- United States

- /

- Insurance

- /

- NYSE:WRB

W. R. Berkley (NYSE:WRB) Eyes Market Revaluation with 48.4% Undervaluation and Tech Investments

Reviewed by Simply Wall St

W. R. Berkley (NYSE:WRB) has demonstrated impressive financial performance, with a 22.5% annual earnings growth over the past five years and a recent net profit margin increase to 12%. Despite these achievements, the company faces challenges such as a slowdown in earnings growth and a Return on Equity below the desired threshold. The following report will explore key areas such as the company's strategic growth avenues, potential vulnerabilities, and the risks impacting its future success.

Innovative Factors Supporting W. R. Berkley

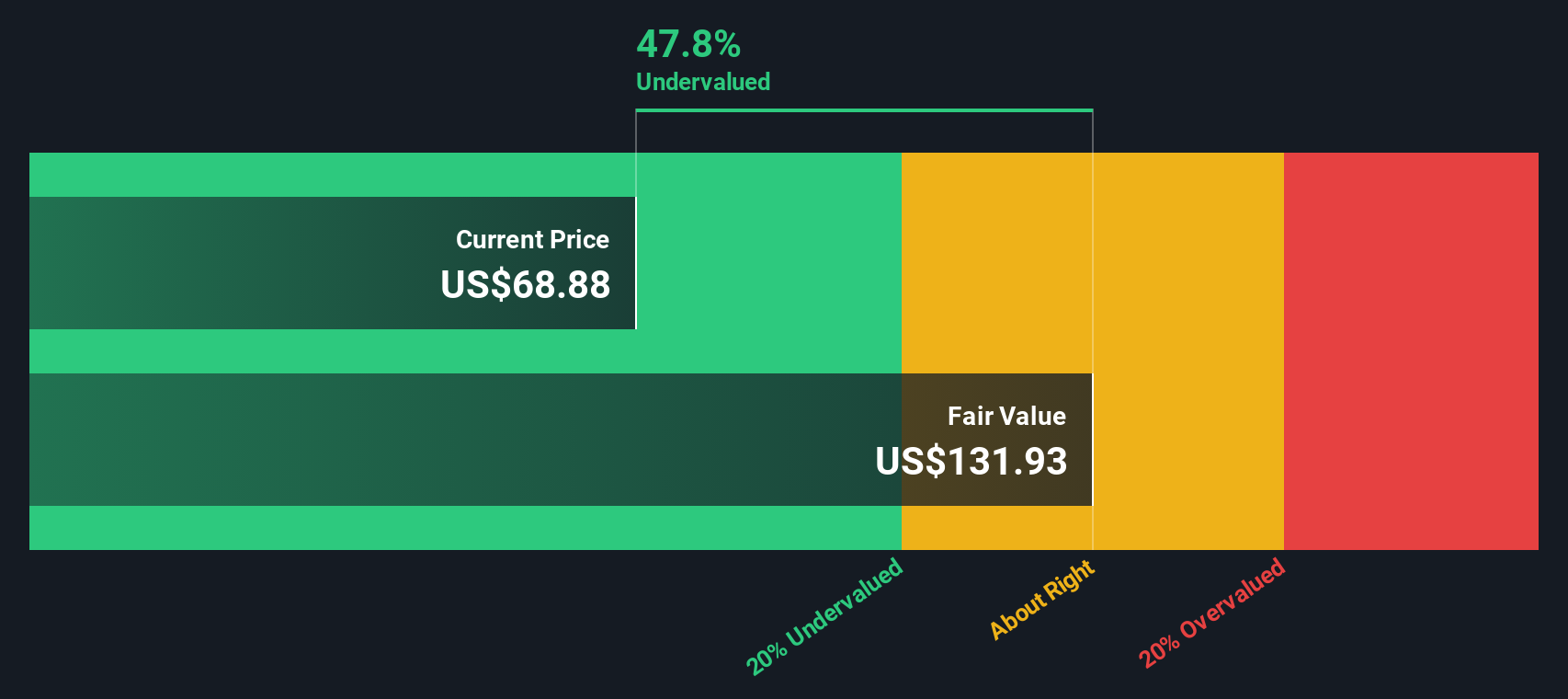

W. R. Berkley's financial performance over the past five years has been notable, with earnings growing at an impressive rate of 22.5% annually. This growth is reflected in their current net profit margin of 12%, an improvement from the previous year's 11.4%. The company's effective management, as highlighted by CFO Richard Baio, has led to a record net income of $1.2 billion over nine months, showcasing strong financial health. Additionally, their disciplined underwriting and strategic investment decisions have ensured stability and growth, even in challenging conditions. The company's dividends are well-covered by earnings, with a payout ratio of 7.8%, indicating a strong alignment between shareholder returns and financial performance. Despite being considered expensive based on its Price-To-Earnings Ratio compared to the industry average, WRB trades below its SWS fair value, suggesting potential for revaluation.

Vulnerabilities Impacting W. R. Berkley

However, W. R. Berkley faces certain challenges. Their earnings growth of 15.5% over the past year falls short of the five-year average of 22.5%, and they lag behind the insurance industry's 33.2% growth. This suggests a need for strategic adjustments to maintain competitive positioning. The company's Return on Equity at 18.7% is below the desired 20% threshold, indicating potential areas for improvement in operational efficiency. Additionally, the volatility and unreliability in dividend payments over the past decade pose a concern for investors seeking stable returns. Furthermore, the dividend yield of 1.9% is relatively low compared to the top 25% of dividend payers in the US market, which stands at 4.21%.

Growth Avenues Awaiting W. R. Berkley

Opportunities for W. R. Berkley are promising, particularly in the specialty and E&S markets. CEO W. Robert Berkley, Jr. has emphasized the potential for growth in these segments, which are expected to drive more business. The company's strategic investments in technology and data are anticipated to enhance operational efficiencies and customer experience, positioning them for future growth. Moreover, with WRB trading at 48.4% below the estimated fair value, there is a significant opportunity for market revaluation as the company continues to improve its earnings and revenue growth rates.

Key Risks and Challenges That Could Impact W. R. Berkley's Success

Despite these opportunities, W. R. Berkley is not without risks. The company is exposed to natural catastrophes, which can significantly impact financial performance. CEO W. Robert Berkley, Jr. has acknowledged the challenges posed by such events, highlighting the need for effective risk management. Additionally, regulatory and political challenges present ongoing risks, potentially affecting the company's ability to adapt and grow in certain markets. These external factors could influence long-term growth and market share, necessitating strategic foresight and adaptability.

Conclusion

W. R. Berkley's impressive financial performance over the past five years, with a 22.5% annual earnings growth and a current net profit margin of 12%, highlights effective management and strategic decision-making. This financial strength is further underscored by a well-covered dividend payout ratio of 7.8%, aligning shareholder returns with company performance. However, recent earnings growth of 15.5% indicates a slowdown compared to the industry, suggesting the need for strategic adjustments to maintain competitiveness. Despite being considered expensive based on its Price-To-Earnings Ratio relative to the industry, the company's trading position at 48.4% below its estimated fair value presents a significant opportunity for market revaluation, especially as it capitalizes on growth avenues in specialty markets and technological investments. The company's future performance will depend on its ability to navigate risks such as natural catastrophes and regulatory challenges, while leveraging its strengths to enhance operational efficiencies and market positioning.

Make It Happen

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.