- United States

- /

- Insurance

- /

- NYSE:SPNT

What SiriusPoint (SPNT)'s Credit Outlook Upgrade Means for Shareholders

Reviewed by Sasha Jovanovic

- In late September 2025, S&P Global Ratings revised SiriusPoint Ltd.'s outlook to Positive from Stable and affirmed its core credit ratings, following similar updates from Fitch and AM Best, citing the company's strong underwriting profits and lower risk profile.

- This coordinated uplift by major agencies highlights SiriusPoint's transformation, emphasizing a significantly reduced exposure to catastrophic and investment risks and supporting improved credit quality perceptions.

- We’ll explore how recognition of SiriusPoint’s disciplined risk management by all three agencies could influence its investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

SiriusPoint Investment Narrative Recap

To be a shareholder in SiriusPoint today, one needs to be confident in the company's ability to sustain disciplined underwriting and capitalize on its specialty insurance strategy, as well as its capacity to manage risk in a competitive market. The latest round of credit rating outlook upgrades does bolster the company’s investment case, supporting improved confidence in short-term stability, but does not materially shift the biggest catalyst, continued growth from specialty MGA partnerships, or reduce the key risk of margin pressure if new partnerships underperform or market competition intensifies.

Among recent announcements, the August 2025 earnings release stands out: SiriusPoint posted Q2 revenue of US$748.2 million and net income of US$63.2 million. Strong underwriting and revenue growth support the positive outlook from rating agencies, anchoring the company's near-term catalyst around sustained success in specialty markets and fee-based MGA relationships.

However, despite these positive rating revisions, investors should be alert to the risk that, if new MGA relationships slow or underperform...

Read the full narrative on SiriusPoint (it's free!)

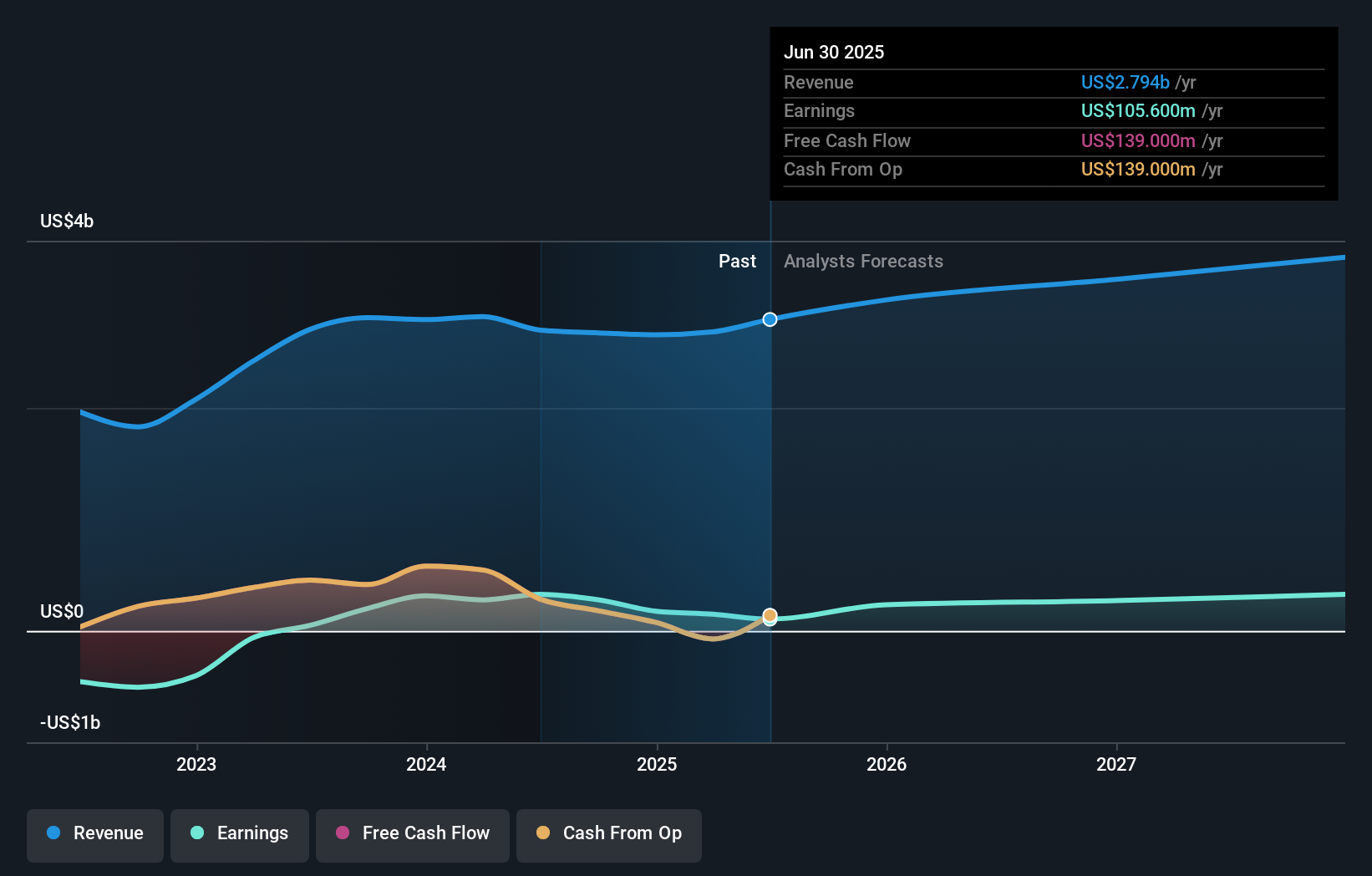

SiriusPoint's narrative projects $3.5 billion in revenue and $402.8 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $297 million earnings increase from current earnings of $105.6 million.

Uncover how SiriusPoint's forecasts yield a $27.50 fair value, a 48% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members contributed one fair value estimate for SiriusPoint, pegging it at US$15.93 per share. While investors often hold widely differing views, the risk of specialty MGA partnerships failing to deliver remains a central theme for longer-term outcomes.

Explore another fair value estimate on SiriusPoint - why the stock might be worth 14% less than the current price!

Build Your Own SiriusPoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiriusPoint research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free SiriusPoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiriusPoint's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPNT

SiriusPoint

Provides multi-line reinsurance and insurance products and services worldwide.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion