- United States

- /

- Insurance

- /

- NYSE:RYAN

Ryan Specialty (RYAN): Valuation Insights After Strong Q3 Earnings and Upbeat 2025 Growth Guidance

Reviewed by Simply Wall St

Ryan Specialty Holdings (RYAN) just released third-quarter earnings, showing strong gains in both revenue and net income compared to last year. The company also reaffirmed that it expects double-digit organic revenue growth for the full year 2025.

See our latest analysis for Ryan Specialty Holdings.

After delivering impressive third-quarter results and confirming its robust outlook for 2025, Ryan Specialty Holdings has seen its share price regain momentum, rising 5.1% over the past week to $57.85. Despite some choppiness earlier this year, the company’s three-year total shareholder return of 73% points to enduring long-term strength. However, the latest twelve months saw a challenging total return of -18.7%.

If these recent gains have you rethinking your investment approach, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock climbing after robust earnings and a confident outlook from management, investors must now weigh whether Ryan Specialty remains undervalued or if its future growth is already fully reflected in the share price.

Most Popular Narrative: 15.3% Undervalued

According to the most closely tracked narrative, the current consensus fair value stands notably above the last closing price of $57.85. While the market has acknowledged Ryan Specialty’s improved outlook, this narrative points to stronger upside potential if key assumptions hold. This sets the stage for a deeper look at the growth drivers behind the valuation.

The increasing complexity and frequency of emerging risks, such as large-scale catastrophes, social inflation in casualty lines, and rising exposures in cyber and liability, are driving a steady migration of business into specialty markets. This is positioning Ryan Specialty to capture sustained growth in submission flows and premium volumes, directly supporting revenue expansion over the long term.

Want to know how this valuation is justified? There is a surprising growth outlook, a sharp margin rebound, and aggressive targets baked into these fair value projections. Discover which financial levers the narrative believes could propel the company far beyond current expectations. Just a click away reveals all.

Result: Fair Value of $68.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining insurance pricing and the risks tied to integrating new acquisitions could quickly challenge the current valuation outlook for Ryan Specialty Holdings.

Find out about the key risks to this Ryan Specialty Holdings narrative.

Another View: Trading at a Premium?

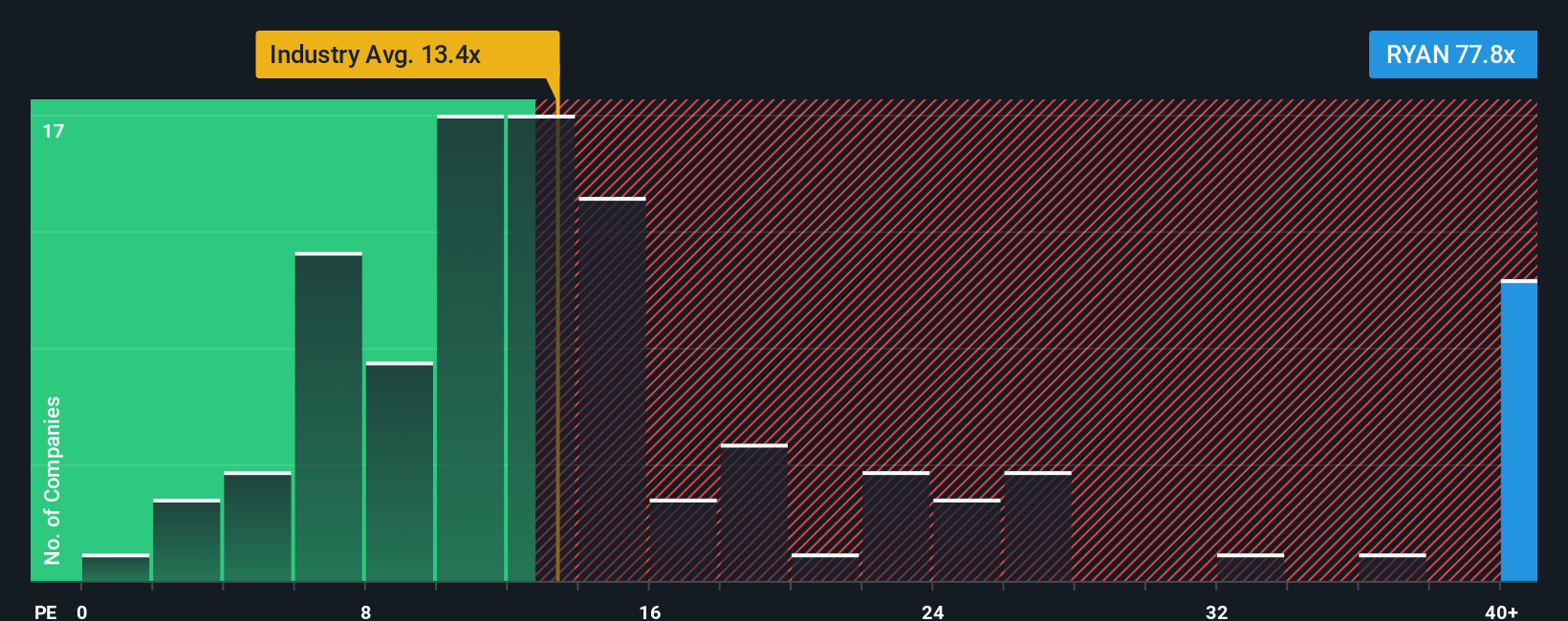

Taking a closer look at the earnings ratio, Ryan Specialty trades at 105.7x, which is far higher than both the US Insurance industry average of 13.3x and its peer group’s 30.7x. Even the estimated fair ratio stands at 72.9x, well below its current level. This gap suggests investors may be paying up for growth expectations, but are those hopes already factored in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryan Specialty Holdings Narrative

If you think there’s another angle or want to dig into the data on your own terms, you can build your personalized outlook in just a few minutes: Do it your way

A great starting point for your Ryan Specialty Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your portfolio game by tapping into stocks shaping tomorrow’s market. You’ll want to act now, as the best opportunities rarely wait around.

- Tap into revolutionary companies riding the AI boom with these 25 AI penny stocks. This can help you position yourself ahead of shifting tech trends.

- Supercharge your income potential by screening for robust yields through these 15 dividend stocks with yields > 3%, and uncover businesses built for dependable returns.

- Grab hold of hidden value in the market by starting your search with these 857 undervalued stocks based on cash flows, targeting stocks trading below their fair worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYAN

Ryan Specialty Holdings

Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, rest of Europe, India, and Singapore.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives