- United States

- /

- Insurance

- /

- NYSE:ORI

Old Republic International’s Valuation After Strong Q3 Results and Everett Cash Mutual Acquisition

Reviewed by Simply Wall St

Old Republic International (ORI) recently delivered third-quarter 2025 earnings that surpassed expectations, while also unveiling its acquisition of Everett Cash Mutual. These moves showcase the company’s execution and evolving approach to broadening its offerings.

See our latest analysis for Old Republic International.

This combination of a strong earnings report and fresh expansion moves has not gone unnoticed by investors. Old Republic International’s share price has built notable momentum this year, with a 25% year-to-date return and a robust 29% total shareholder return over the past twelve months. This reflects optimism about the company’s steady growth and evolving strategy.

If you’re curious where else momentum and strategic moves are shaping investor sentiment, now is the time to broaden your search and discover fast growing stocks with high insider ownership

The question now is whether Old Republic International’s impressive performance and strategic shifts still leave room for upside. Alternatively, the market may have already priced in its future growth prospects, which could diminish the chances of a true bargain for new investors.

Most Popular Narrative: 3.1% Undervalued

Old Republic International’s widely held narrative suggests the stock’s fair value stands above its recent close of $45.08, making it an intriguing case for investors searching for hidden upside. The stage is set by a blend of digital innovation as well as barriers that protect margins and market share.

Ongoing investments in digitalization, data analytics, and artificial intelligence are expected to streamline underwriting and claims processes. This could drive operating efficiencies and lower administrative expenses, which may positively impact net margins over the long term.

What is fueling this optimism? The most popular narrative hints at bold projections for revenue growth, future profit margins, and a crucial drop in share count. Want to see how these quantitative assumptions combine to push the fair value higher? Don’t miss the details that could change your view on ORI’s potential.

Result: Fair Value of $46.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in real estate or rising expense ratios could pressure Old Republic International's margins and expose the narrative to downside if conditions fail to improve.

Find out about the key risks to this Old Republic International narrative.

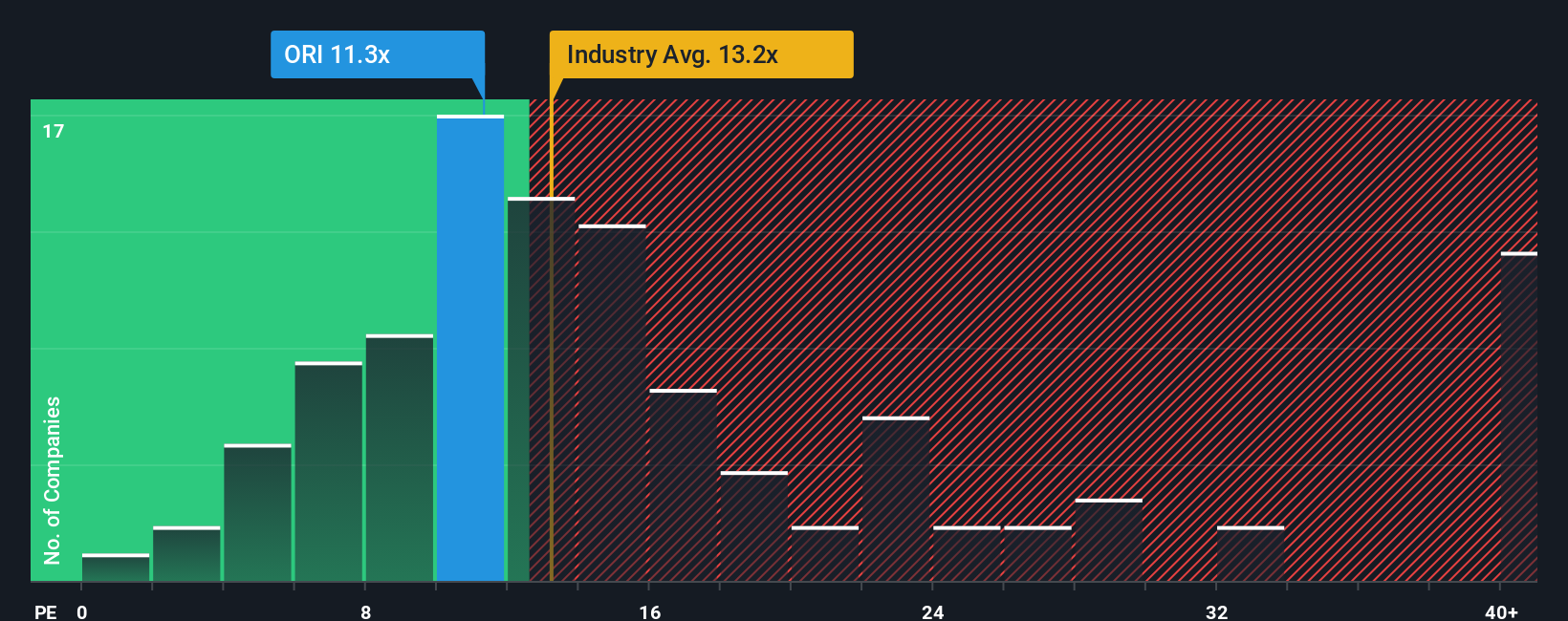

Another View: What the Market’s Ratio Signals

Not everyone agrees with the narrative of hidden value for Old Republic International. Looking at its price-to-earnings ratio, the stock trades at 13.2x, which is higher than both its industry peer average of 12x and its fair ratio of just 10.8x. This suggests some investors may already be paying a premium for its stability and future prospects. Could this premium mean less room for upside, or is there more to the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old Republic International Narrative

If you see the story differently, or want to dig into the numbers on your own terms, you can build your own perspective in under three minutes, too, with Do it your way.

A great starting point for your Old Republic International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead of the curve, don't miss the chance to tap into new opportunities using the Simply Wall Street Screener. Start making smarter, faster moves and be the one uncovering game-changing stocks before everyone else notices.

- Uncover high-potential companies making waves in digital health by using these 30 healthcare AI stocks, stepping up with medical breakthroughs.

- Jump on opportunities in sectors with genuine undervaluation by checking these 921 undervalued stocks based on cash flows, where strong fundamentals meet attractive prices.

- Capture the growth and volatility of the digital asset economy via these 81 cryptocurrency and blockchain stocks, where innovation drives the next big winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives