- United States

- /

- Insurance

- /

- NYSE:MCY

Mercury General (MCY): Earnings Rose 22.2% as Profit Margin Improved, Countering Market Growth Concerns

Reviewed by Simply Wall St

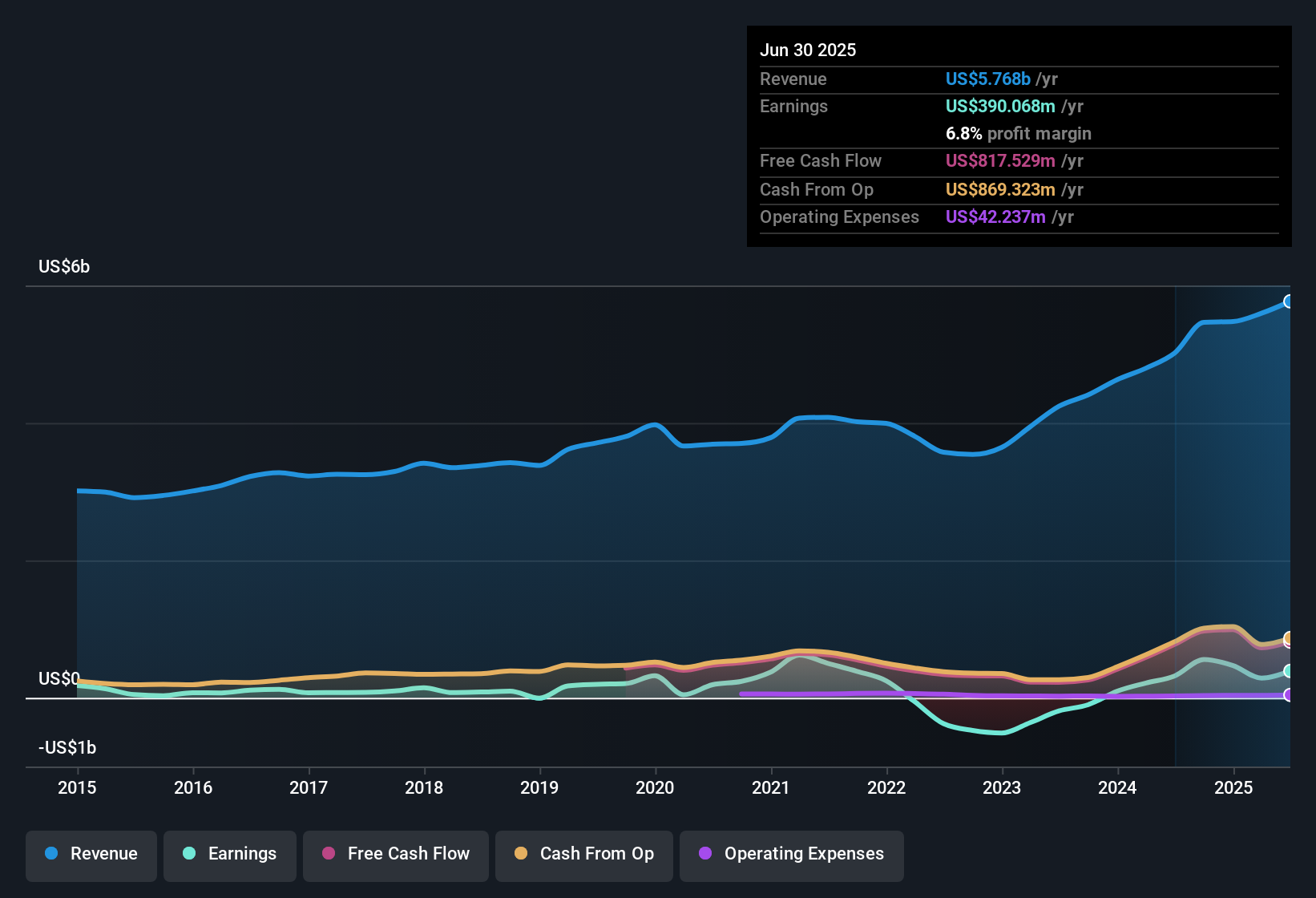

Mercury General (MCY) reported earnings growth of 22.2% over the last year, with its net profit margin rising to 6.8% from 6.4% a year ago. Earnings have averaged 2% growth per year over the past five years, and the stock’s Price-To-Earnings ratio of 11.6x sits below both peer and industry averages. However, the share price currently trades above modeled fair value. Revenue is expected to grow at 6% annually, which lags the broader US market's 10.5% forecast. The story is one of improving profitability and attractive valuation, even as top-line growth is expected to be more muted going forward.

See our full analysis for Mercury General.Next, we will compare these headline results with the main market narratives for Mercury General to see which themes hold up and which get put to the test.

See what the community is saying about Mercury General

Margin Gains Support Stability

- Mercury General’s net profit margin is running at 6.8%, holding steady with analyst assumptions that expect it to remain at this level over the next three years. This places greater emphasis on earnings quality rather than external growth rates.

- According to the analysts' consensus view, stability in the core business lines, especially personal auto and homeowners, underpins future earnings potential.

- Favorable combined ratios suggest that even with only moderate revenue growth, the company can maintain consistent profitability from its main insurance operations.

- Analysts highlight that steady underlying earnings in 2025 could help rebuild statutory surplus and strengthen net margins. This supports confidence in the company’s ability to weather unforeseen events.

- The latest results continue to put Mercury General in the spotlight for its balanced financial performance and set the stage for a deeper look at how these trends align with consensus expectations.

See how analysts' balanced take lines up with the numbers in the full consensus narrative. 📊 Read the full Mercury General Consensus Narrative.

Wildfire Exposure Pressures Outlook

- The company faces significant gross catastrophe losses from wildfires, with estimates between $1.6 billion and $2 billion. This raises the risk that margin stability could come under pressure if these events persist or intensify.

- Consensus narrative concerns focus on whether these outsized catastrophe losses and potential reinsurance cost increases will undercut net margins and threaten the recovery strategy.

- Critics note the danger that increased reinsurance costs, if realized, may erode the benefit of stable profit margins, making it harder to reach the anticipated $452.5 million in earnings by 2028.

- Uncertainties around reinsurance recovery and possible new California FAIR Plan assessments create additional liquidity and capital pressures, amplifying business risk in future periods.

Valuation Advantage versus Industry

- Mercury General trades at a Price-To-Earnings ratio of 11.6x, which is attractively below the US insurance industry’s 13.7x and its closest peers at 13.5x. However, the stock’s $81.75 share price currently sits above the modeled DCF fair value of $52.37.

- Consensus narrative highlights that analysts base fair value on a blend of next-cycle earnings and sector multiples, noting that sustaining sector-low PE ratios depends on achieving realistic revenue growth targets, not just margin strength.

- If revenues only rise at 6% annually, as forecasted, analysts suggest that share price appreciation will likely be limited unless the market becomes more optimistic about underlying margin durability.

- With the analyst price target set at $100.00, there is debate on whether the valuation appeal can persist if competitive and catastrophe risks do not subside as forecasted.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mercury General on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells another story? Take just a few minutes to shape your own view and share your perspective. Do it your way

A great starting point for your Mercury General research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Mercury General’s earnings outlook faces limitations due to only moderate revenue growth and ongoing valuation concerns, with the share price now above its assessed fair value.

If you’re searching for stocks that offer clear value without the premium price tag, use our these 836 undervalued stocks based on cash flows to discover investment ideas trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives