- United States

- /

- Insurance

- /

- NYSE:MKL

Stronger Q2 Results and ESOP Offering Might Change the Case for Investing in Markel Group (MKL)

Reviewed by Simply Wall St

- Markel Group Inc. reported second quarter 2025 results, showing revenue of US$4.60 billion and net income of US$657.15 million, both higher than the same period last year, while closing a US$17.10 million Employee Stock Ownership Plan-related common share offering in August 2025.

- Despite stronger quarterly earnings, the company's six-month revenue and net income were lower than the prior year's, highlighting variability in recent financial results.

- We'll review how Markel Group's sharp quarterly earnings growth could influence its future prospects and the prevailing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Markel Group Investment Narrative Recap

Being a Markel Group shareholder often comes down to believing in its ability to deliver long-term value through thoughtful insurance underwriting and disciplined capital allocation, even when quarterly earnings fluctuate. The Q2 2025 surge in revenue and net income doesn’t materially change the biggest near-term catalyst, management’s push for profitability in U.S. E&S lines, nor does it alter the top risk: ongoing earnings volatility linked to investment market swings and insurance losses.

The recent closing of the US$17.10 million ESOP-related common share offering, while an important employee and capital event, does not directly impact the main drivers of earnings or the challenges tied to catastrophe exposure and investment income swings. Instead, the real focal point for investors is the company's continuing operational improvements and re-underwriting efforts, which underpin its path toward stronger, more stable margins.

But this latest performance should also remind investors how, despite operational progress, market-driven swings in unrealized investment gains remain a key issue they need to watch for...

Read the full narrative on Markel Group (it's free!)

Markel Group's narrative projects $17.6 billion revenue and $2.0 billion earnings by 2028. This requires 4.2% yearly revenue growth and a $0.2 billion earnings increase from $1.8 billion.

Uncover how Markel Group's forecasts yield a $1895 fair value, a 3% downside to its current price.

Exploring Other Perspectives

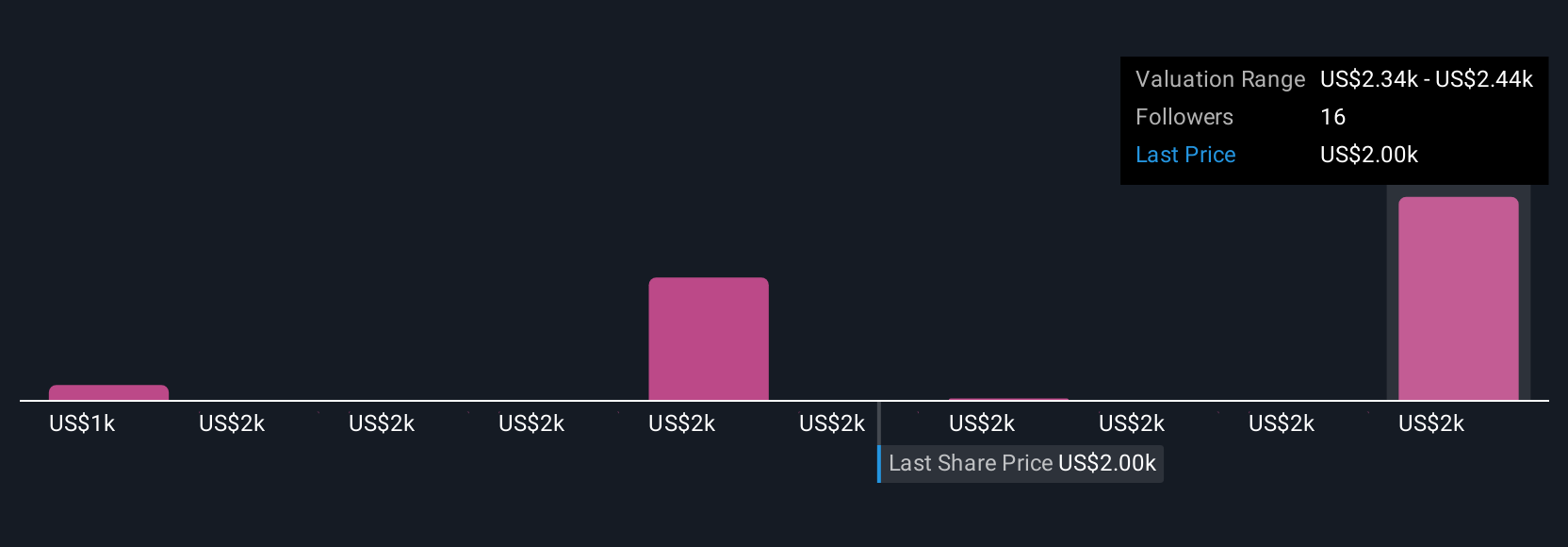

Six fair value estimates from the Simply Wall St Community place Markel Group’s worth between US$1,449.63 and US$2,407.14 per share. While these opinions vary widely, many continue to watch for persistent earnings volatility that can significantly affect future fundamentals.

Explore 6 other fair value estimates on Markel Group - why the stock might be worth 26% less than the current price!

Build Your Own Markel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Markel Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Markel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Markel Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives