- United States

- /

- Insurance

- /

- NYSE:ORI

Does ORI’s Above-Estimate Earnings and Insider Sale Signal Shifting Confidence in its Growth Story?

Reviewed by Sasha Jovanovic

- On November 14, 2025, Carolyn Monroe, SVP - Title Insurance at Old Republic International, sold 6,680 shares of common stock following the release of its third-quarter earnings that surpassed analyst expectations with an EPS of US$0.78 versus the forecasted US$0.76.

- This outperformance against market estimates has drawn renewed attention from analysts and investors regarding the company's ability to deliver above-forecast results.

- With Old Republic International beating earnings projections, we'll explore how this may influence the investment narrative focused on margin pressures and growth outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Old Republic International Investment Narrative Recap

To be a shareholder in Old Republic International, you need to believe in its ability to manage through cyclical slowdowns in real estate and mortgage markets while controlling costs in its Title Insurance segment. The recent earnings beat and insider selling do not materially shift the most important near-term catalyst, improvements in operating efficiency, or resolve the biggest risk, which continues to be margin pressure from elevated expense ratios and a sluggish real estate cycle.

Among recent company announcements, the October 2025 buyback update stands out, with more than 1.28 million shares repurchased last quarter and nearly 11 percent of total shares bought back since 2024. While these buybacks could support per-share metrics in the short term, their effect does not directly address the core profitability concerns or the ongoing risk from soft Title Insurance demand.

Yet investors should be mindful that despite the current optimism around earnings, the impact of elevated expense ratios and cost controls...

Read the full narrative on Old Republic International (it's free!)

Old Republic International's narrative projects $10.2 billion revenue and $865.3 million earnings by 2028. This requires 5.7% yearly revenue growth and a $28.3 million decrease in earnings from $893.6 million currently.

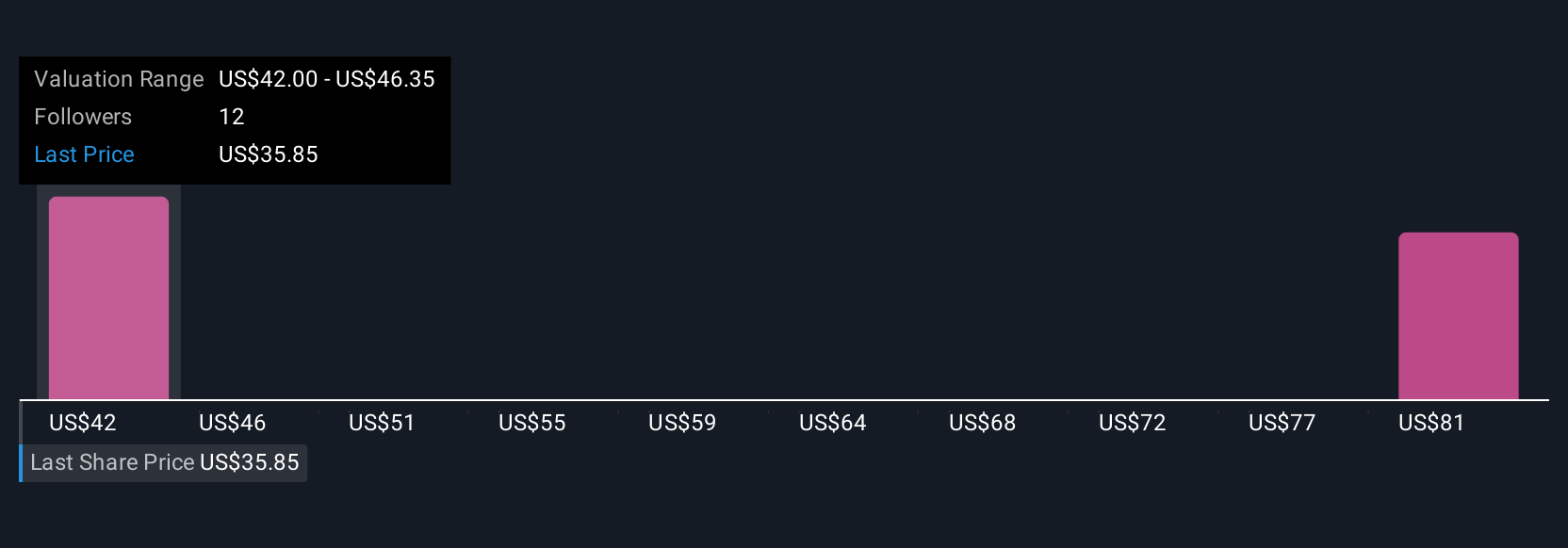

Uncover how Old Republic International's forecasts yield a $46.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see fair value for Old Republic ranging from US$46.50 to US$69.30, based on three unique analyses. While some forecast significant upside, ongoing margin pressures and slow profit growth remain central to the company's future performance, explore a variety of viewpoints before making your assessment.

Explore 3 other fair value estimates on Old Republic International - why the stock might be worth just $46.50!

Build Your Own Old Republic International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Old Republic International research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Old Republic International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Old Republic International's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives