- United States

- /

- Insurance

- /

- NYSE:OSCR

Will Oscar Health's (OSCR) AI Investments Reshape Its Earnings Profile and Competitive Edge?

Reviewed by Sasha Jovanovic

- Oscar Health reaffirmed its 2025 revenue guidance of about US$11.2–11.3 billion and operating income of US$225–275 million, issued US$410 million in convertible debt to fund AI initiatives, and announced with Hy-Vee the launch of an employer-sponsored health plan starting January 2026.

- The collaboration with Hy-Vee marks Oscar Health's entry into the employer-sponsored market beyond its core ACA offerings, signaling a diversification of business strategy.

- We will explore how Oscar Health's investment in AI initiatives could influence its future earnings profile and overall investment case.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Oscar Health Investment Narrative Recap

To be a shareholder in Oscar Health, you need to believe in the company’s ability to leverage technology and diversify beyond the ACA market, while overcoming persistent unprofitability and shifting risk pools. The recent reaffirmation of 2025 revenue guidance and the Hy-Vee partnership offer strategic clarity, but do not materially change the biggest short-term catalyst, the potential extension of ACA subsidies, or the primary risk from regulatory and claim cost volatility.

Among recent announcements, the US$410 million convertible debt raise to fund AI development stands out. This investment underscores Oscar’s focus on tech-driven operational efficiency, directly impacting cost control, a key factor as margin pressures and unpredictable claims costs remain front of mind for market participants.

Yet, despite these efforts, investors should be aware that accelerating regulatory scrutiny and market-wide morbidity trends may still...

Read the full narrative on Oscar Health (it's free!)

Oscar Health's outlook anticipates $12.4 billion in revenue and $245.4 million in earnings by 2028. This implies a 4.9% annual revenue growth rate and an increase in earnings of $406.6 million from the current loss of $-161.2 million.

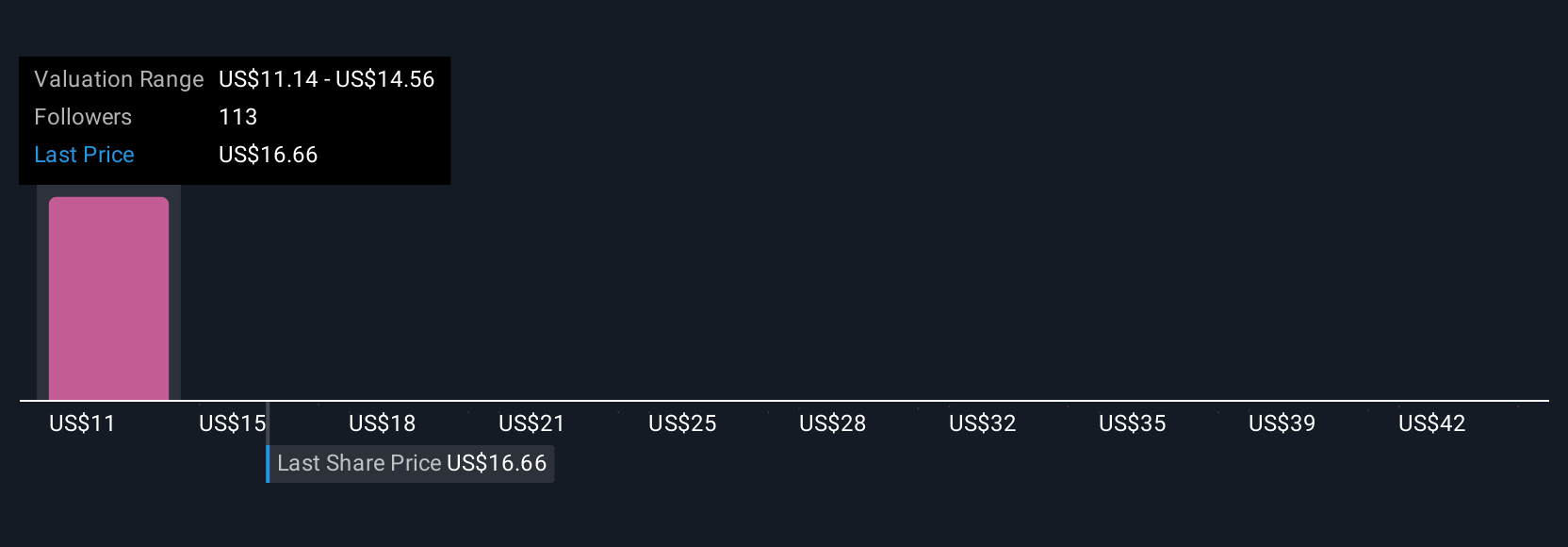

Uncover how Oscar Health's forecasts yield a $11.71 fair value, a 43% downside to its current price.

Exploring Other Perspectives

Twenty-two members of the Simply Wall St Community have valued Oscar Health between US$11.52 and US$48.14 per share, showing wide differences in future growth expectations. With potential regulatory shifts affecting risk pools and margins, these varied outlooks invite you to consider a range of views on the company’s prospects.

Explore 22 other fair value estimates on Oscar Health - why the stock might be worth over 2x more than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives