- United States

- /

- Insurance

- /

- NYSE:MCY

Will Mercury General's (MCY) Winter Safety Focus Reflect Broader Shifts in Risk Management Strategy?

Reviewed by Sasha Jovanovic

- On November 21, 2025, Mercury Insurance released winter driving safety advice, emphasizing measures to reduce accidents and underscoring the risks posed by snowy or icy roads.

- This guidance not only reflects the company's commitment to policyholder risk reduction but also highlights the continuing impact of environmental conditions on insurance operations.

- Next, we'll explore how market optimism about potential interest rate cuts, which can benefit insurance firms' bond investments, affects Mercury General's investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Mercury General Investment Narrative Recap

To be a shareholder in Mercury General, one needs to be confident in its ability to grow core insurance operations, manage catastrophe exposure, and capitalize on favorable market conditions such as potential interest rate cuts that could boost investment returns. The recent guidance on winter driving safety, while aligned with the company's risk management focus, does not materially alter the short-term catalyst, improving net margins through core business growth, or address the key risk from wildfire-related losses and potential reinsurance cost pressures.

Among recent announcements, Mercury General's appointment of a Senior Director of Climate and Catastrophe Science stands out as directly relevant, signaling focused attention on environmental hazards like those driving the company's most pressing earnings risks. While initiatives such as expanding EV insurance or launching new products are growth oriented, resilience to catastrophic loss and effective risk pricing remain crucial, particularly as interest rate changes influence capital returns and surplus rebuilding.

However, investors should be aware that even as market sentiment rallies around possible interest rate cuts, exposure to unpredictable wildfire losses could still...

Read the full narrative on Mercury General (it's free!)

Mercury General's narrative projects $6.7 billion revenue and $452.5 million earnings by 2028. This requires 5.1% yearly revenue growth and a $62.4 million earnings increase from $390.1 million currently.

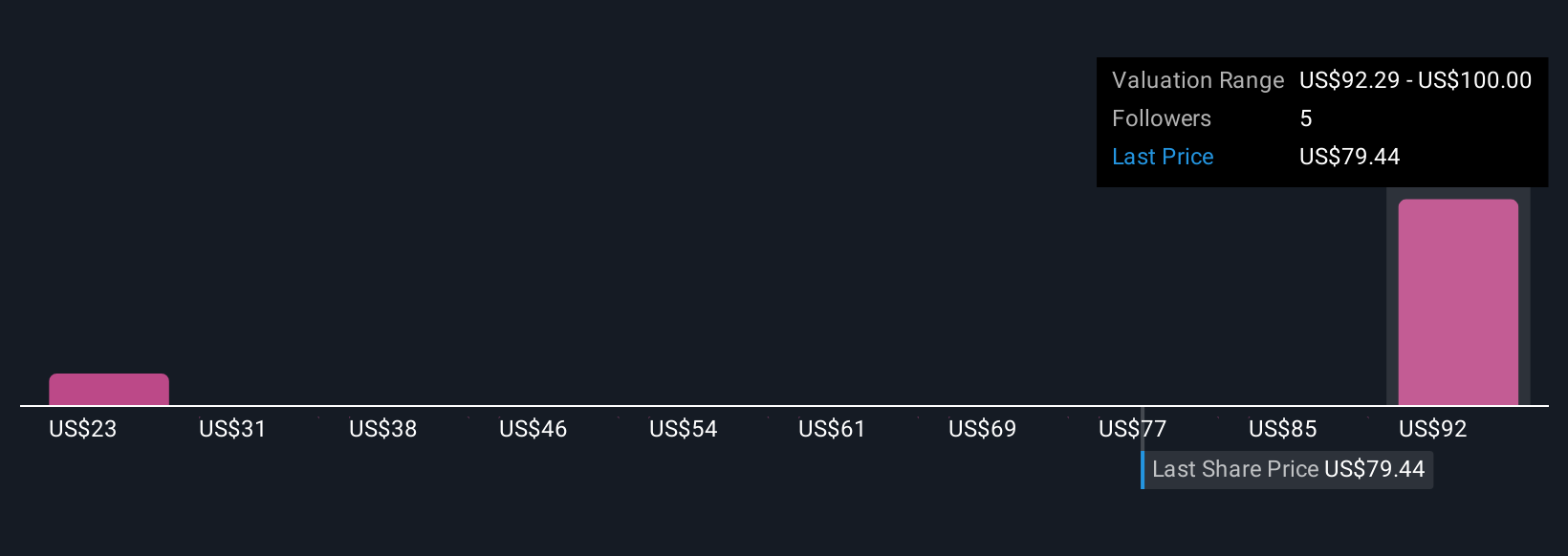

Uncover how Mercury General's forecasts yield a $100.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members currently place Mercury General’s fair value between US$79.55 and US$100. Core operating gains continue as a focal point, but wildfire-related losses cast a shadow over future profitability, inviting you to consider a range of viewpoints.

Explore 2 other fair value estimates on Mercury General - why the stock might be worth 13% less than the current price!

Build Your Own Mercury General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury General research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Mercury General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury General's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives