Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 39% increase over the past year, with earnings forecasted to grow by 15% annually. In this vibrant environment, identifying stocks that are poised for growth involves focusing on those with strong fundamentals and unique market positions that have not yet captured widespread attention.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 169.49% | 12.30% | 1.92% | ★★★★★★ |

| Shore Bancshares | 23.15% | 24.96% | 10.17% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.13% | 19.43% | 29.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

CTS (NYSE:CTS)

Simply Wall St Value Rating: ★★★★★★

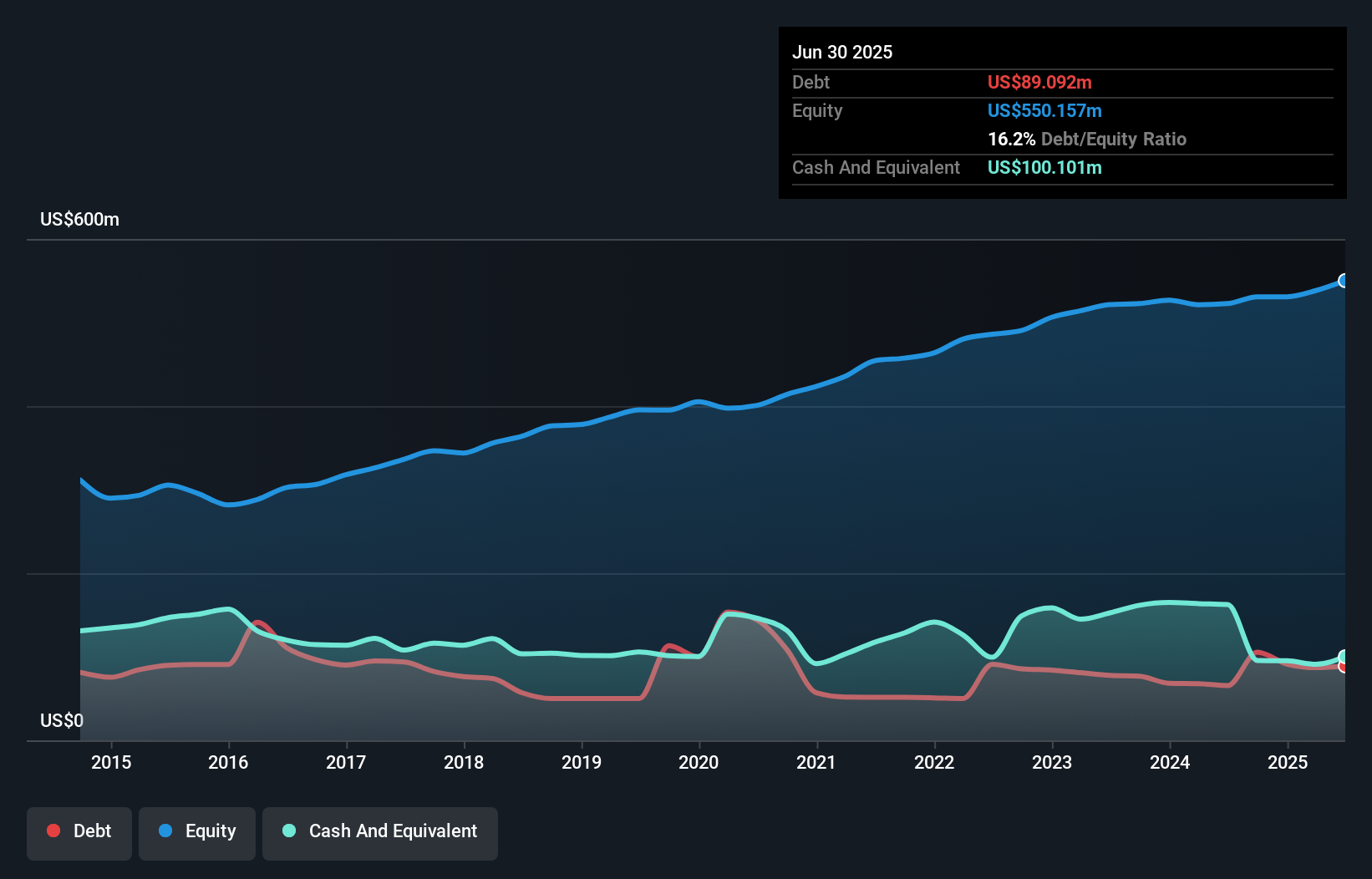

Overview: CTS Corporation manufactures and sells sensors, actuators, and connectivity components across North America, Europe, and Asia with a market capitalization of approximately $1.45 billion.

Operations: CTS generates revenue primarily from its Electronic Components & Parts segment, amounting to $515.16 million.

CTS is carving a niche in the defense sector with its acquisition of SyQwest LLC, aiming to boost revenue and stabilize earnings. Despite a dip in sales from US$145.18 million to US$130.16 million year-over-year, net income rose from US$12.9 million to US$14.71 million, reflecting improved profitability with diluted EPS climbing from $0.41 to $0.48 per share for the quarter ending June 30, 2024. The company repurchased 399,814 shares for US$18.76 million this year, showing confidence in its value proposition amidst challenges like transportation market softness and integration hurdles from acquisitions.

Miller Industries (NYSE:MLR)

Simply Wall St Value Rating: ★★★★☆☆

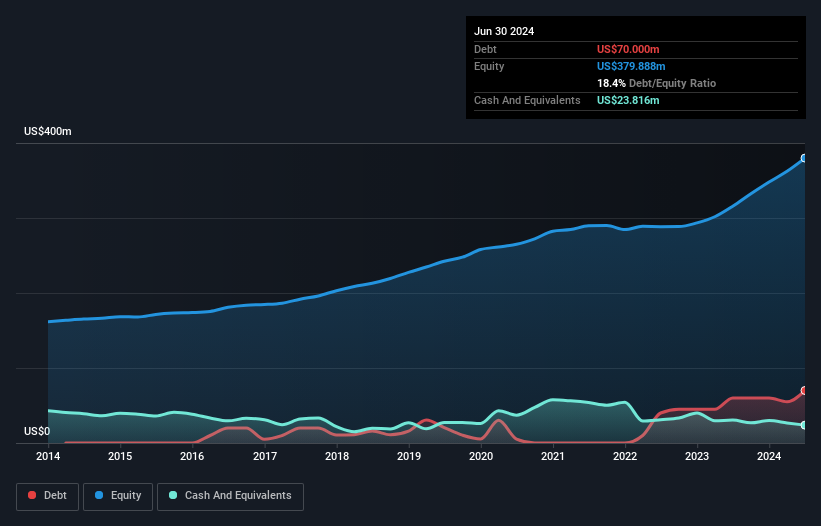

Overview: Miller Industries, Inc. manufactures and sells towing and recovery equipment, with a market cap of $755.95 million.

Operations: The company generates revenue primarily from the Auto Manufacturers segment, totaling $1.29 billion.

Miller Industries, a notable player in the machinery sector, has shown impressive growth with earnings surging 85% over the past year, outpacing the industry's 11%. The company repurchased 35,000 shares for US$2.05 million recently, signaling confidence in its valuation which is currently trading at nearly 68% below estimated fair value. Despite a net debt to equity ratio of 12%, considered satisfactory, Miller's interest payments are well-covered by EBIT at a healthy multiple of nearly 15x. However, challenges like negative free cash flow persist alongside robust sales growth from US$300 million to US$371 million year-over-year.

Stewart Information Services (NYSE:STC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Stewart Information Services Corporation operates through its subsidiaries to offer title insurance and real estate transaction services both in the United States and internationally, with a market cap of approximately $1.91 billion.

Operations: Stewart Information Services generates revenue primarily from its Title segment, including mortgage services, which accounts for $2.05 billion, and Real Estate Solutions contributing $333.08 million.

Stewart Information Services, a nimble player in the market, reported impressive earnings growth of 70% over the past year, outpacing the insurance industry's 28.9%. The company's net income for Q3 2024 was US$30.1 million, doubling from US$14 million a year ago. With earnings per share rising to US$1.07 from US$0.51 and trading at 22.3% below fair value estimates, Stewart seems undervalued with high-quality earnings and robust interest coverage at 6.1 times EBIT. Despite an increased debt-to-equity ratio from 13.3% to 31.5%, its net debt level remains satisfactory at 15.3%.

Taking Advantage

- Embark on your investment journey to our 226 US Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTS

CTS

Manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia.

Flawless balance sheet with moderate growth potential.