- United States

- /

- Insurance

- /

- NYSE:LNC

Lincoln National’s Profitable Quarter and Strong Annuities Could Be a Game Changer for LNC

Reviewed by Sasha Jovanovic

- Lincoln National Corporation recently reported third-quarter earnings showing US$4.56 billion in revenue and a return to profitability, supported by robust annuity deposits and strong results in Group Protection and Life Insurance segments.

- Alongside the improved earnings, the company completed a US$499.61 million fixed-income offering and maintained dividend payouts on its preferred stock, underscoring its balanced approach to capital management and funding.

- With operating income rising across key business segments, we'll examine how Lincoln National's financial performance may influence its future investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Lincoln National Investment Narrative Recap

To be a Lincoln National shareholder, you need to believe in the company's ability to deliver stable, long-term returns through a diversified insurance and retirement-focused product suite, while overcoming capital and earnings volatility from legacy annuity exposure. The recent return to profitability and new US$499.61 million fixed-income offering may strengthen the company's short-term capital position, but does not materially alter the biggest risk, managing volatility tied to older variable annuity guarantees.

Of the recent company actions, the completion of the large senior note offering is most relevant, as it enhances near-term financial flexibility and supports ongoing investments in diversification, an area seen as a key catalyst for future growth.

However, even with an improved capital base, investors should be aware that, if market conditions shift, the impact of legacy guarantees could quickly ...

Read the full narrative on Lincoln National (it's free!)

Lincoln National's narrative projects $21.0 billion in revenue and $1.6 billion in earnings by 2028. This requires 5.2% yearly revenue growth and a $0.6 billion earnings increase from $1.0 billion today.

Uncover how Lincoln National's forecasts yield a $44.00 fair value, a 7% upside to its current price.

Exploring Other Perspectives

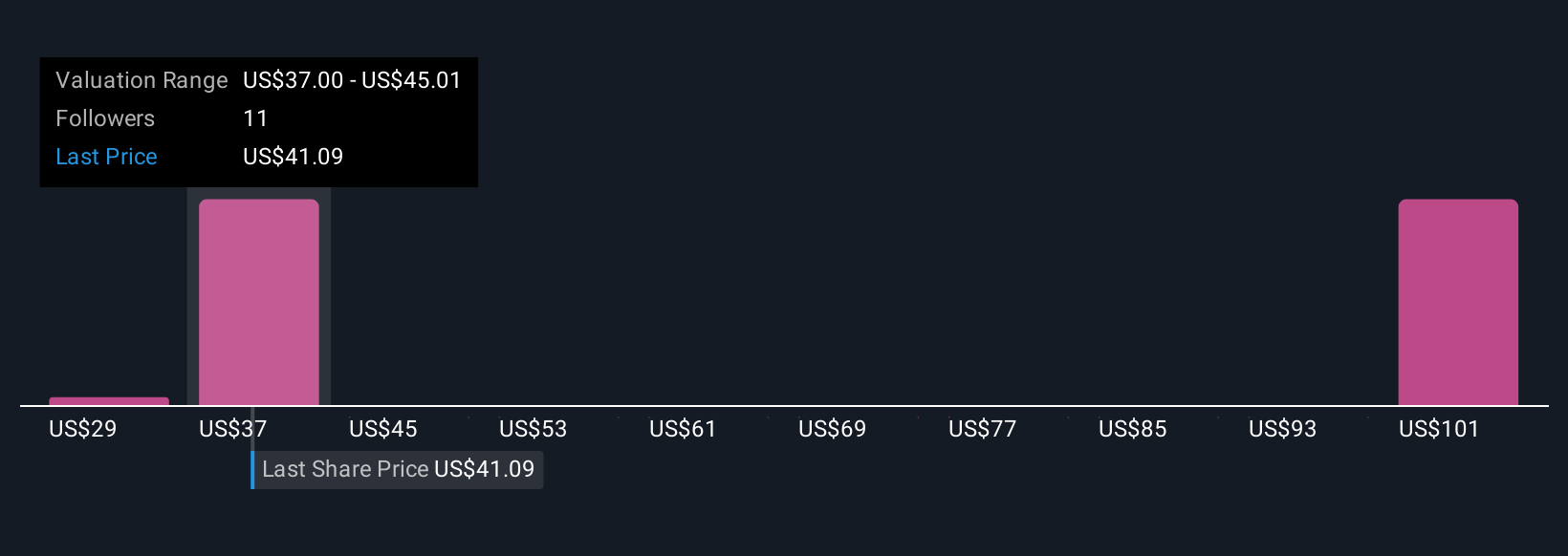

Three fair value estimates from the Simply Wall St Community range from US$28.99 to US$92.79, illustrating significant differences in opinion. While community sentiment is far from unified, capital strength and earnings volatility remain critical factors for Lincoln National's performance going forward, explore these varied perspectives to inform your own view.

Explore 3 other fair value estimates on Lincoln National - why the stock might be worth 30% less than the current price!

Build Your Own Lincoln National Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lincoln National research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lincoln National research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lincoln National's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNC

Lincoln National

Through its subsidiaries, operates multiple insurance and retirement businesses in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives