- United States

- /

- Insurance

- /

- NYSE:OSCR

Oscar Health (OSCR): Is the Growing Product Pipeline Reflected in Its Current Valuation?

Reviewed by Simply Wall St

Oscar Health (NYSE:OSCR) just announced a wave of new health plan offerings, highlighted by Oswell, its first personal AI agent, and HelloMeno, the inaugural menopause-focused plan in the ACA marketplace. The company is also expanding into new regions and employer markets.

See our latest analysis for Oscar Health.

All this new product momentum comes on the heels of a strong run for Oscar Health's shares, with a 90-day share price return of nearly 40% and a year-to-date gain of 44%. Looking longer term, total shareholder return stands at an impressive 420% over three years. This suggests enthusiasm for the company’s expanding footprint and rapidly improving financial results remains high, even with some pullback in the latest week.

If Oscar’s pace of innovation has you eager to discover what’s next in healthcare, take a look at the top performers in our dedicated screener: See the full list for free.

The question now is whether these big product moves and financial gains have left Oscar Health undervalued, or if the market has already factored in its ambitious growth. Could this be the next opportunity, or has the rally run its course?

Most Popular Narrative: 57.9% Overvalued

Analysts place Oscar Health’s fair value at $12.38 a share, which is well below the last closing price of $19.54. This sizable gap suggests current optimism around new products and expansion is already priced in. This sets the stage for deeper debate around the company’s long-term financial trajectory.

“The analysts have a consensus price target of $11.143 for Oscar Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.0.”

Want to know the engine driving this high valuation skepticism? The real story comes down to a bold swing in future profitability and a growth forecast rarely seen in insurance. What is the single quantitative leap analysts are banking on to support a turnaround? Click through and see what surprising assumptions underpin this narrative’s sharply lower price target.

Result: Fair Value of $12.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong digital adoption and Oscar’s aggressive cost-cutting could lead to margin growth and profitability more quickly than current analyst expectations suggest.

Find out about the key risks to this Oscar Health narrative.

Another View: What Multiples Say

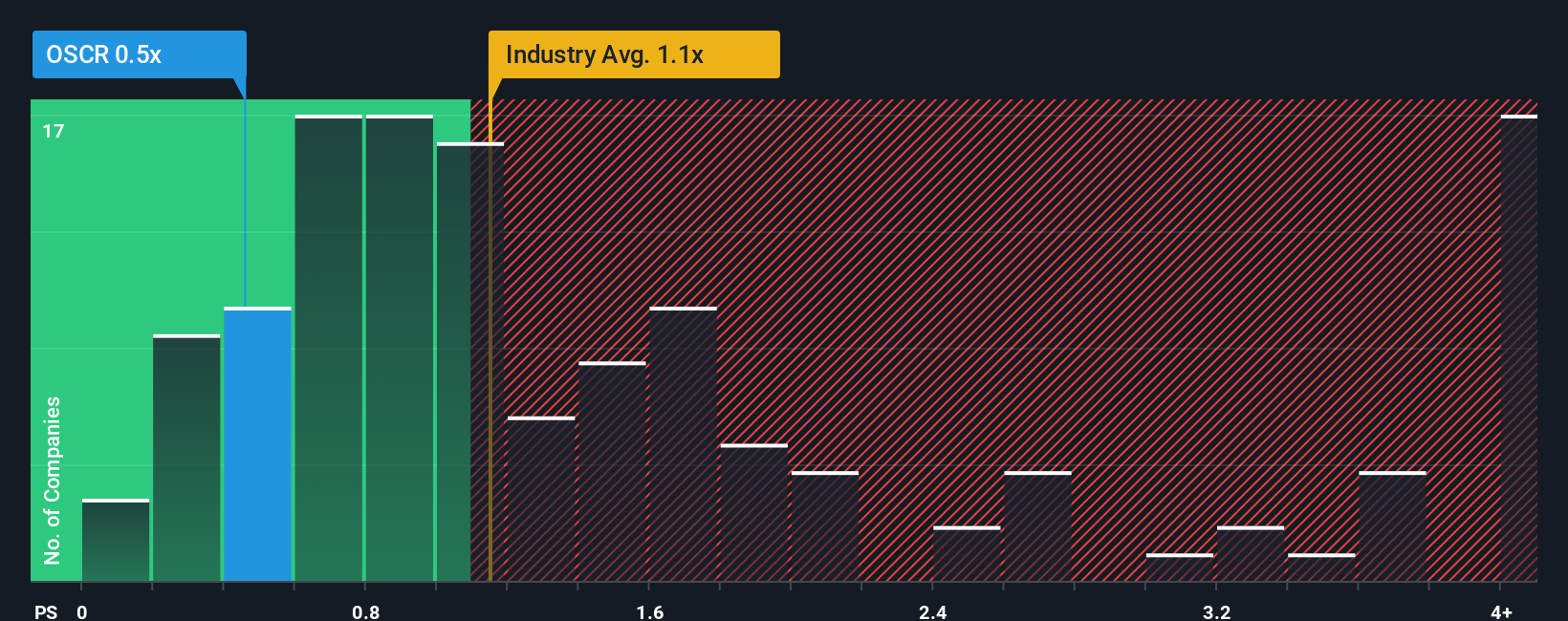

Looking at Oscar Health through the lens of its price-to-sales ratio tells a different story. At just 0.5x, the company trades not only below its peers’ average of 0.8x, but also lower than the US Insurance industry average of 1.1x. The fair ratio, or where the market could move towards, is also 0.8x. This suggests that even as analysts sound caution, the market currently values Oscar at a significant discount to its sector. Is this an overlooked opportunity or a warning about future risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Oscar Health Narrative

If you see things differently or want to take a deeper dive into the numbers on your own terms, you can construct your own view on Oscar Health in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Oscar Health.

Looking for more investment ideas?

Smart investors look beyond headlines to find their next winning move. Set yourself up for what's next by checking out these top opportunities now:

- Capitalize on future tech breakthroughs by scanning these 28 quantum computing stocks for companies advancing quantum computing solutions that could upend entire industries.

- Lock in steady income streams when you browse these 21 dividend stocks with yields > 3% offering yields above 3 percent and built for market resilience.

- Ride the momentum in artificial intelligence through these 26 AI penny stocks and spot innovators shaping how machines learn, think, and transform our world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives