- United States

- /

- Insurance

- /

- NYSE:WTM

How Rising Revenue and Lower Profit at White Mountains (WTM) Reshape Its Investment Narrative

Reviewed by Sasha Jovanovic

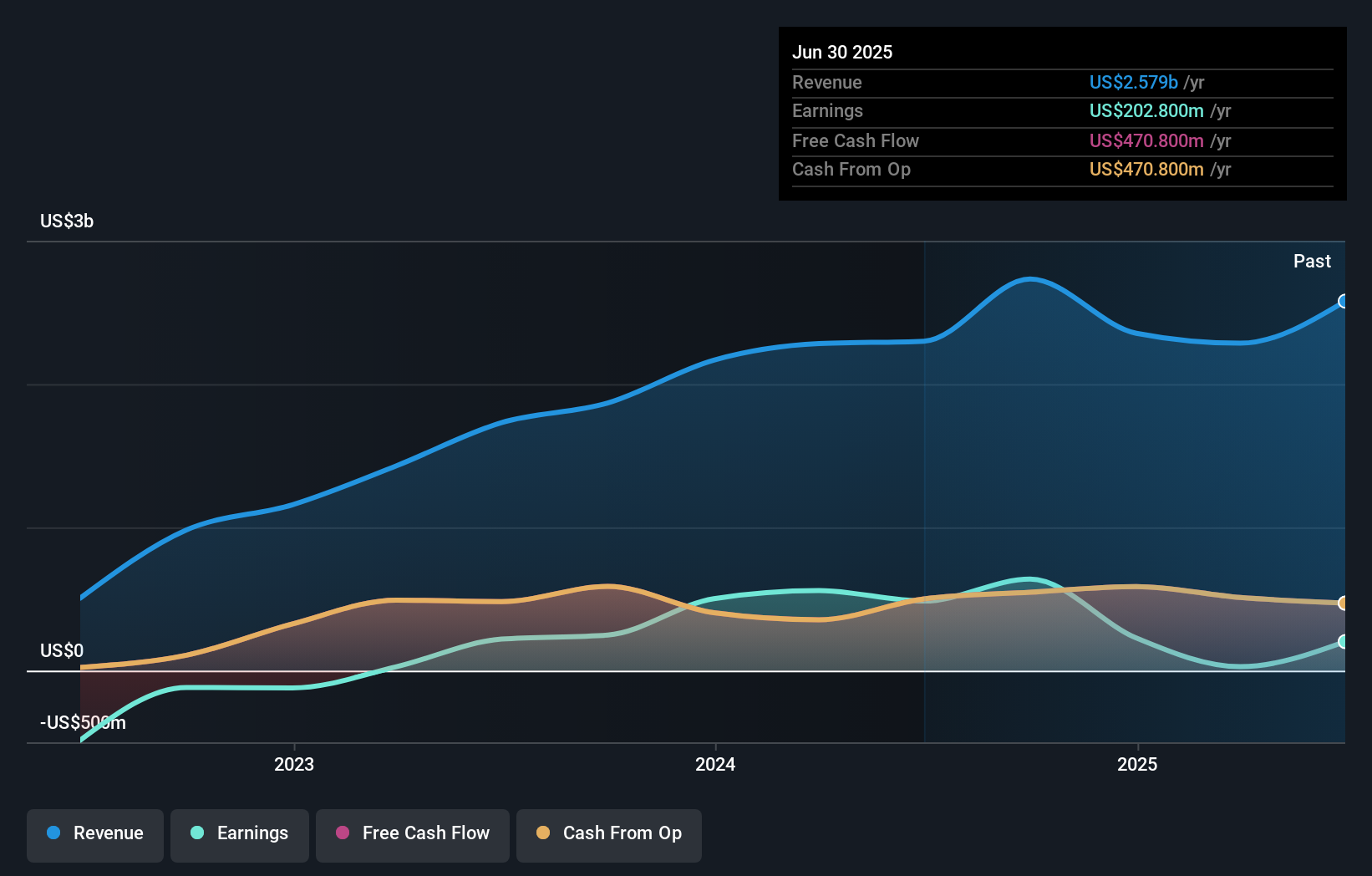

- White Mountains Insurance Group reported its third quarter and nine-month earnings for 2025, posting third quarter revenue of US$864.2 million and net income of US$113.8 million, both compared to the prior year’s results.

- While the company achieved higher revenue, the decline in net income and earnings per share suggests rising costs or other factors impacted profitability.

- We’ll explore how higher revenue alongside reduced profitability shapes the investment narrative for White Mountains Insurance Group.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is White Mountains Insurance Group's Investment Narrative?

To be a shareholder in White Mountains Insurance Group, you need confidence in the company’s ability to navigate a complex insurance and investment landscape that’s recently shown stronger top-line growth but pressured bottom-line results. The latest earnings report, with higher revenue yet sharply lower net income and profit margins, puts the spotlight on short-term catalysts like cost control and possible performance shifts as the company transitions leadership in early 2026. The impact of these results is material: continued weakness in profitability may challenge near-term investor confidence, especially with a new CEO and CFO taking over. The biggest risks now include managing operational costs, justifying a premium valuation versus peers, and restoring margins in a business where earnings have declined over several years. This recent update forces a reassessment of whether upcoming management changes will address these issues quickly enough.

On the other hand, rapid leadership turnover adds uncertainty that investors should pay attention to.

Exploring Other Perspectives

Explore 2 other fair value estimates on White Mountains Insurance Group - why the stock might be worth as much as $1581!

Build Your Own White Mountains Insurance Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your White Mountains Insurance Group research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free White Mountains Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate White Mountains Insurance Group's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if White Mountains Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WTM

White Mountains Insurance Group

Through its subsidiaries, engages in the provision of insurance and other financial services in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives