- United States

- /

- Insurance

- /

- NYSE:ORI

Is Old Republic International's (ORI) Environmental Insurance Expansion Shaping Its Long-Term Diversification Strategy?

Reviewed by Sasha Jovanovic

- Old Republic International Corporation recently launched Old Republic Environmental, Inc., a new underwriting subsidiary delivering customized environmental insurance products for businesses through a select network of wholesale and retail brokers.

- This expansion, led by George Holderied, marks the seventh specialty insurance company added by Old Republic in the last eight years, further strengthening its diversification and expertise in specialty markets.

- We'll now examine how the addition of environmental insurance expertise influences Old Republic International's long-term investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Old Republic International Investment Narrative Recap

To be a shareholder in Old Republic International, you need to believe in the company’s ability to diversify earnings streams and strengthen specialty insurance offerings, even as the Title Insurance segment faces cyclical softness and operating margin pressure. The launch of Old Republic Environmental Inc. points to ongoing progress in specialty insurance, but does not materially offset the near-term headwinds for Title, continued weakness in real estate and mortgage markets remains the biggest risk, while digitalization and specialty expansion are still the key catalysts ahead.

Among recent announcements, the Board’s 9.4% increase in the annual dividend to US$1.16 per share further underscores Old Republic’s capital return focus. This commitment to shareholders is significant, given ongoing sector and macroeconomic challenges, and pairs well with new specialty launches to underline management’s confidence in generating sustainable cash flows.

On the other hand, the pressure on Title Insurance operating income, a persistent risk that investors should be mindful of, especially if the real estate cycle remains weak...

Read the full narrative on Old Republic International (it's free!)

Old Republic International is projected to reach $10.2 billion in revenue and $865.3 million in earnings by 2028. This outlook assumes a 5.7% annual revenue growth rate but a decrease in earnings of $28.3 million from the current $893.6 million.

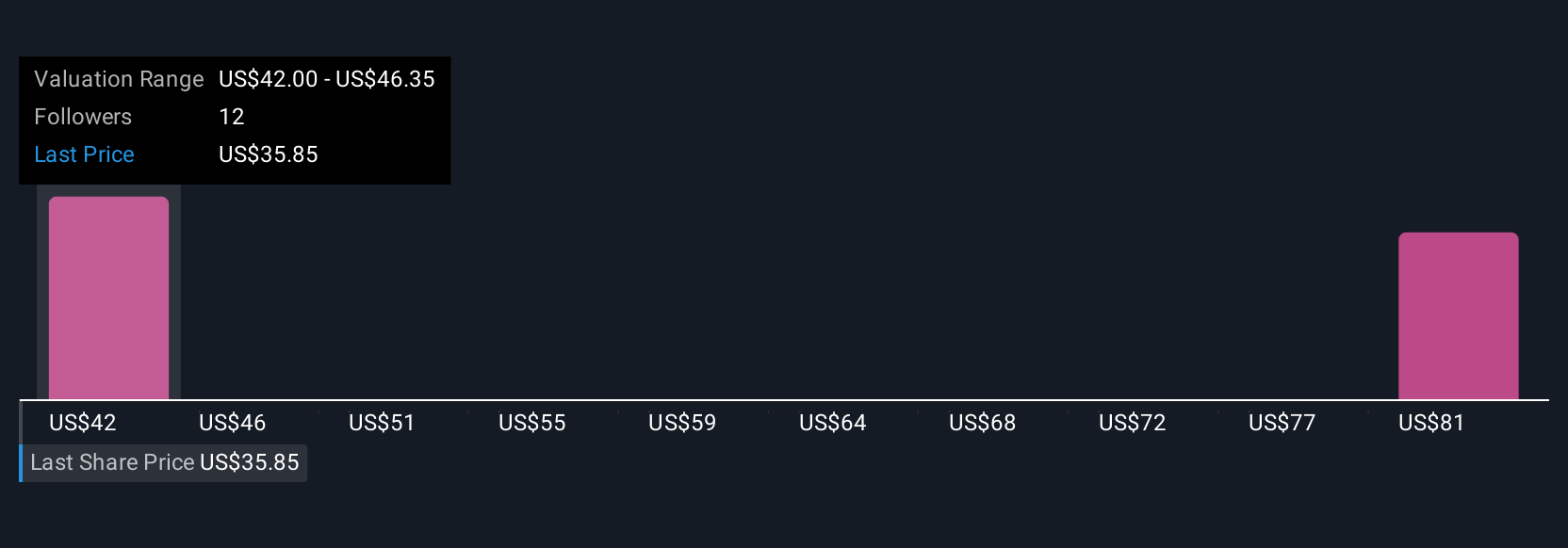

Uncover how Old Republic International's forecasts yield a $46.00 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have set fair values for Old Republic International from US$46 to US$68.27 per share. While views differ, the ongoing pressure on the Title Insurance segment may weigh on performance and is a theme several participants have flagged, see what other perspectives emerge.

Explore 3 other fair value estimates on Old Republic International - why the stock might be worth just $46.00!

Build Your Own Old Republic International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Old Republic International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Old Republic International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Old Republic International's overall financial health at a glance.

No Opportunity In Old Republic International?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives