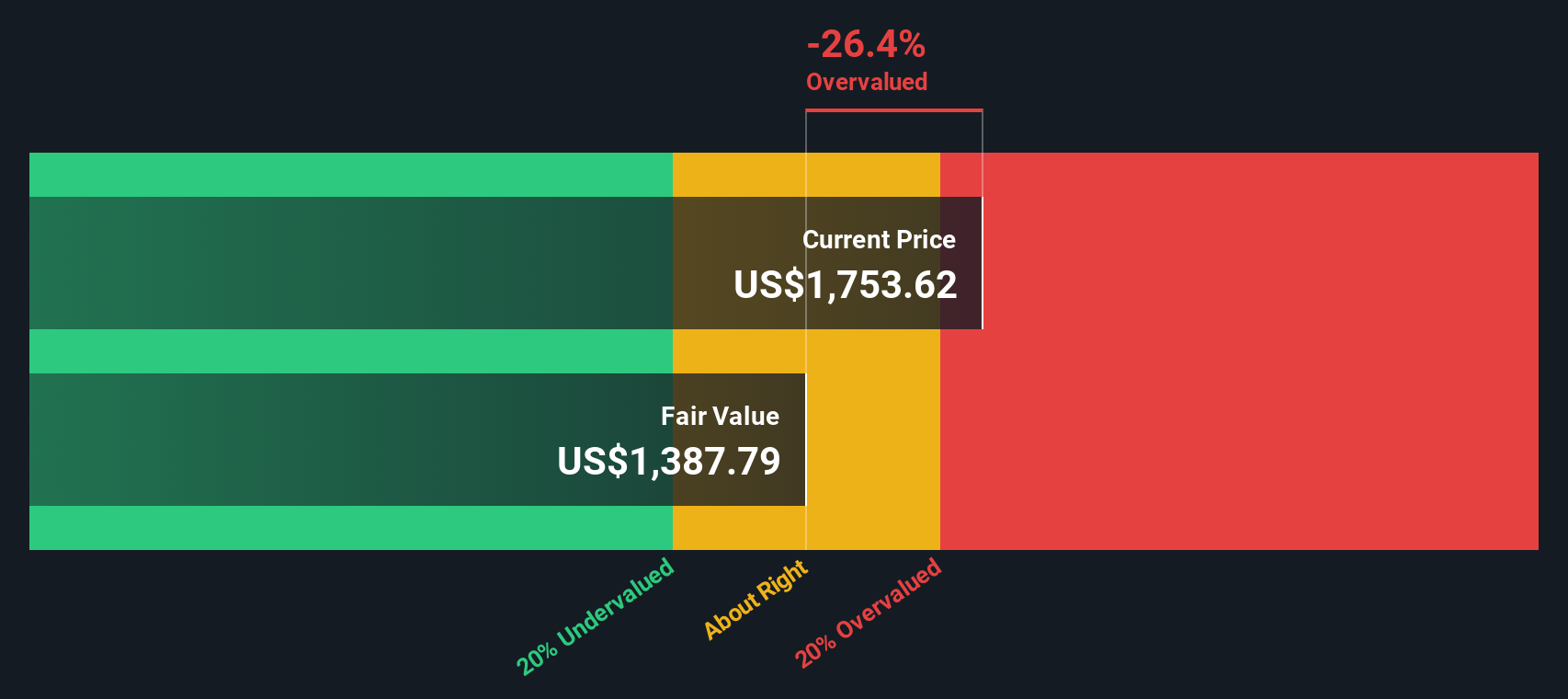

After news of share buybacks and a major business divestiture, investors are left wondering whether White Mountains Insurance Group is now trading at an attractive discount or if the market is already accounting for all the future upside.

Price-to-Earnings of 36.5x: Is it justified?

White Mountains Insurance Group's shares last closed at $2003.65, trading at a price-to-earnings ratio of 36.5x. Compared to its peers and the broader insurance industry, this signals a clear premium valuation rather than a bargain opportunity.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of reported earnings. For an insurance company, a lower P/E could imply skepticism about future growth or concerns over earnings quality. Conversely, a higher P/E, such as 36.5x, suggests strong optimism or limited near-term earnings power.

With a P/E ratio nearly triple the US Insurance industry average of 12.9x and more than double the peer group average of 15.3x, the market is assigning White Mountains Insurance Group a significant valuation premium. This level suggests investors anticipate a turnaround in earnings or are willing to overlook recent negative profit trends, possibly in anticipation of improved performance following recent corporate actions.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 36.5x (OVERVALUED)

However, limited revenue and net income growth, or a lack of follow-through after recent divestitures, could quickly dampen investor optimism.

Find out about the key risks to this White Mountains Insurance Group narrative.

Another View: Discounted Cash Flow Tells a Different Story

Switching focus from price-to-earnings, our SWS DCF model takes future cash flows into account and estimates a fair value of $1,172.01 per share for White Mountains Insurance Group. With the current price at $2,003.65, this method suggests the stock may be overvalued from a cash flow perspective. Does this challenge the optimism reflected in current prices?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out White Mountains Insurance Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own White Mountains Insurance Group Narrative

If you see the data differently or want to reach your own conclusions, you can quickly craft a personalized analysis of White Mountains Insurance Group in just a few minutes. Do it your way.

A great starting point for your White Mountains Insurance Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Jump on timely trends and pinpoint new stocks that fit your strategy using our powerful Simply Wall Street Screener.

- Unlock the potential of AI innovation by checking out these 26 AI penny stocks with rapid earnings growth and disruptive technology leadership.

- Supercharge your income strategy by targeting reliable payouts and reviewing these 14 dividend stocks with yields > 3% with yields over 3% and robust fundamentals.

- Get ahead of the next major trend in digital assets by identifying these 81 cryptocurrency and blockchain stocks making waves in payments, infrastructure, and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, engages in the provision of insurance and other financial services in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success