- United States

- /

- Insurance

- /

- NYSE:RGA

Reinsurance Group of America (RGA): Assessing Valuation Following Strong Q3 Revenue and Profit Growth

Reviewed by Simply Wall St

Reinsurance Group of America (RGA) just announced third quarter results showing both revenue and net income increased compared to last year. Earnings per share also came in higher, catching investors’ attention.

See our latest analysis for Reinsurance Group of America.

After posting better-than-expected earnings and recent share buybacks, Reinsurance Group of America’s stock has shown some resilience, finishing at $186.65 and delivering a 1.6% share price return over the past 90 days. However, the one-year total shareholder return still sits at -10.8%. Longer-term performance remains strong, with a total return of 76.3% over five years, reflecting underlying value even amid this year’s volatility.

If you’re curious what other standout stocks are catching attention lately, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With RGA trading well below analyst price targets and showing consistent profit growth, the question is whether shares offer a compelling bargain or if the market has already factored in its future prospects.

Most Popular Narrative: 21.2% Undervalued

Reinsurance Group of America's widely followed narrative sets a fair value significantly above the current share price, building its case from aggressive international expansion and new technology adoption. Much of this outlook hinges on whether ambitious business growth translates into higher sustainable earnings over the next several years.

The company's leadership in digital underwriting solutions and customized reinsurance products, bolstered by data analytics and exclusive arrangements, enhances efficiency and pricing power. This is likely to improve net margins and generate higher earnings as these tech-enabled capabilities scale.

Want to know why this narrative values RGA so highly? It is all about big bets on premium growth and a future profit trajectory built on industry-defying earnings leaps. Which targets and which numbers are fueling this boldest of takes? Uncover the forecast that is turning heads and stirring debate among the market-watchers.

Result: Fair Value of $236.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently volatile U.S. claims and rising healthcare costs could quickly challenge the bullish outlook and prompt investors to rethink future expectations.

Find out about the key risks to this Reinsurance Group of America narrative.

Another View: Market Ratios Tell a Different Story

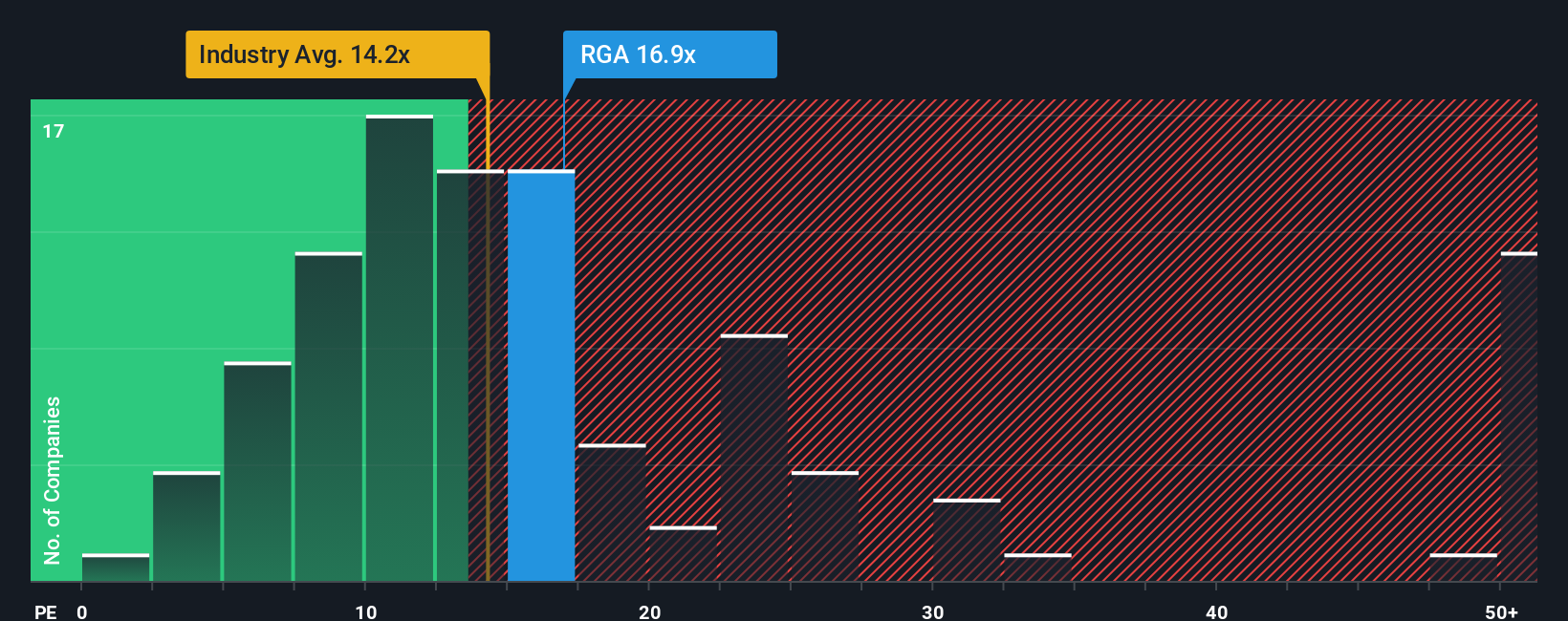

While analysts see RGA as undervalued based on future growth and discounted cash flows, the current price-to-earnings ratio actually looks slightly expensive. At 14.1x, RGA trades above both the US Insurance sector average of 13.1x and the peer average of 13.9x. It remains below its estimated fair ratio of 21.3x. This raises the question: is the market being too cautious, or are the optimistic forecasts a step too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reinsurance Group of America Narrative

If you think the story deserves a different angle or want to dig deeper into the figures yourself, it only takes a few minutes to craft your own perspective. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Reinsurance Group of America.

Looking for More Smart Investing Opportunities?

Why limit your strategy to a single stock when there are so many high-potential ideas waiting? Make your next move before the crowd catches on by checking these out:

- Tap into future leaders and get ahead of the market by reviewing these 27 AI penny stocks, which are making waves in artificial intelligence.

- Pursue stable income by checking out these 20 dividend stocks with yields > 3%, which offer yields over 3% for reliable returns.

- Position yourself early in cutting-edge finance by seeing these 82 cryptocurrency and blockchain stocks that are reshaping digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RGA

Reinsurance Group of America

Provides reinsurance and financial solutions.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives