- United States

- /

- Insurance

- /

- NYSE:THG

Hanover Insurance Group (THG): Profitability Jump Reinforces Value Narrative Despite Cautious Growth Outlook

Reviewed by Simply Wall St

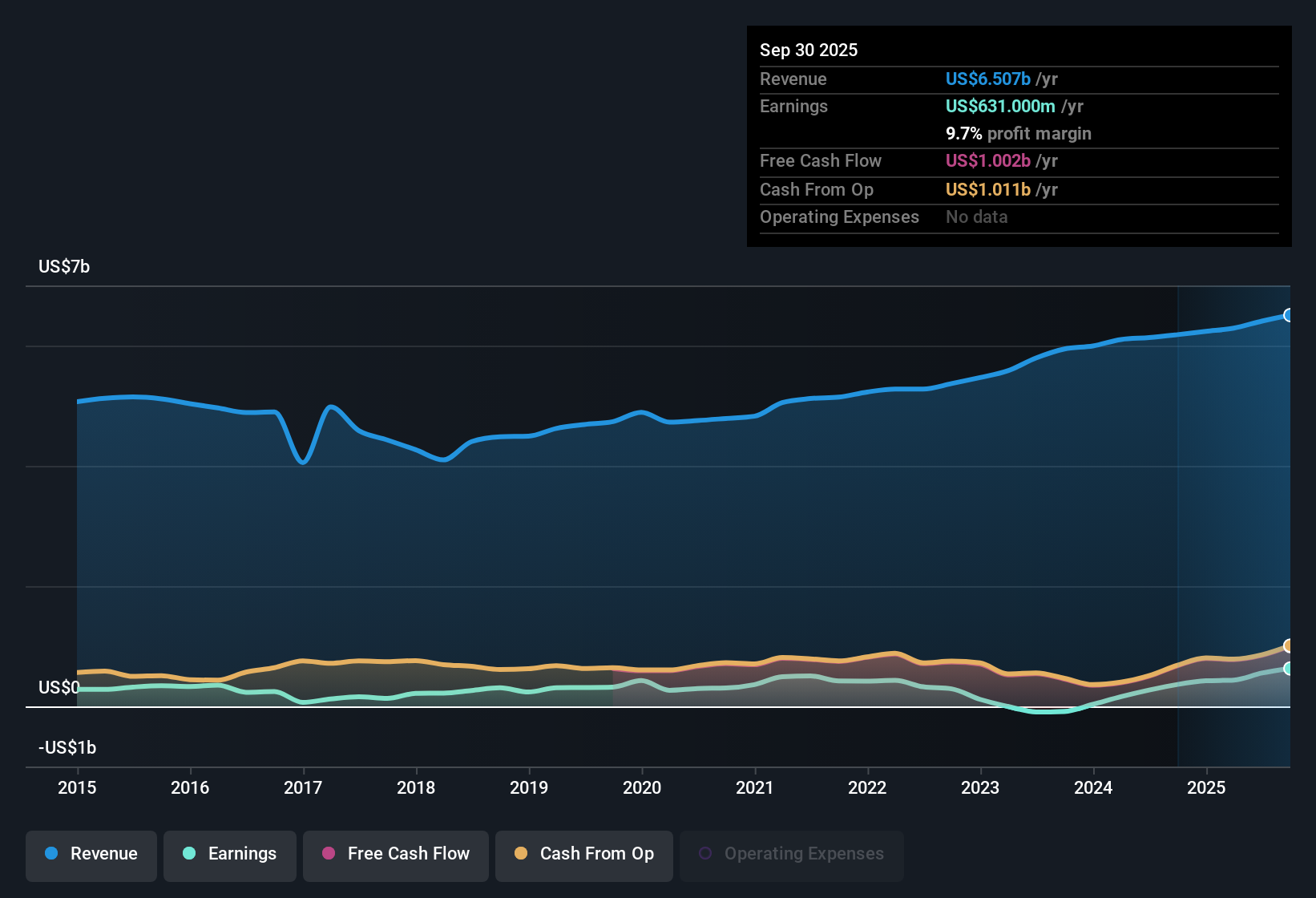

Hanover Insurance Group (THG) delivered a sharp turnaround in profitability, with earnings growth reaching 72.7% over the past year. This represents a significant difference from its five-year annual average change of -0.09%. Net profit margins climbed to 9.7%, up from last year’s 5.9%. Revenue is forecasted to grow at 4.5% per year, which is below the broader US market’s 10.3% average. Despite expectations for earnings to contract at an annualized rate of -0.2% over the next three years, the company’s shares are trading at a price-to-earnings ratio of 9.7x, below both peer and industry averages, which suggests a valuation below fair value.

See our full analysis for Hanover Insurance Group.The next section compares these numbers with the current market narrative to see how the data aligns with popular investor stories and to identify areas where those stories might be challenged.

See what the community is saying about Hanover Insurance Group

Technology Spending Anchors Margin Stability

- Analysts expect profit margins to edge up from 8.7% to 8.8% over the next three years, a modest gain fueled by investment in advanced technology, data analytics, and AI-driven automation to improve expense ratios and operational scale.

- According to the analysts' consensus view, these technology upgrades are expected to support sustained efficiency and underwriting profitability, even as industry competition and cost pressures intensify.

- Consensus narrative notes that scalable, automated risk assessment and improved workflow should lower expense ratios and maintain or improve net margins relative to peers.

- However, execution risk remains. Failure to deliver on these upgrades could lead to higher expense ratios or lost share if competitors move ahead more quickly.

Premium Growth Slows but Retention Holds

- Revenue is projected to grow at only 4.5% annually, below the US market’s 10.3% average, even as the company emphasizes its diversified specialty product lines and pricing discipline to retain customers and drive premiums.

- The consensus narrative highlights that disciplined pricing and a focus on niche, resilient products help offset slowdowns in segment growth, but warns that competitive pressures and a softer rate environment in specialty lines could cap future gains.

- Bears argue that exposure to specialty segment deceleration and increased competition could compress premium growth and margins despite solid underlying product strategies.

- The industry’s broader headwinds, such as catastrophe risks and rising claims costs, make it harder to grow premiums quickly in traditional lines.

Price-to-Earnings Lags Industry Peers

- Shares trade at a price-to-earnings ratio of 9.7x, far below the insurance industry average of 13.2x and the peer average of 11.8x, putting the company at a relative valuation discount despite recent profitability gains.

- Analysts’ consensus view contends that the current share price of $170.26 sits nearly 15% below the only approved analyst price target of $198.86, reinforcing that the market is discounting future earnings risk even as profitability improves.

- What is surprising is that even with improved margins and quality earnings, the risk of profit contraction and the slower growth trajectory weigh heavily on valuation relative to both peers and the sector.

- This gap may tempt value-focused investors, but it also shows the market is cautious given the outlook for flat or slightly declining earnings in the near term.

Analysts are watching closely to see whether modest margin gains and steady customer retention will be enough to overcome revenue headwinds and unlock the upside in Hanover’s deep value metrics.

📊 Read the full Hanover Insurance Group Consensus Narrative.Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hanover Insurance Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your perspective and craft your narrative in just a few minutes. Do it your way

A great starting point for your Hanover Insurance Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Hanover Insurance Group faces flat earnings growth, slowing premiums, and industry headwinds that limit its ability to deliver consistent revenue expansion.

If you want stocks proving they can grow steadily year after year, check out stable growth stocks screener (2113 results) and discover companies with reliable performance through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanover Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THG

Hanover Insurance Group

Through its subsidiaries, provides various property and casualty insurance products and services in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives