- United States

- /

- Insurance

- /

- NYSE:LMND

Lemonade (LMND) Revenue Forecast Outpaces Market, Challenging Profitability and Valuation Narratives

Reviewed by Simply Wall St

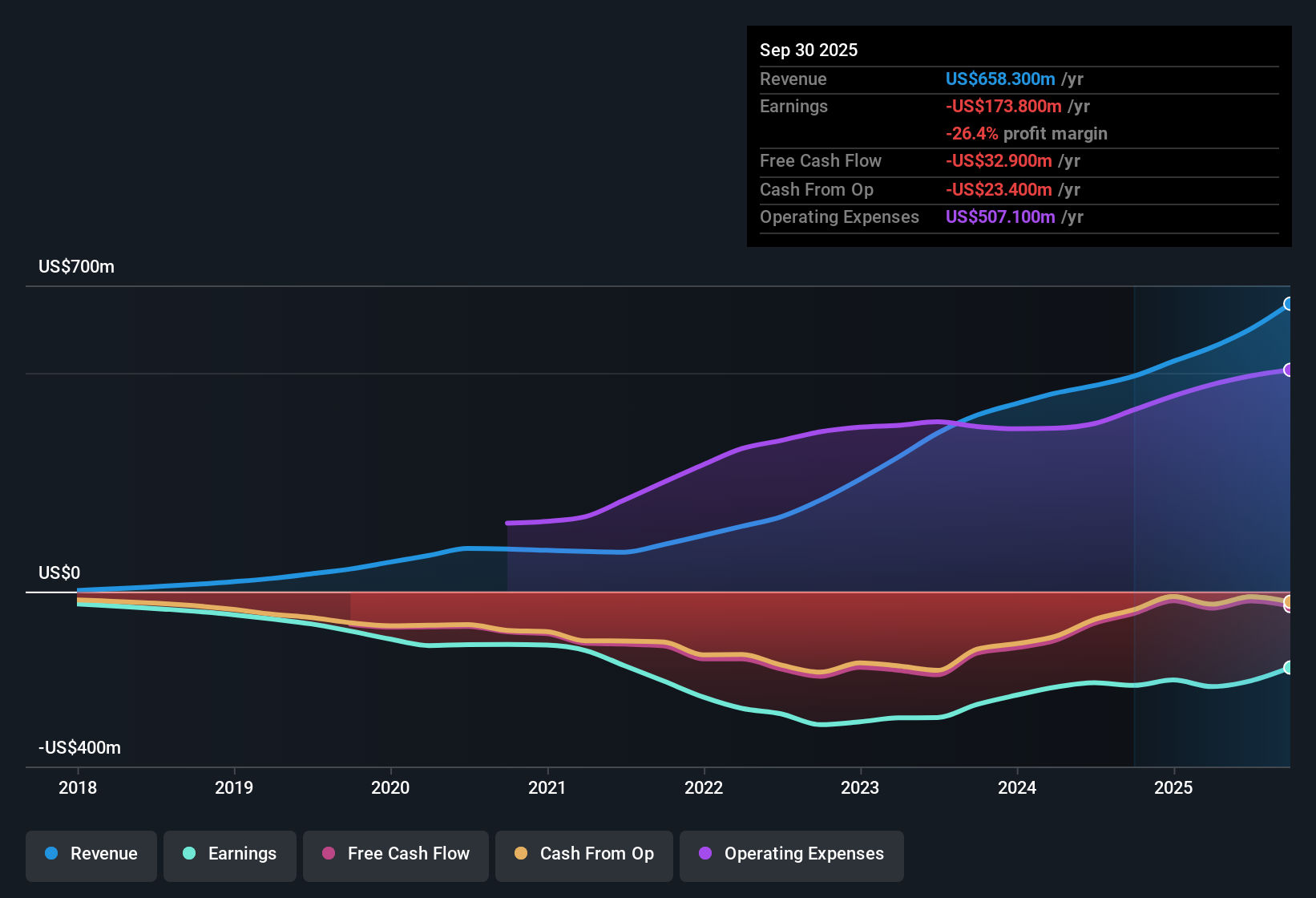

Lemonade (LMND) is forecast to grow revenue at 27.1% per year, outpacing the US market average of 10.5% per year. Still, the company remains unprofitable, with losses increasing at a rate of 5.7% per year over the past five years and profitability not expected within the next three years. While investors may be drawn to the rapid growth potential, ongoing losses and lack of near-term profitability are likely to weigh on sentiment.

See our full analysis for Lemonade.Next up, we will see how these earnings results hold up when set against the most widely debated market narratives for Lemonade. Some numbers will support the story, while others might turn it on its head.

See what the community is saying about Lemonade

Price-to-Sales at 9.7x Widens Peer Gap

- Lemonade currently trades at a price-to-sales ratio of 9.7x, which is significantly higher than US insurance peers at 2x and the broader industry average of 1.1x.

- Analysts' consensus view places heavy scrutiny on Lemonade’s premium valuation, especially given its lack of profitability.

- While rapid expansion and AI investments are fueling optimism, trading at almost five times the peer ratio highlights the challenge. Expectations are high for future growth, but without a positive earnings history, analysts suggest the market may be overlooking sustained competitive or margin pressures.

- With the current share price at $78.73, which is well above the only permitted analyst price target of $49.63, the consensus perspective is that market confidence may be running ahead of financial fundamentals.

- To see how Lemonade's growth ambitions stack up against analysts' balanced take, read the full consensus narrative for real-world context on this valuation gap. 📊 Read the full Lemonade Consensus Narrative.

Net Profit Still Deep in Red Territory

- Lemonade has not improved its net profit margin over the past five years, with losses actually growing at 5.7% per year, and profitability not expected within the next three years.

- The analysts' consensus narrative warns that aggressive expansion and AI-powered scale have not yet translated into earnings quality.

- Despite diversification and technology investment, net losses persist against a margin landscape where the industry averages 11% profit.

- Competitive pressure and high customer acquisition costs remain real headwinds, supporting the view that this business model could struggle to reach consistent profitability without a sharp margin turnaround.

Share Price Volatility Clouds Valuation Confidence

- Over the past three months, Lemonade’s share price has lacked stability, undermining investor certainty and aligning with analyst caution around current value.

- Consensus narrative highlights that until Lemonade delivers on promised earnings improvements, high valuation multiples and upsized price swings will continue to invite skepticism.

- Market optimism over AI-driven expansion is countered by tangible risks such as rising claims costs and regulatory scrutiny, which could magnify volatility rather than dampen it.

- Analysts point out that for the $78.73 share price to hold, Lemonade must demonstrate sustainable growth and profit margins well ahead of the industry, something not yet seen in the financials.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lemonade on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Not seeing the data the same way? In just a few minutes, you can share your viewpoint and make your perspective count. Do it your way

A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Lemonade continues to struggle with deepening losses, high valuation multiples, and a lack of near-term profitability, which clouds confidence in its trajectory.

If you’re looking for value opportunities where the numbers better support the price, check out these 836 undervalued stocks based on cash flows to discover companies trading below fair value and backed by more resilient financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives