- United States

- /

- Insurance

- /

- NYSE:SLQT

Market Cool On SelectQuote, Inc.'s (NYSE:SLQT) Revenues Pushing Shares 29% Lower

SelectQuote, Inc. (NYSE:SLQT) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 33% share price drop.

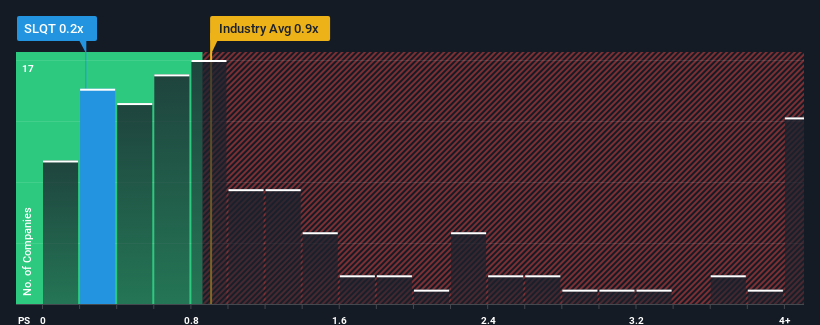

Since its price has dipped substantially, it would be understandable if you think SelectQuote is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in the United States' Insurance industry have P/S ratios above 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for SelectQuote

How SelectQuote Has Been Performing

Recent times have been advantageous for SelectQuote as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think SelectQuote's future stacks up against the industry? In that case, our free report is a great place to start.How Is SelectQuote's Revenue Growth Trending?

In order to justify its P/S ratio, SelectQuote would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. This was backed up an excellent period prior to see revenue up by 98% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 17% over the next year. That's shaping up to be materially higher than the 4.9% growth forecast for the broader industry.

With this in consideration, we find it intriguing that SelectQuote's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does SelectQuote's P/S Mean For Investors?

SelectQuote's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

SelectQuote's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for SelectQuote (1 is a bit concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SLQT

SelectQuote

Operates a technology-enabled, direct-to-consumer distribution and engagement platform that sells insurance policies and healthcare services in the United States.

Acceptable track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives