- United States

- /

- Insurance

- /

- NYSE:MET

If You Like EPS Growth Then Check Out MetLife (NYSE:MET) Before It's Too Late

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in MetLife (NYSE:MET). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for MetLife

How Quickly Is MetLife Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. MetLife managed to grow EPS by 9.4% per year, over three years. That's a good rate of growth, if it can be sustained.

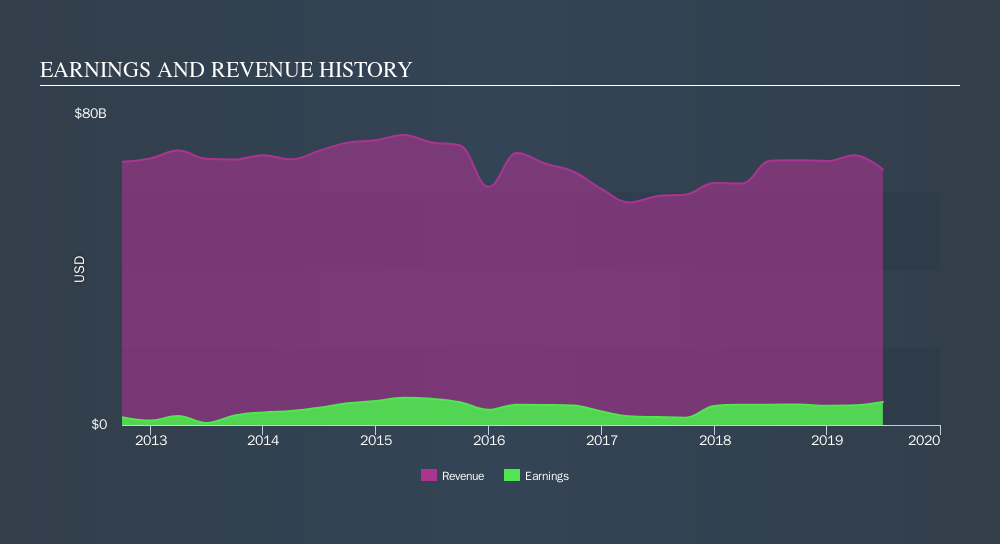

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that MetLife's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. MetLife's EBIT margins have actually improved by 5.1 percentage points in the last year, to reach 13%, but, on the flip side, revenue was down 3.3%. That falls short of ideal.

In the chart below, you can see how the company has grown earnings, and revenue, over time. You can view the exact numbers in our full report.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future MetLife EPS 100% free.

Are MetLife Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

First things first; I didn't see insiders sell MetLife shares in the last year. Even better, though, is that the Director, Carlos Gutierrez, bought a whopping US$250k worth of shares, paying about US$39.04 per share, on average. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

Along with the insider buying, another encouraging sign for MetLife is that insiders, as a group, have a considerable shareholding. With a whopping US$54m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Does MetLife Deserve A Spot On Your Watchlist?

One positive for MetLife is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for my watchlist - and arguably a research priority. Now, you could try to make up your mind on MetLife by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that MetLife is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives