- United States

- /

- Insurance

- /

- NYSE:WRB

Is There an Opportunity in W. R. Berkley After 32.7% Share Price Rally in 2025?

Reviewed by Bailey Pemberton

- Thinking about whether W. R. Berkley is a solid buy right now? If you are curious about the real value behind the stock price, you are in the right place.

- W. R. Berkley’s shares have climbed 32.7% year-to-date and surged 31.6% over the past year, with a steady gain of 3.2% in just the last week. This comes even after a mild pullback of -1.9% in the past month.

- This momentum has sparked interest among investors, especially as the insurance sector faces ongoing shifts in industry risk and some regulatory discussions that could impact future growth. Recent news about the company's insurance products gaining traction in emerging markets suggests evolving opportunities and competitive positioning.

- On our value check, W. R. Berkley scores just 2 out of 6 points, suggesting there is more to uncover than meets the eye. Up next, we will look at a range of valuation approaches. Stay tuned for a fresh perspective that might change how you view what “fair value” really means.

W. R. Berkley scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: W. R. Berkley Excess Returns Analysis

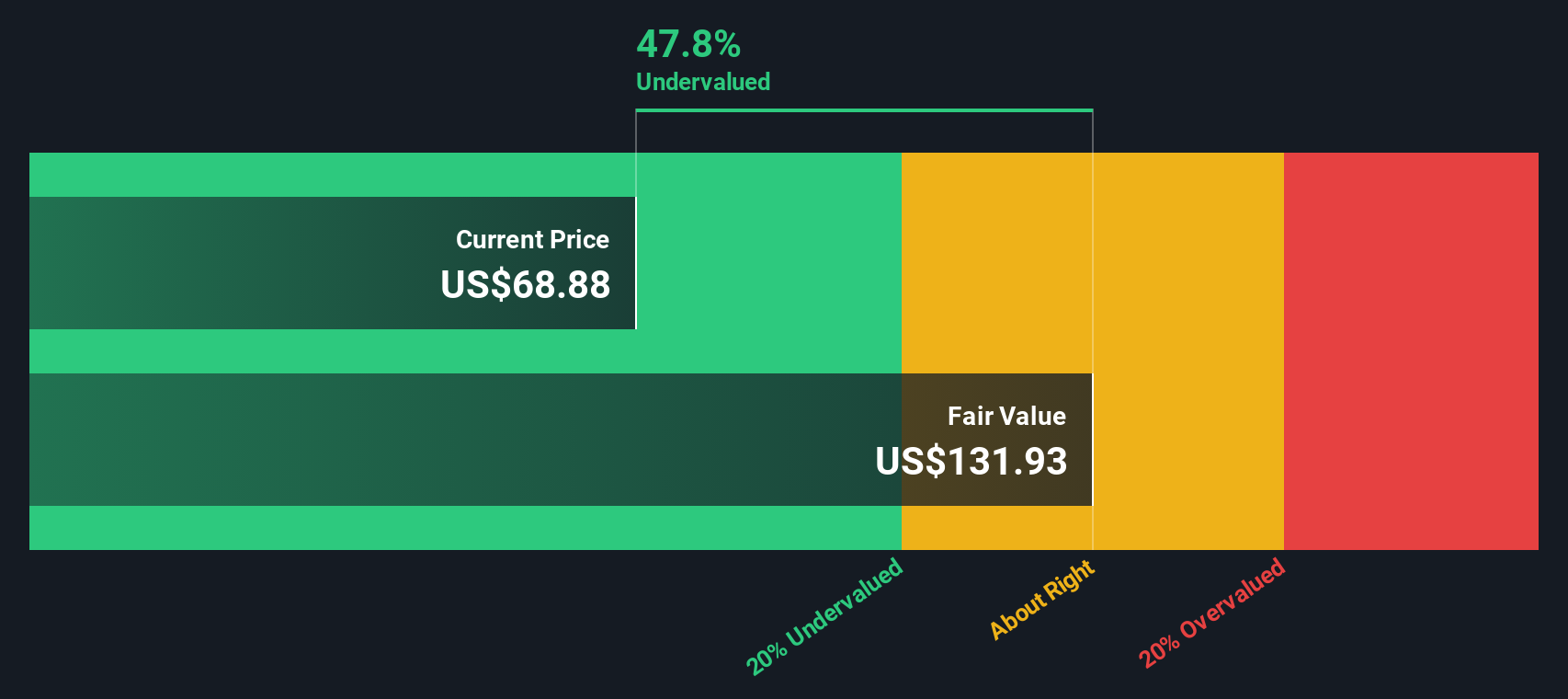

The Excess Returns valuation model estimates a company's true value by examining how effectively it generates returns beyond the required cost of equity. For W. R. Berkley, this approach places emphasis on measures like return on equity, earnings power, and book value to assess the company’s ongoing ability to create shareholder value.

W. R. Berkley has a Book Value of $25.79 per share and a Stable Book Value expectation of $29.82 per share, based on projections from eight analysts. Its Stable Earnings Per Share is $5.35, drawn from weighted future Return on Equity estimates by ten analysts. The company’s average Return on Equity stands strong at 17.93%, while its Cost of Equity registers at $2.07 per share. These figures translate into an Excess Return of $3.27 per share, showing profitability above the minimum return required by shareholders.

Based on this methodology, the model suggests W. R. Berkley is currently trading at a price that is 35.0% below its intrinsic value. This significant discount means the stock may offer attractive upside potential, especially for those seeking companies that consistently deliver value over the cost of equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests W. R. Berkley is undervalued by 35.0%. Track this in your watchlist or portfolio, or discover 878 more undervalued stocks based on cash flows.

Approach 2: W. R. Berkley Price vs Earnings

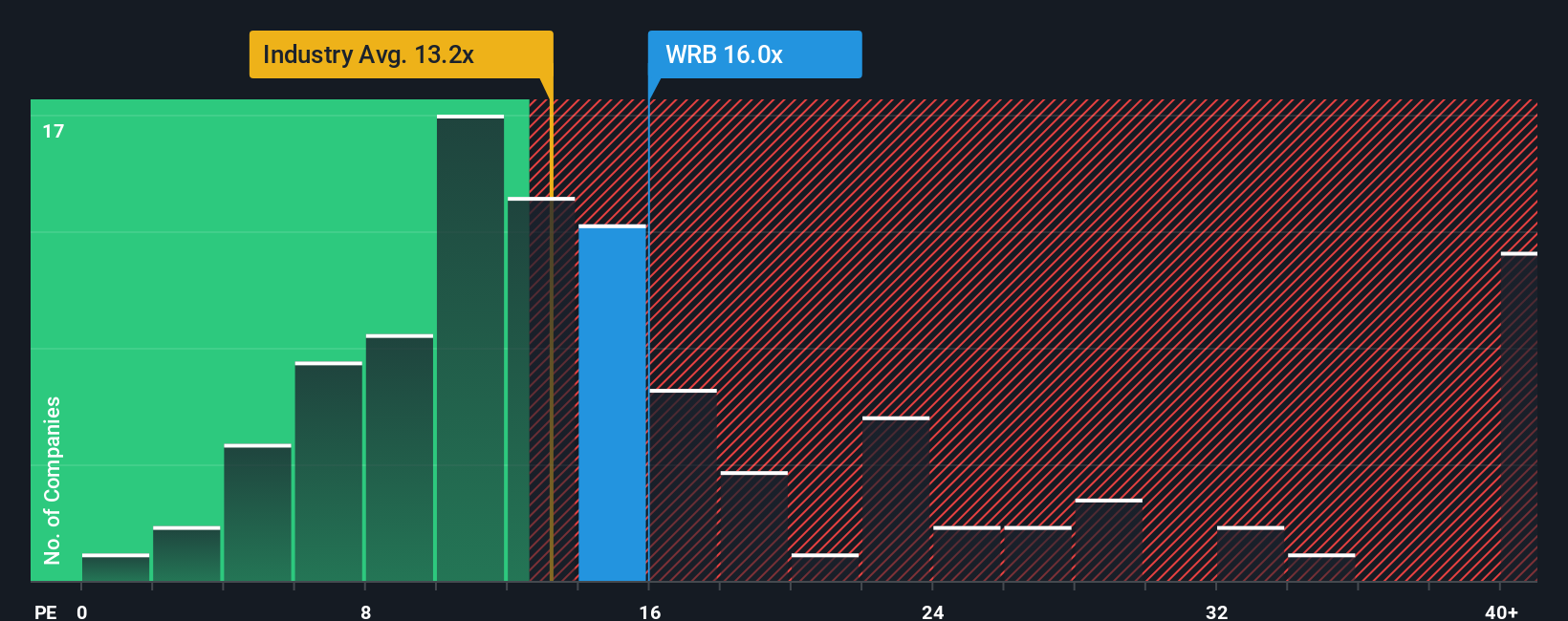

The Price-to-Earnings (PE) ratio is often the go-to valuation tool for profitable companies because it directly connects a company's stock price to its core earnings. This makes it useful for retail investors who want to gauge how much they are paying for each dollar of profit the company generates. When a business is profitable and its earnings are relatively stable, the PE ratio gives a clear-cut view of valuation compared to its past performance and peers.

However, it is essential to recognize that growth prospects and business risks play a large role in what counts as a “normal” or “fair” PE ratio. Companies expected to grow faster or carry less risk usually warrant a higher PE, while slow-growing or riskier companies trade at lower multiples. This context matters when comparing a company to industry standards or other peers.

Currently, W. R. Berkley is trading at a PE ratio of 15.34x. This is above both the insurance industry average of 13.17x and the peer group average of 13.02x. To help investors go beyond these surface comparisons, Simply Wall St’s proprietary “Fair Ratio” model estimates a fair PE of 11.72x for W. R. Berkley. Unlike industry averages or peer benchmarks, the Fair Ratio takes into account the company’s particular earnings growth, profit margins, industry trends, market cap, and unique risks, giving a more tailored valuation perspective.

When we compare the current PE ratio of 15.34x with the Fair Ratio of 11.72x, W. R. Berkley appears to be overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your W. R. Berkley Narrative

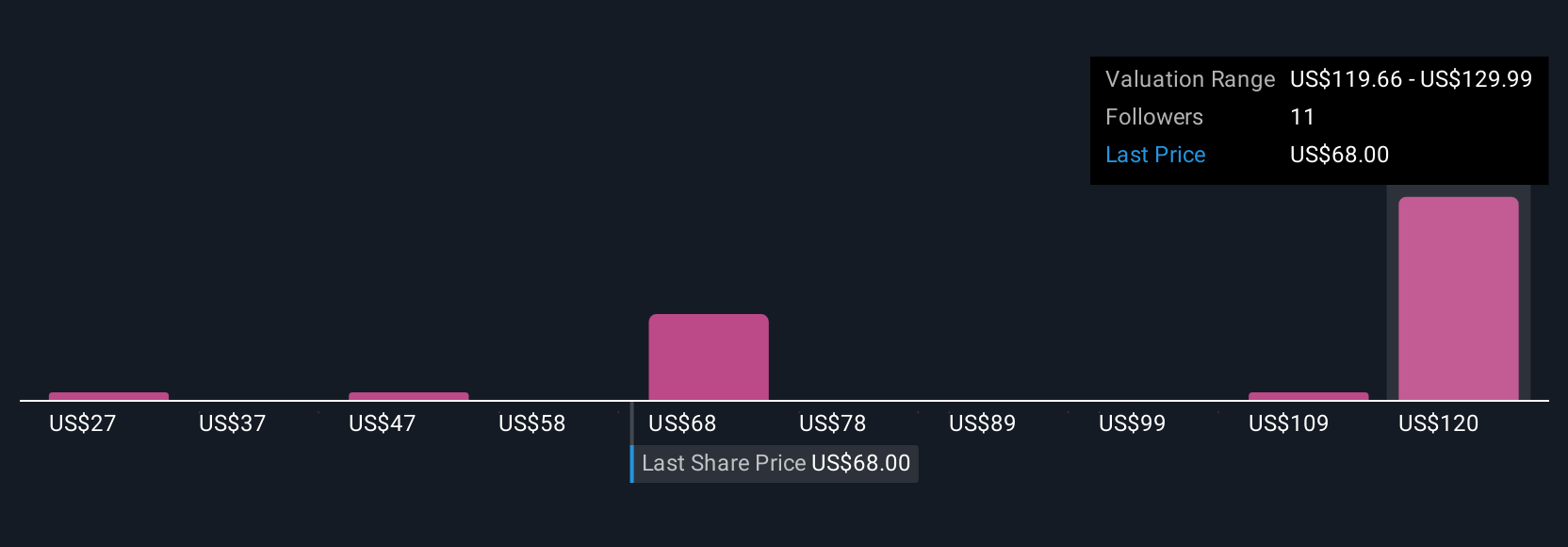

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company’s future. It is how you connect what you believe will happen to W. R. Berkley’s business to a financial forecast and ultimately a fair value for the stock.

With Narratives, you are not just looking at numbers in isolation. Instead, you outline your assumptions about how W. R. Berkley will perform, such as its future revenue growth, profit margins, or earnings, and then let the tool translate this storyline directly into an estimated fair value. This makes it much easier to see whether your expectations mean the stock is a buy or a hold compared to its current price.

Narratives are accessible to everyone on Simply Wall St's platform, used by millions of investors, and are found in the Community page for each company. As new information comes in, such as earnings, news, or major developments, Narratives are updated in real time so your story always reflects today’s reality.

For example, on W. R. Berkley, some investors see strong specialty growth driving fair values as high as $86, while others warn of competition and margin risks, with fair values closer to $56, showing how different perspectives shape buy or sell decisions.

Do you think there's more to the story for W. R. Berkley? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W. R. Berkley might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WRB

W. R. Berkley

An insurance holding company, operates as a commercial line writer worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives