- United States

- /

- Insurance

- /

- NYSE:OSCR

Are Oscar Health’s (OSCR) Tech Advances Enough to Offset Political and Profitability Pressures?

Reviewed by Sasha Jovanovic

- In the past week, Oscar Health announced the launch of new affordable, technology-enhanced health plans with expanded virtual care and AI-driven services in Southern Florida, while also reporting a significant third-quarter net loss and reaffirming its full-year revenue guidance.

- A crucial insight is that investor concerns were heightened by both political proposals to redirect federal healthcare funding away from insurers and the company's ongoing profitability challenges, despite its innovative plan offerings and reported revenue growth.

- We will examine how heightened political risk and persistent operating losses highlighted in recent news are reshaping Oscar Health’s investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Oscar Health Investment Narrative Recap

To back Oscar Health as a shareholder, you need to believe the company can convert technology-driven, affordable health plans into sustained membership and margin growth despite regulatory and political risks. Recent political proposals to redirect funding away from insurers, alongside persistent operating losses, meaningfully heighten both the near-term risk to Oscar's core business model and the biggest short-term catalyst, progress toward profitability through digital efficiencies and cost discipline. These factors keep the path to sustainable earnings improvement in sharp focus.

One announcement especially relevant in this context is Oscar's recent launch of tech-powered plans across Southern Florida, featuring $0 virtual care and an AI-driven health assistant. This ambitious expansion highlights the company's commitment to product innovation and member engagement, but it also magnifies exposure to abrupt policy changes that could affect the viability of the ACA-based market, a primary revenue stream.

By contrast, investors should be aware that regulatory and political risks could...

Read the full narrative on Oscar Health (it's free!)

Oscar Health's narrative projects $12.4 billion revenue and $245.4 million earnings by 2028. This requires 4.9% yearly revenue growth and a $406.6 million increase in earnings from -$161.2 million currently.

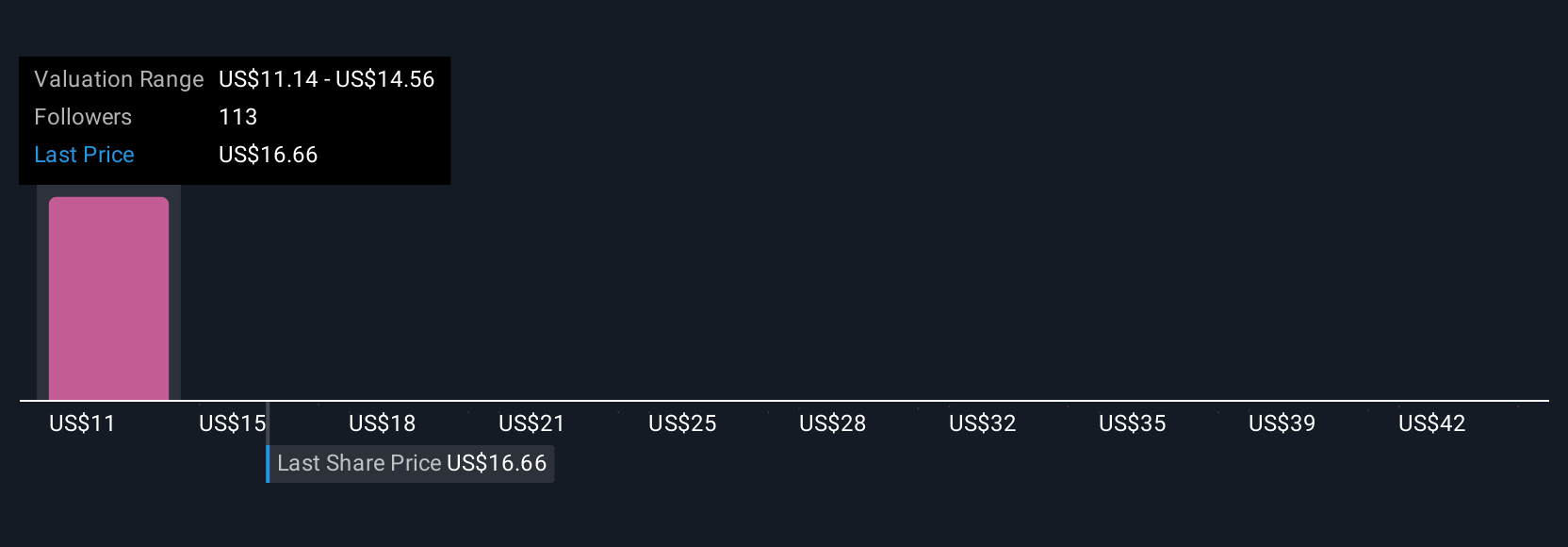

Uncover how Oscar Health's forecasts yield a $12.38 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Twenty-three private investors in the Simply Wall St Community estimated Oscar Health's fair value across a wide US$11.52 to US$66 range. With persistent operating losses front of mind, explore how varied outlooks might affect expectations for recovery or risk.

Explore 23 other fair value estimates on Oscar Health - why the stock might be worth 17% less than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives